Python

-

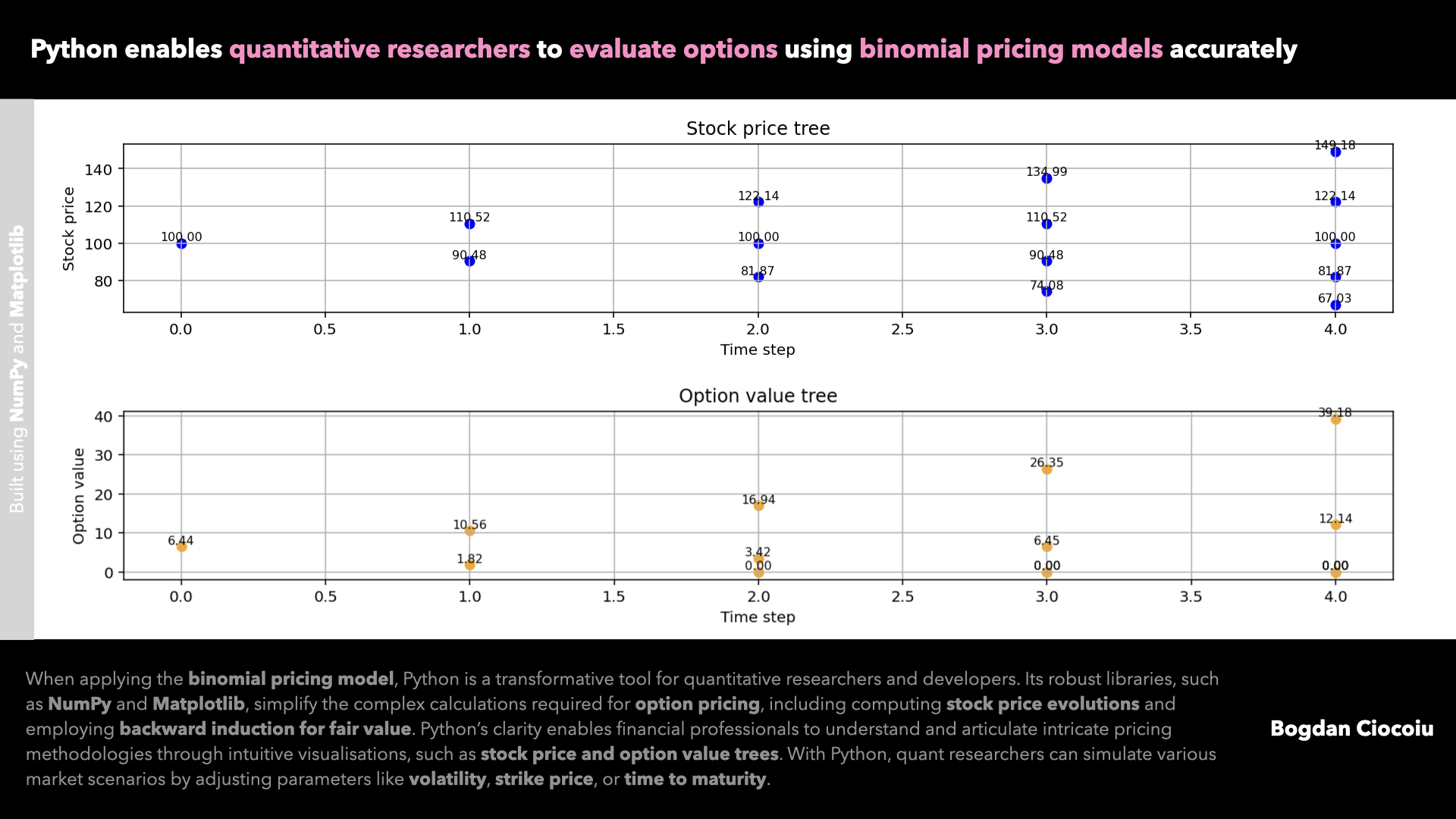

Binomial options pricing model

The ability to price derivatives accurately and efficiently is paramount. The binomial pricing model is one of the most widely used methods for option pricing, providing a structured approach to evaluating potential outcomes under various market conditions. With its powerful…

