Financial markets

-

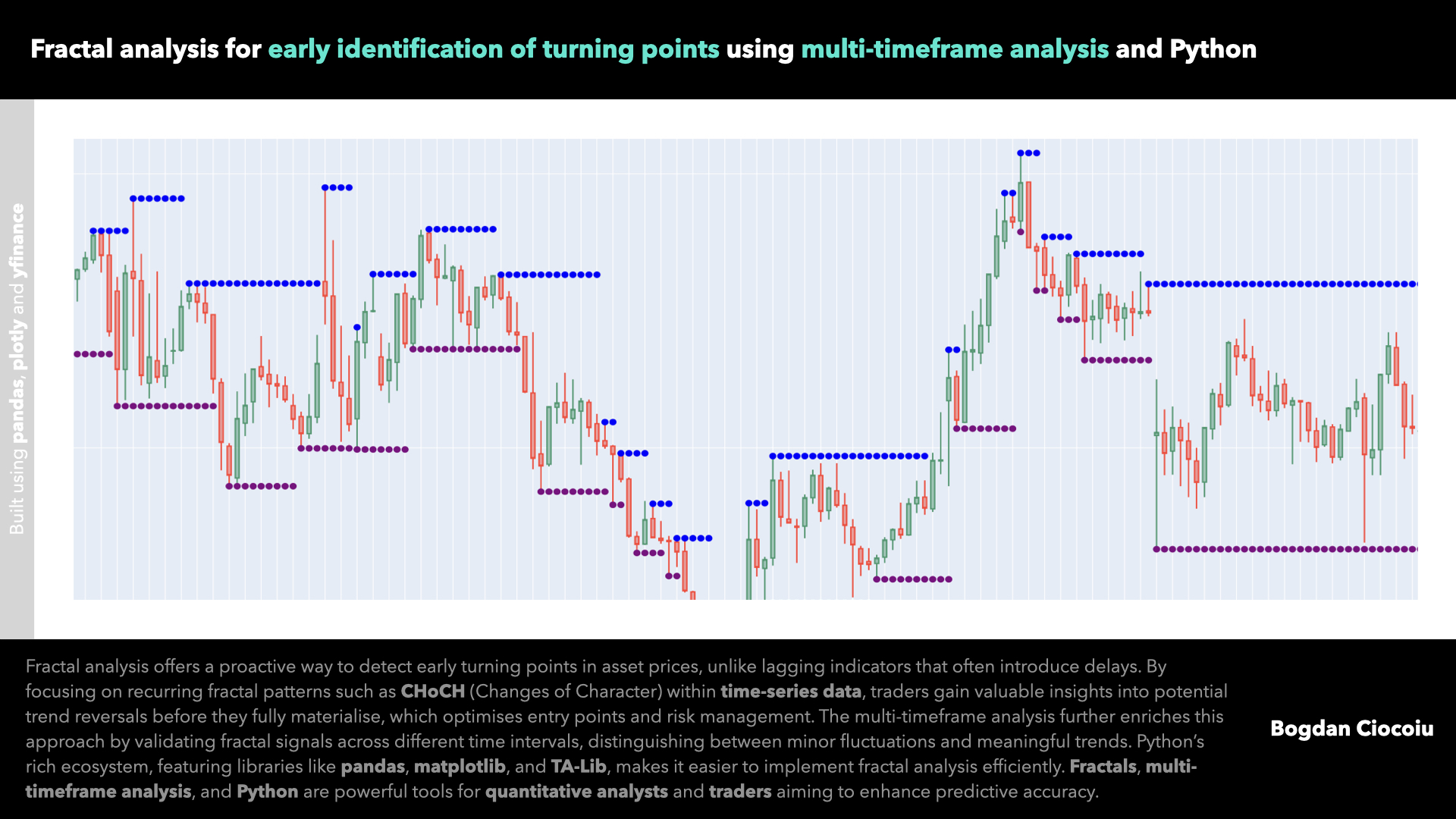

Fractal structure

In financial markets, the ability to accurately and timely identify turning points in floating assets such as stocks, commodities, or forex pairs can spell the difference between profit and loss. Fractal analysis, a technical approach focusing on repetitive patterns and structures within asset price movements, has become a powerful tool for recognising these turning points.…

