Statistical arbitrage (or stat-arb) has become a powerful strategy for quantitative traders to exploit price discrepancies between financial instruments. By harnessing Python’s robust data analysis and statistical libraries, quantitative developers can implement sophisticated trading strategies, including pairs trading, to find and profit from mispricings.

Python libraries

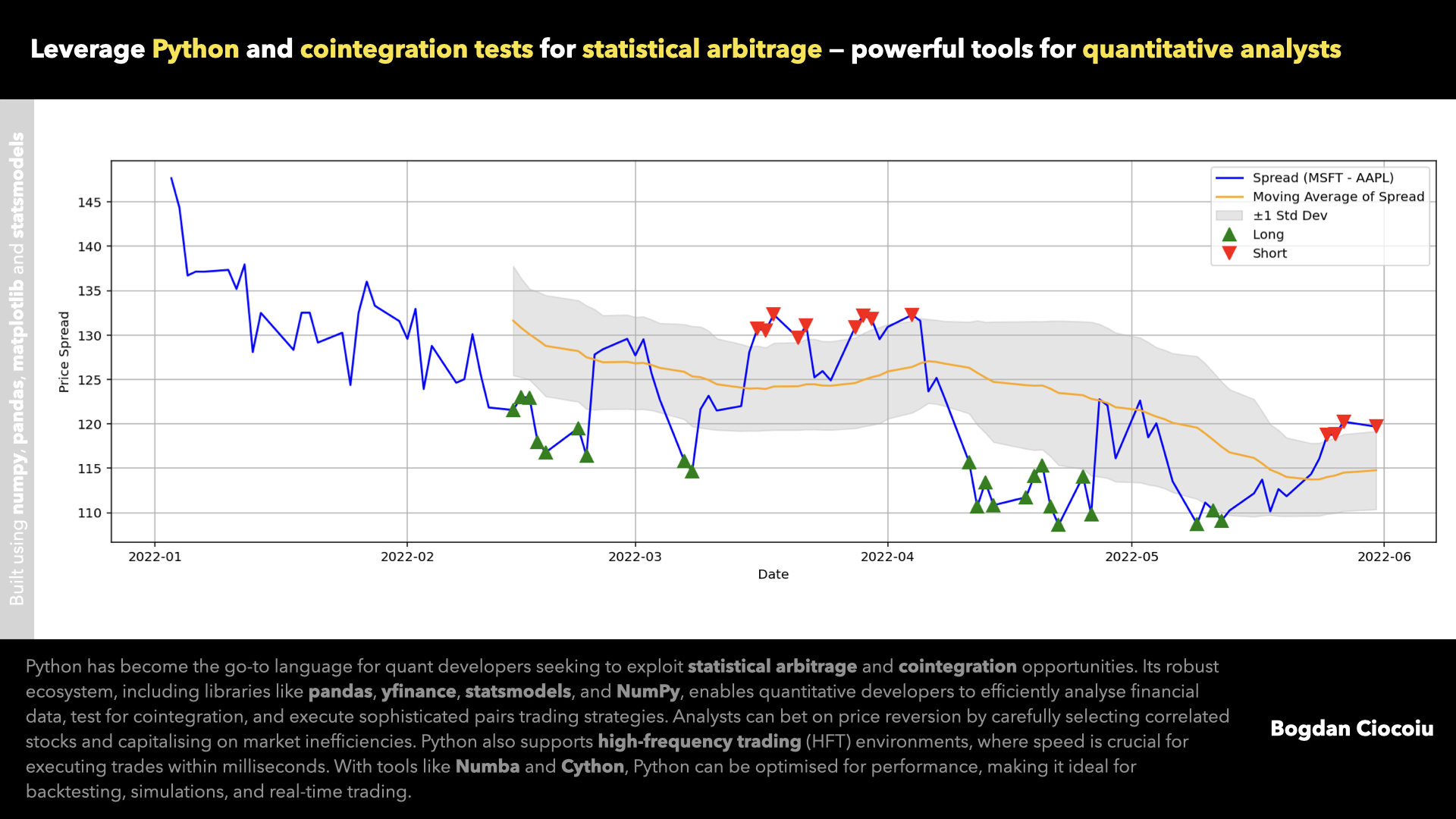

Python has emerged as the go-to programming language for quantitative finance due to its ease of use, extensive library support, and scalability. Some key libraries for statistical arbitrage and financial analysis include:

- yfinance: This library allows easy access to historical stock data.