-

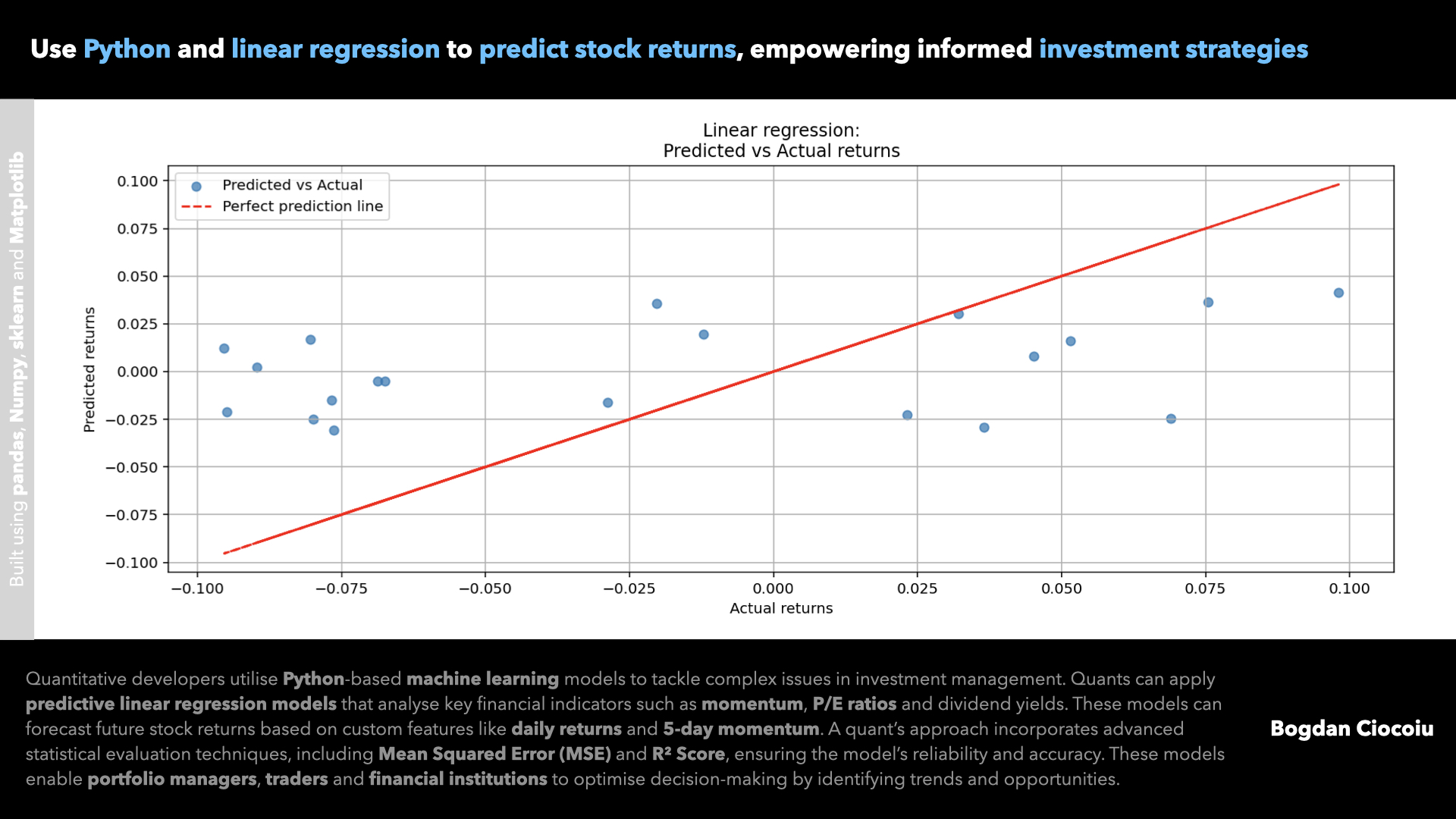

Supervised machine learning – Linear regression

Investment decisions demand a blend of precision, speed, and foresight. Quantitative developers play a pivotal role in enabling financial firms to stay ahead by designing predictive models that extract actionable insights from vast amounts of data. Leveraging Python’s capabilities, one…