-

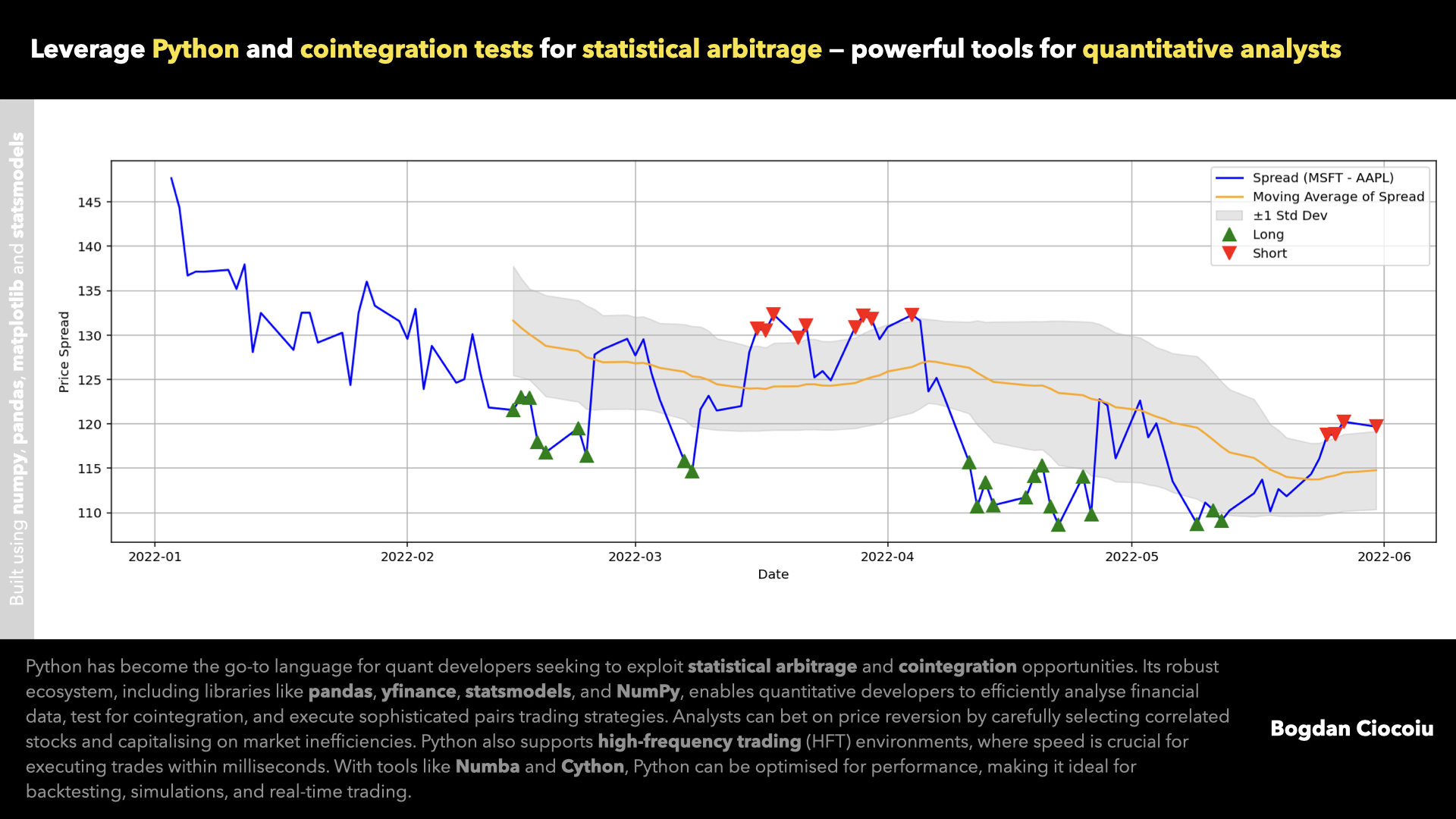

Statistical arbitrage – cointegration

Statistical arbitrage (or stat-arb) has become a powerful strategy for quantitative traders to exploit price discrepancies between financial instruments. By harnessing Python’s robust data analysis and statistical libraries, quantitative developers can implement sophisticated trading strategies, including pairs trading, to find and profit from mispricings. Python libraries Python has emerged as the go-to programming language for quantitative finance due to…