- pandas: A powerful data manipulation library that provides data structures like DataFrames, enabling efficient handling of time series data and calculations such as moving averages.

- NumPy: Essential for numerical computing, it helps perform mathematical operations efficiently, including calculating positions in trading strategies.

- matplotlib: A plotting library used to visualise data, allowing traders to graph stock prices, spreads, and signals.

- statsmodels: Provides statistical functions, such as the cointegration test used in pairs trading to determine whether two financial instruments share a long-term equilibrium.

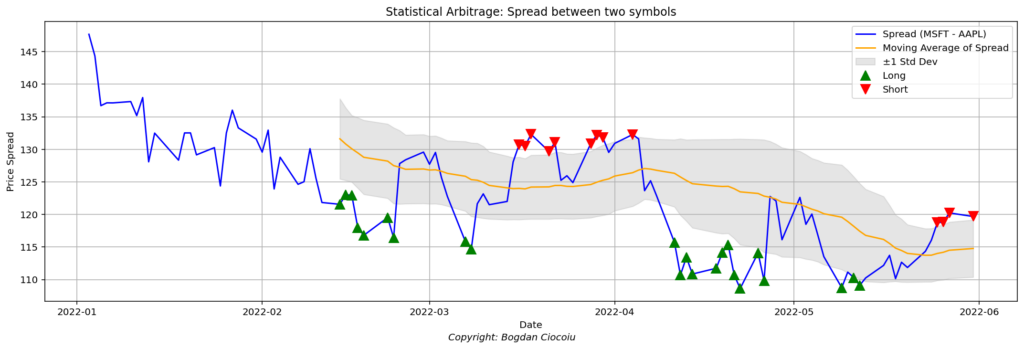

To demonstrate the application, one must use two historically correlated symbols, i.e., stocks (like Microsoft and Apple) and trades based on deviations in their price relationship.

Careful symbol selection

Choosing the right pair of symbols for statistical arbitrage is paramount to the strategy’s success. Ideally, quant developers should select symbols from the same sector or related markets because such instruments will likely share an economic connection that justifies their correlation. They may also respond similarly to macroeconomic events. For instance, Pepsi (PEP) and Coca-Cola (KO) are significant players in the beverage industry and have historically correlated. Trading pairs without strong underlying relationships could lead to unreliable strategies and increased risk.

The cointegration test (using statsmodels.coint) to verify whether the two symbols are cointegrated. This test ensures that even though the stock prices may drift independently in the short term, their long-term price relationship remains stable. A p-value below 0.05 indicates a cointegrated pair, which forms the basis for pairs trading by betting on the reversion of price spreads.

Developing the analysis further

Quant analysts may develop the application of statistical arbitrage as follows:

- Incorporating transaction costs to simulate realistic results

- Optimising thresholds for the entry and exit thresholds (i.e., one standard deviation.

- Machine learning can be applied to predict changes in spread patterns and optimise trading signals based on more complex factors, such as momentum or volume.

High-frequency trading (HFT)

In the realm of HFT, speed is of the essence. While the concept of statistical arbitrage remains the same, in an HFT environment, the strategy would involve executing a high volume of trades within milliseconds. Low-latency setups are crucial to maintaining an edge in such markets, where even minor execution delays can lead to missed opportunities or slippage. Quant developers must secure suitable environments, often facilitated by banks and financial institutions.

While not the fastest language, Python still provides considerable value in quantitative research. Tools like Numba (for just-in-time compilation) and Cython (for writing C extensions in Python) can accelerate Python code in HFT environments. Additionally, Python can be used to backtest trading strategies on historical data and simulate different market conditions before deploying the strategies in real-time trading environments.

Competitive advantages

Using Python, quantitative researchers can quickly iterate through different strategies, test their performance, and adjust parameters to create optimised, profitable systems. Python’s ability to integrate with other technologies like cloud computing (for large-scale data analysis) and machine learning frameworks (for predictive analytics) makes it a powerful tool for modern-day trading desks.

Statistical arbitrage, particularly pairs trading, is a robust strategy that can be efficiently implemented using Python. With powerful libraries like pandas, numpy, yfinance, and statsmodels, quant developers can analyse stock data, test for cointegration, and develop trading signals that exploit market inefficiencies. Python’s versatility and speed optimisation tools enable traders to stay competitive in HFT environments. By selecting symbols carefully and leveraging Python’s vast ecosystem, quant developers can develop statistical arbitrage strategies that stand the test of time, making it a highly appealing skill set for recruiters in the financial industry.

Leave a Reply

You must be logged in to post a comment.