-

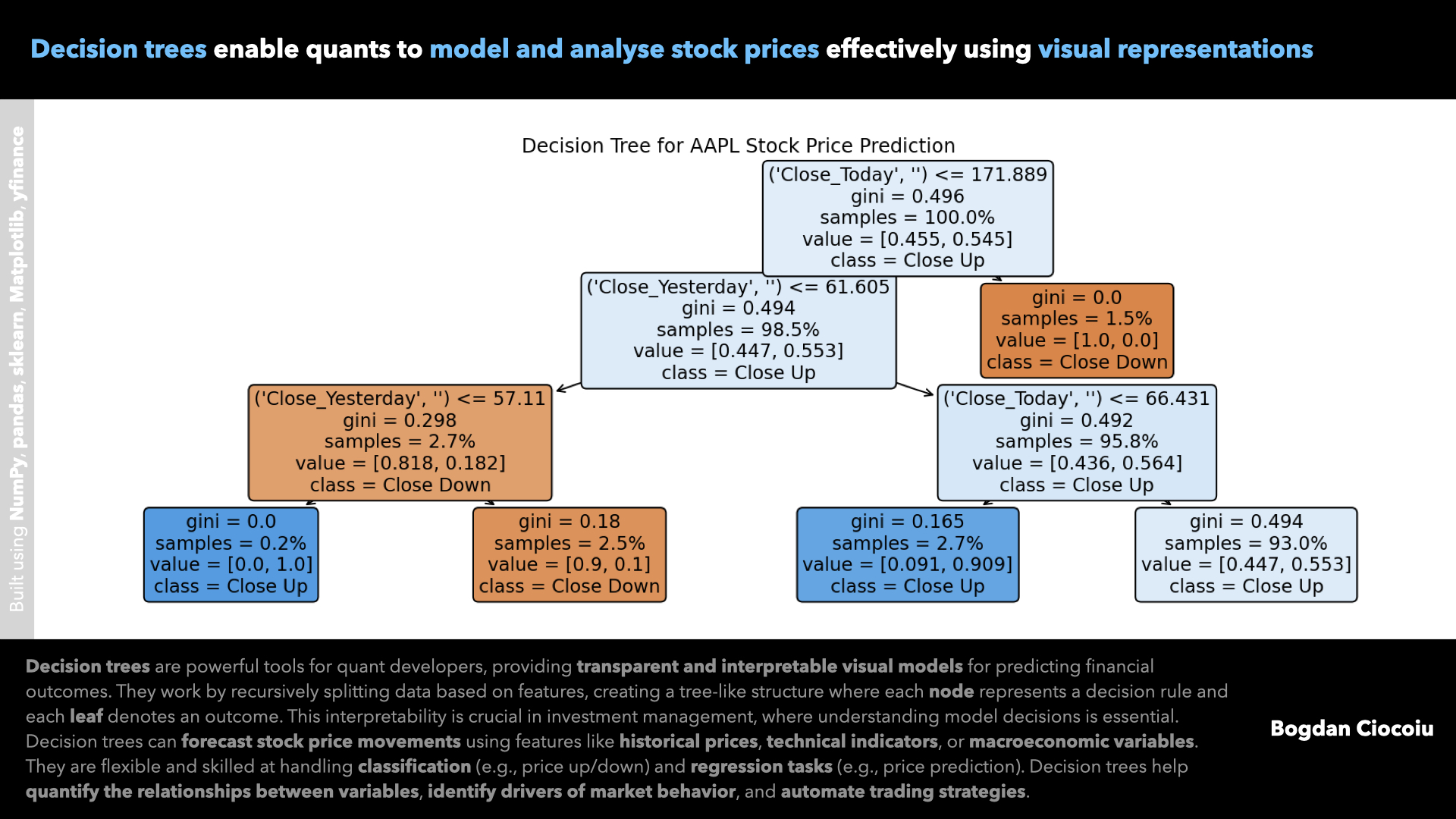

Supervised machine learning – Decision trees

Quantitative developers are pivotal in leveraging data to make informed investment decisions. Among the array of analytical tools available, decision trees are a powerful, interpretable, and versatile method for solving financial problems. Their ability to model decisions based on structured…