-

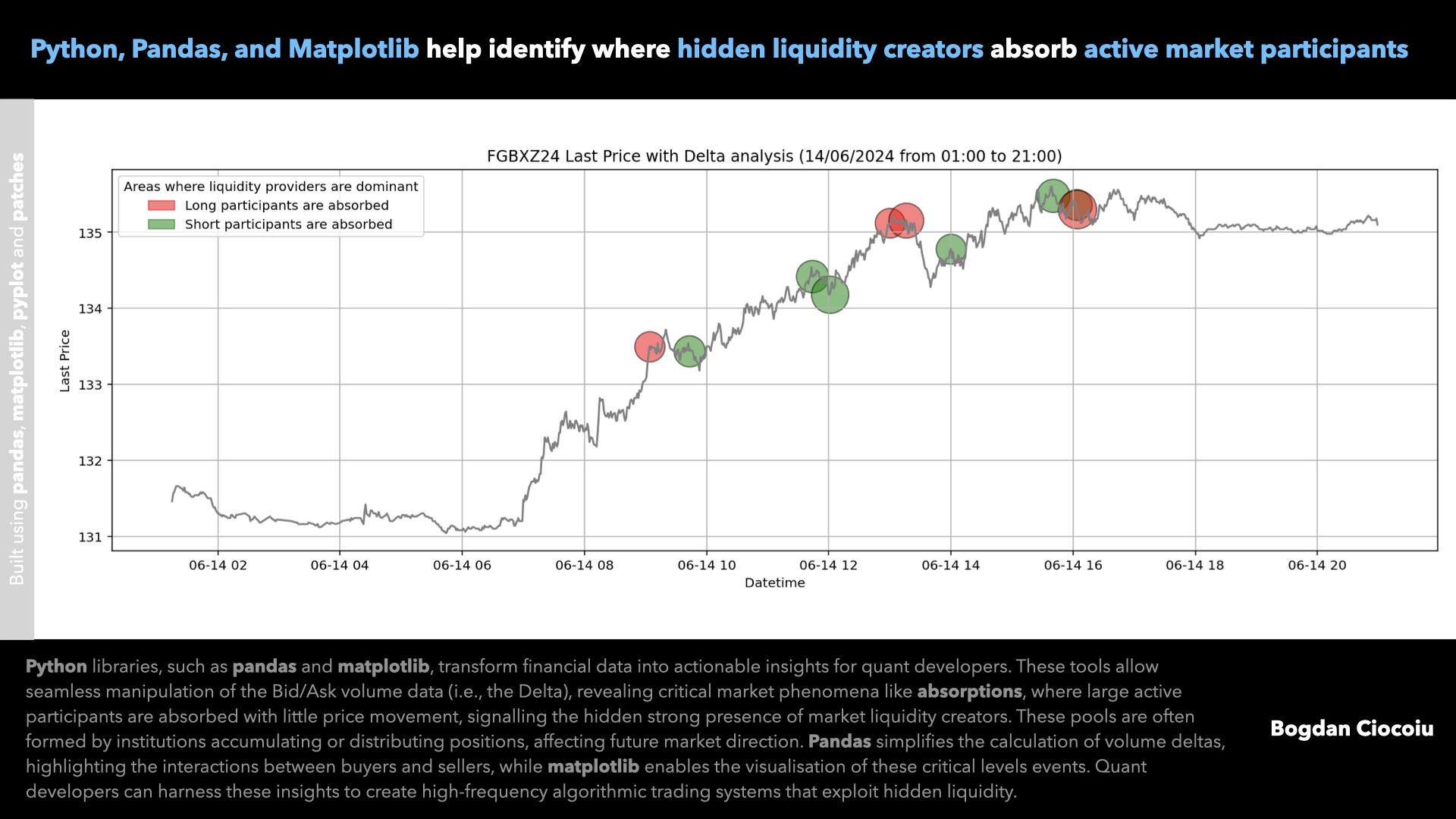

Absorptions

Leveraging Python and its powerful libraries like pandas and matplotlib provides a significant advantage in analysing financial data, especially when interpreting data feeds from centralised exchanges that include bid and ask data. The pandas library is paramount for managing and manipulating structured data in financial markets. A centralised exchange financial data feed that includes bid and ask volumes typically provides a time series…

-

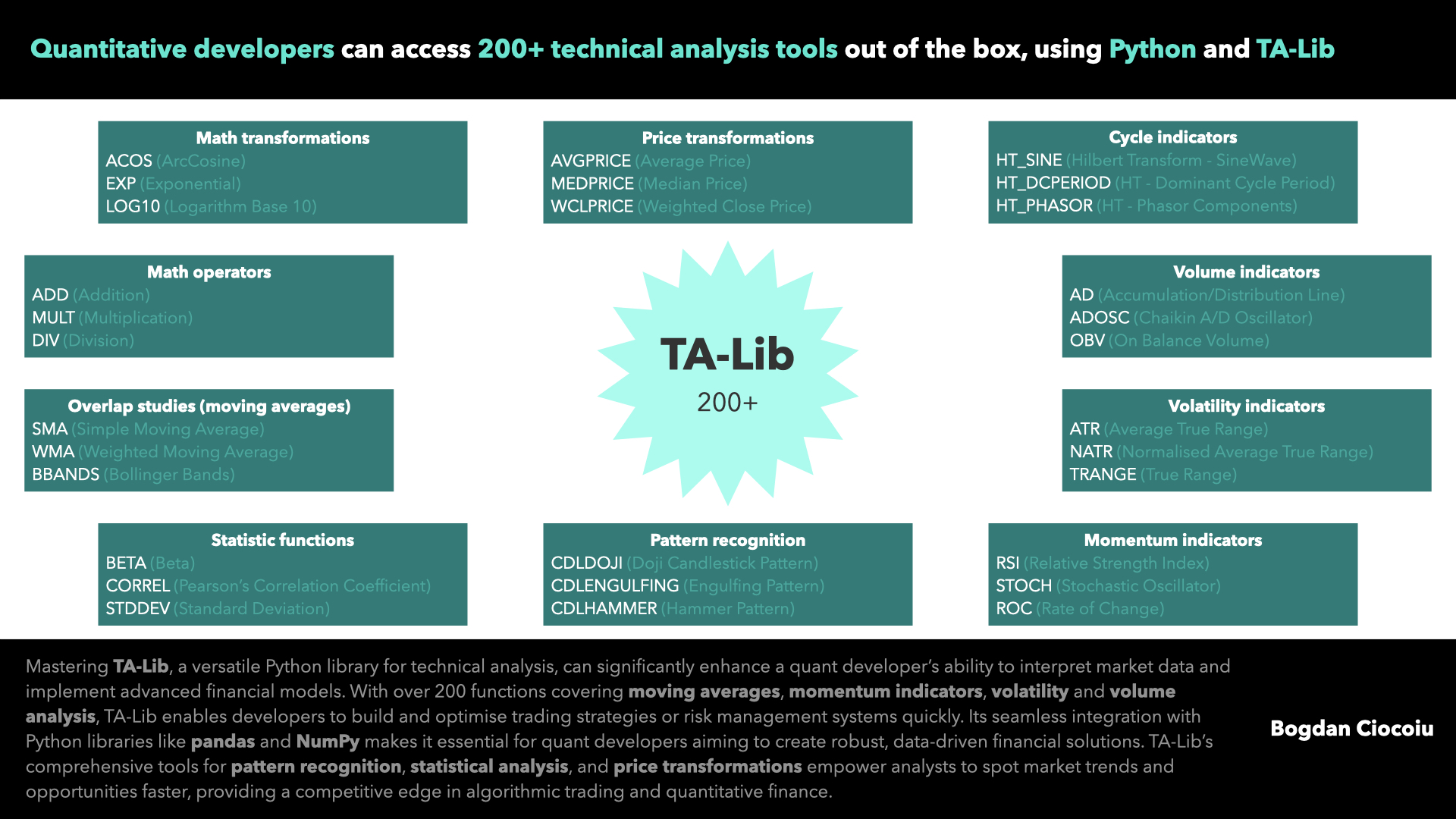

TA-Lib

In quantitative finance, having the right tools is crucial to success. The TA-Lib (Technical Analysis Library) is a powerful resource that every quant developer and quantitative analyst should be familiar with. TA-Lib allows users to seamlessly integrate advanced financial analytics into their workflow by providing a comprehensive range of technical analysis functions in Python. Making quick decisions is critical in a…