-

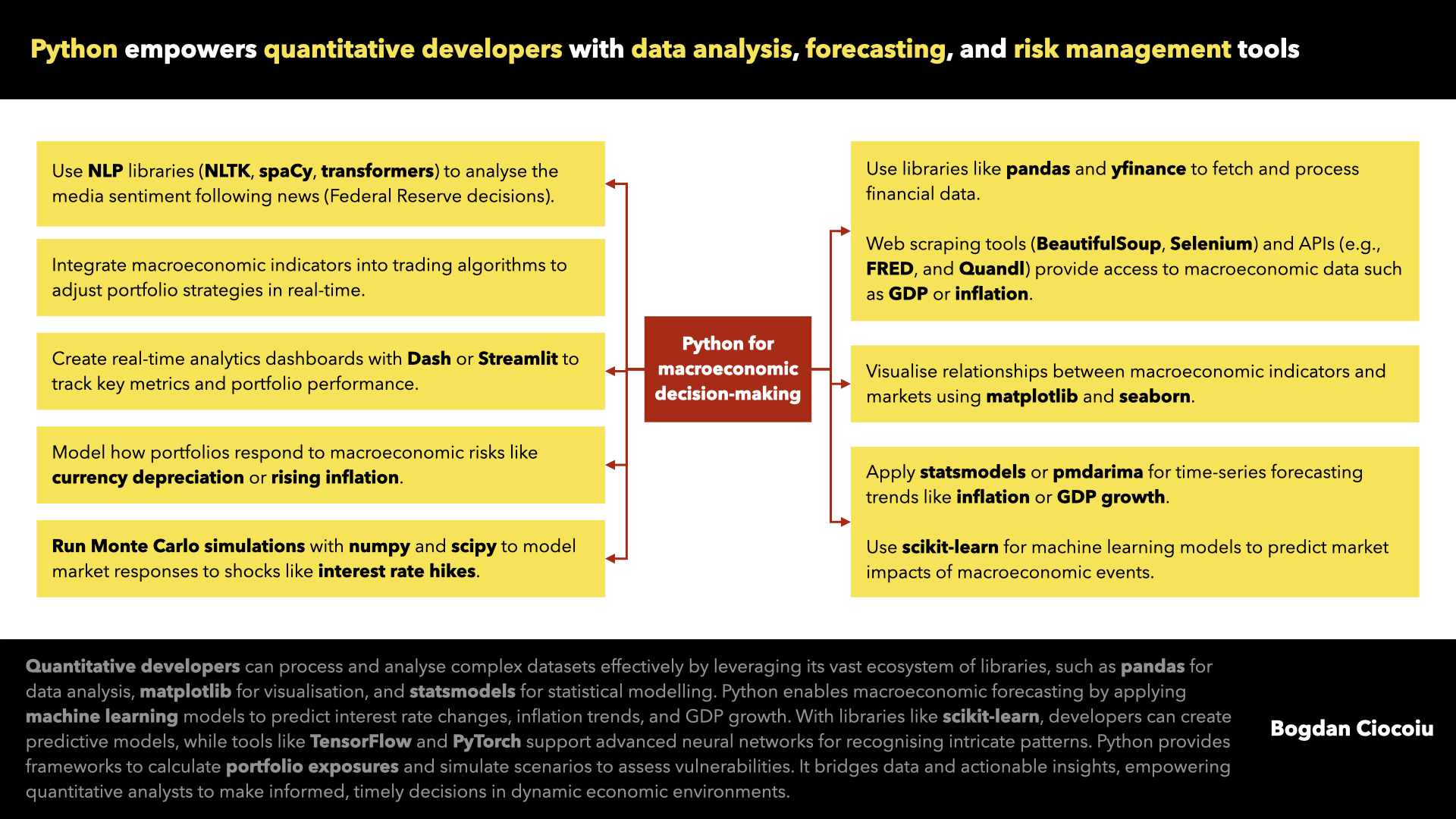

Macroeconomic decision-making

Macroeconomic events are pivotal in influencing market dynamics. Understanding and responding to these events can make the difference between profit and loss for investment professionals. Python, with its extensive ecosystem and user-friendly capabilities, has become a go-to tool for quantitative…