-

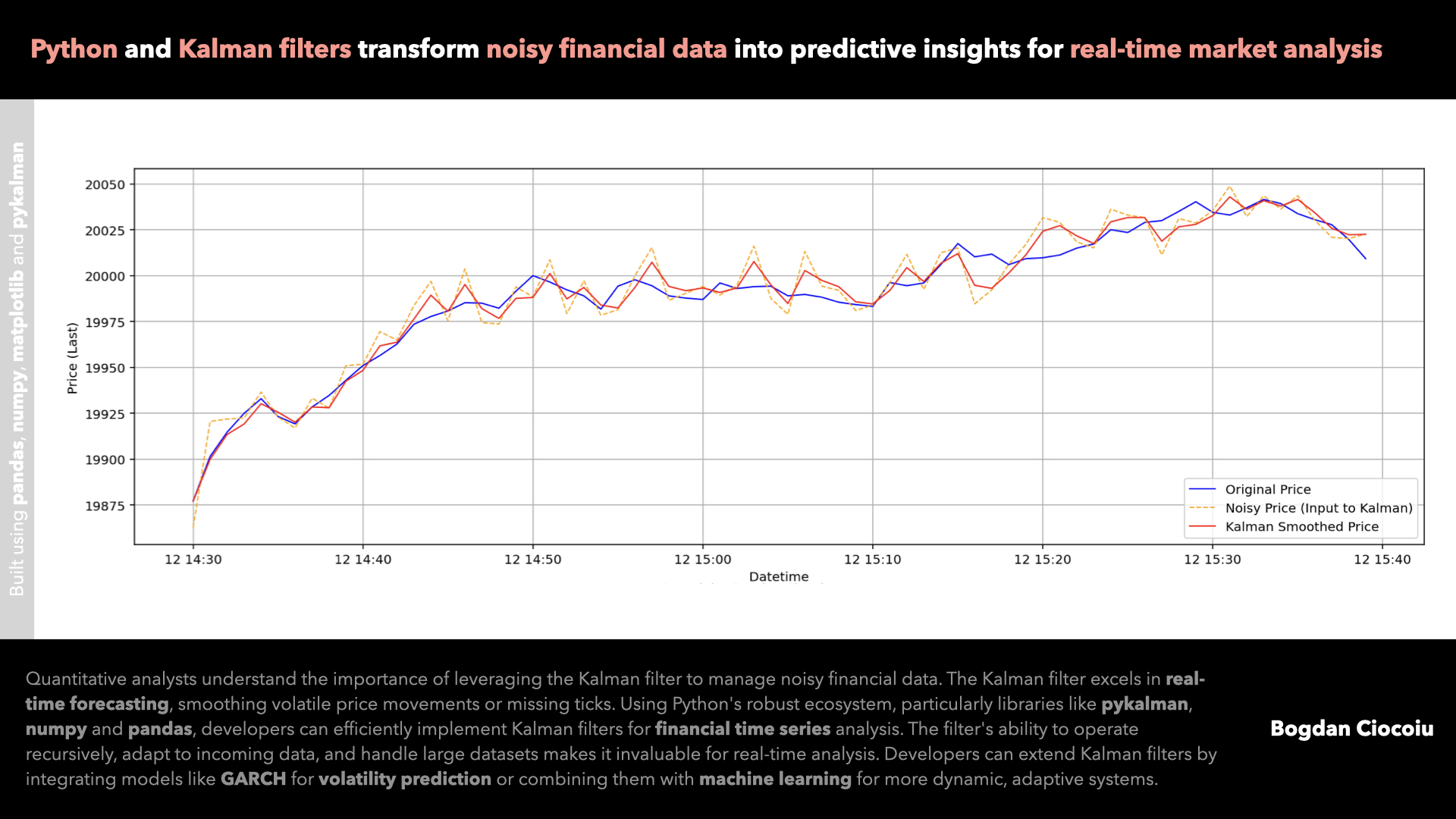

Kalman filter

As a quantitative analyst in financial markets, it is crucial to deploy models that can efficiently manage missing or noisy data and extract meaningful trends. The Kalman filter is one of the most robust tools for this purpose. Originating from control theory, the Kalman filter is now extensively used in finance to smooth out noise in time…

-

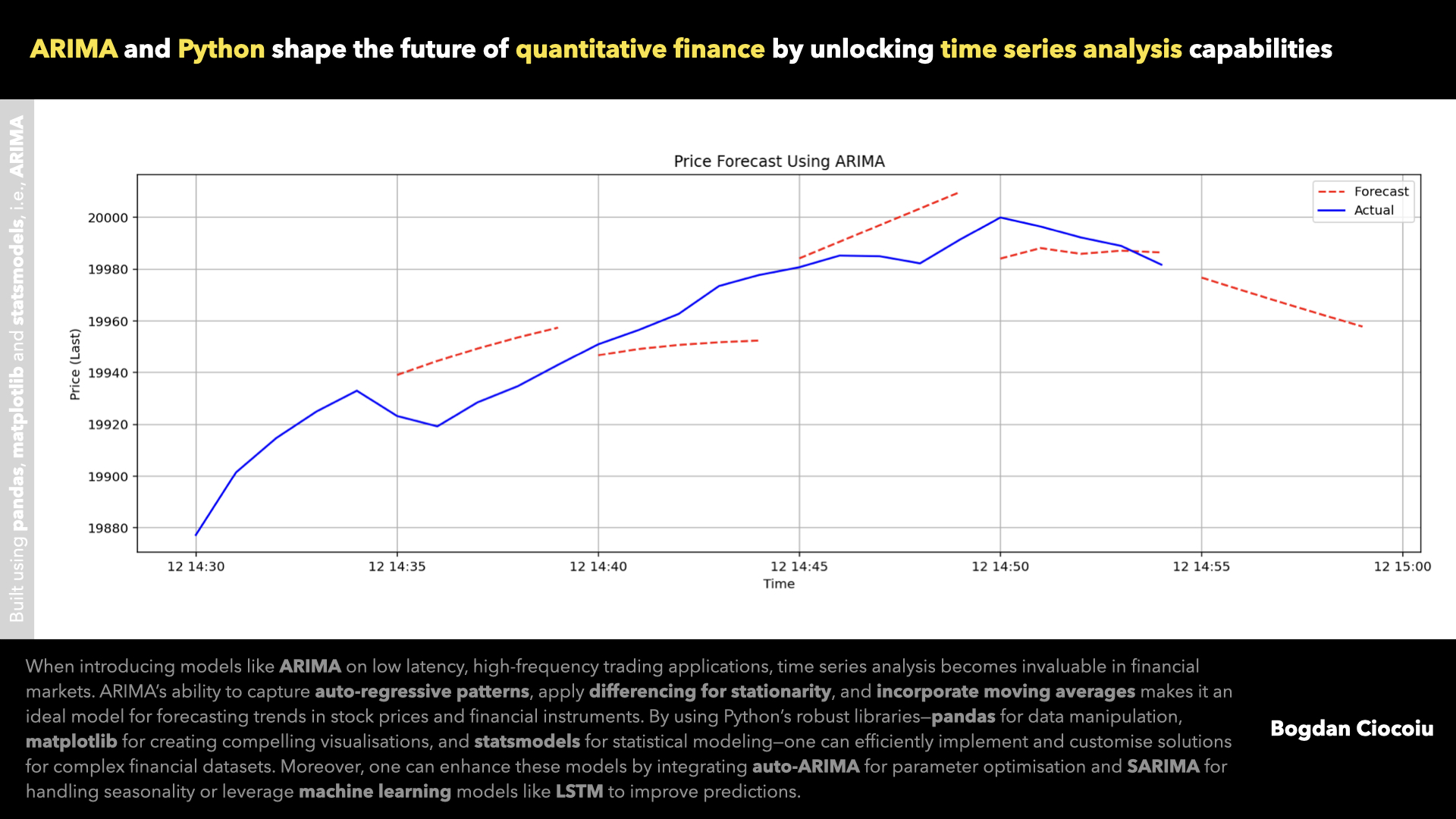

Time series analysis

Understanding time series data is crucial for making informed investment decisions in financial markets and the quantum analysis space. Time series analysis allows financial professionals to model and forecast market movements, identify trends, and detect underlying patterns in asset prices, trading volumes, and economic indicators. For quantitative analysts, the ability to apply robust statistical models…

-

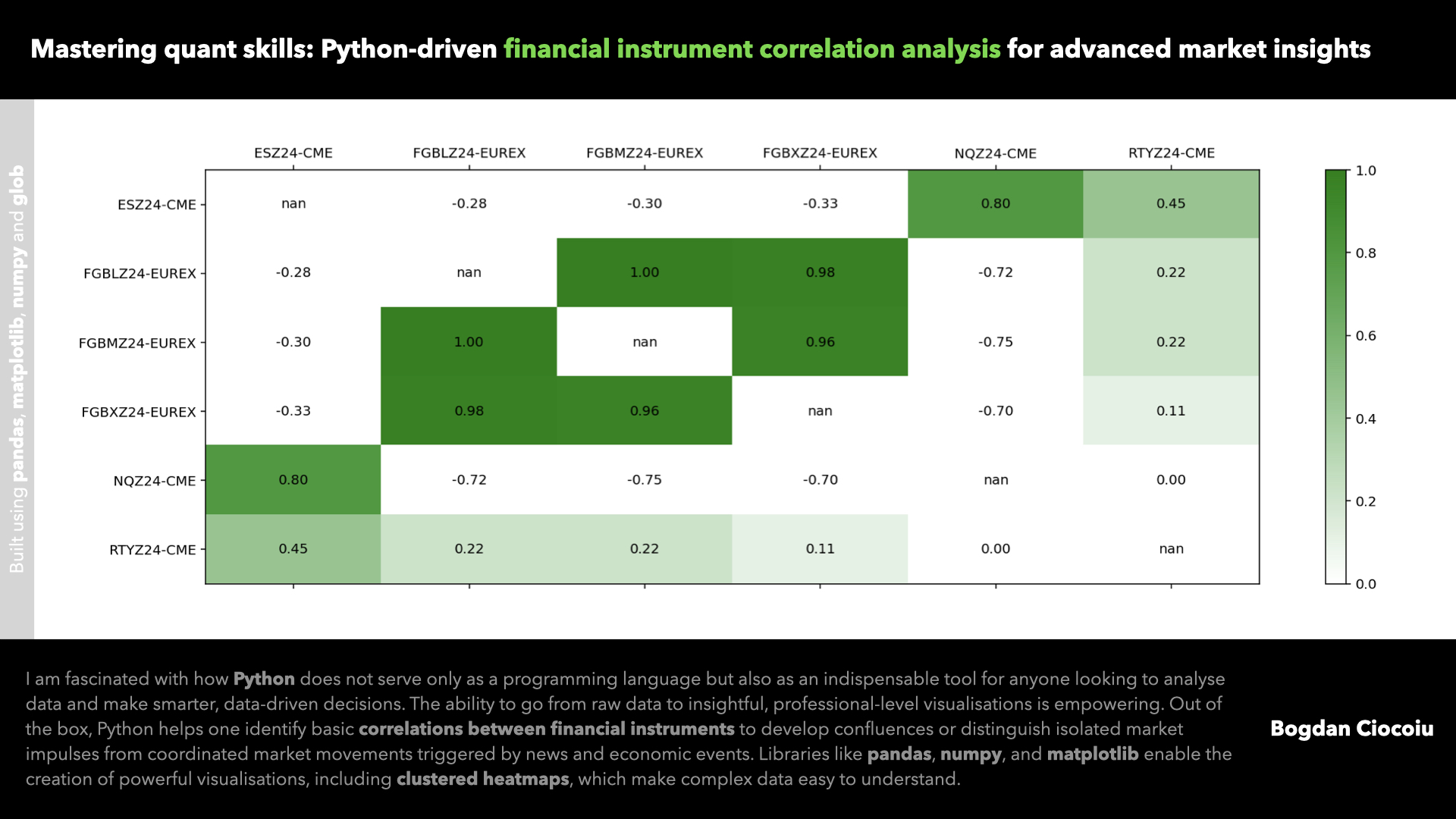

Correlations

Identifying correlations between assets in financial markets is vital in constructing diversified portfolios, managing risk, and improving returns. Correlation, in its simplest form, measures the relationship between two assets and how they move respectively to each other. A high positive correlation suggests that the assets tend to move in the same direction, while a negative…