-

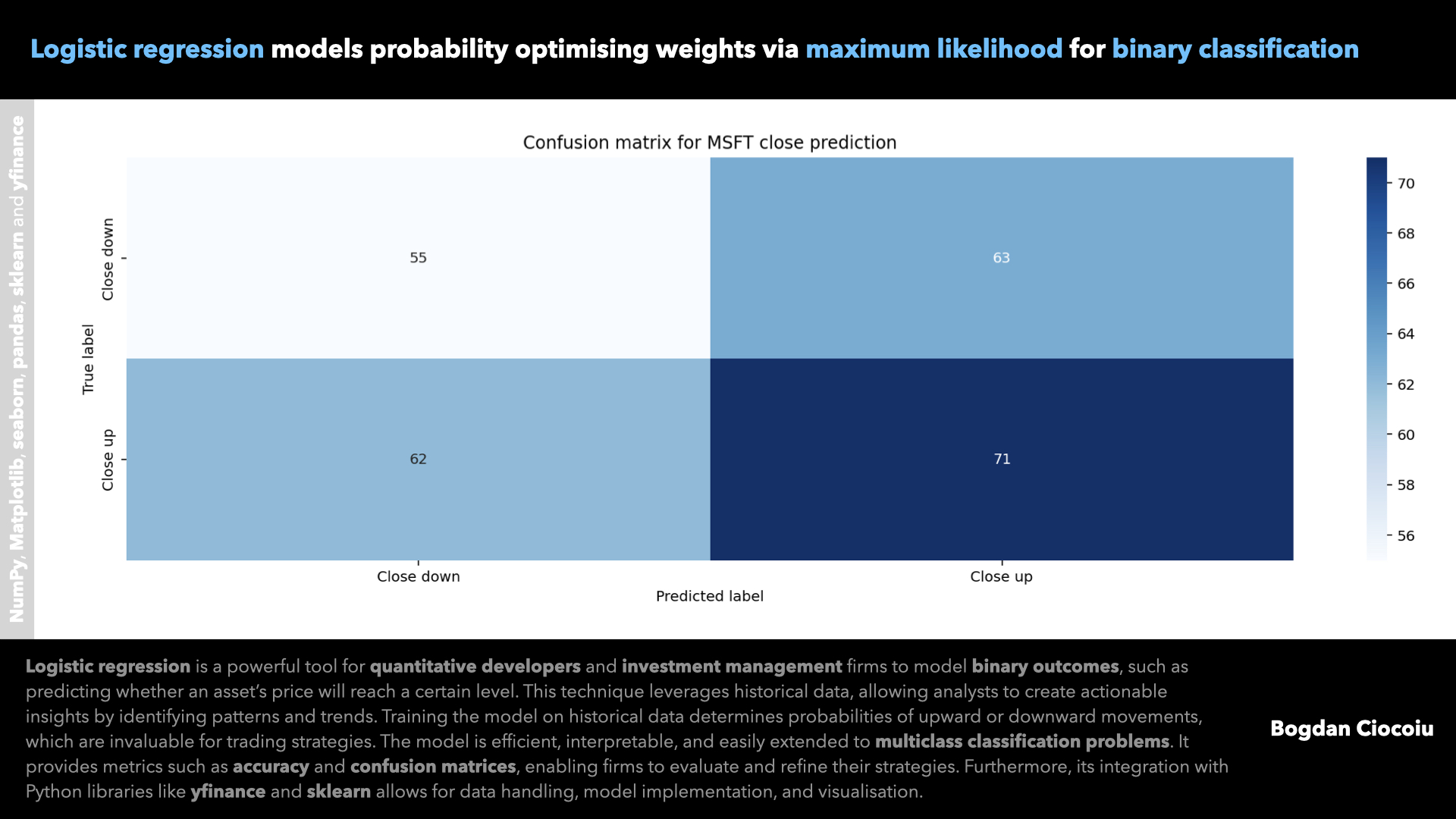

Supervised machine learning – Logistic regression

Predictive models are at the heart of decision-making in quantitative finance. Logistic regression, a fundamental machine learning algorithm, offers quantitative developers a robust and interpretable tool for classification problems. By leveraging logistic regression, financial institutions and developers can predict market…

-

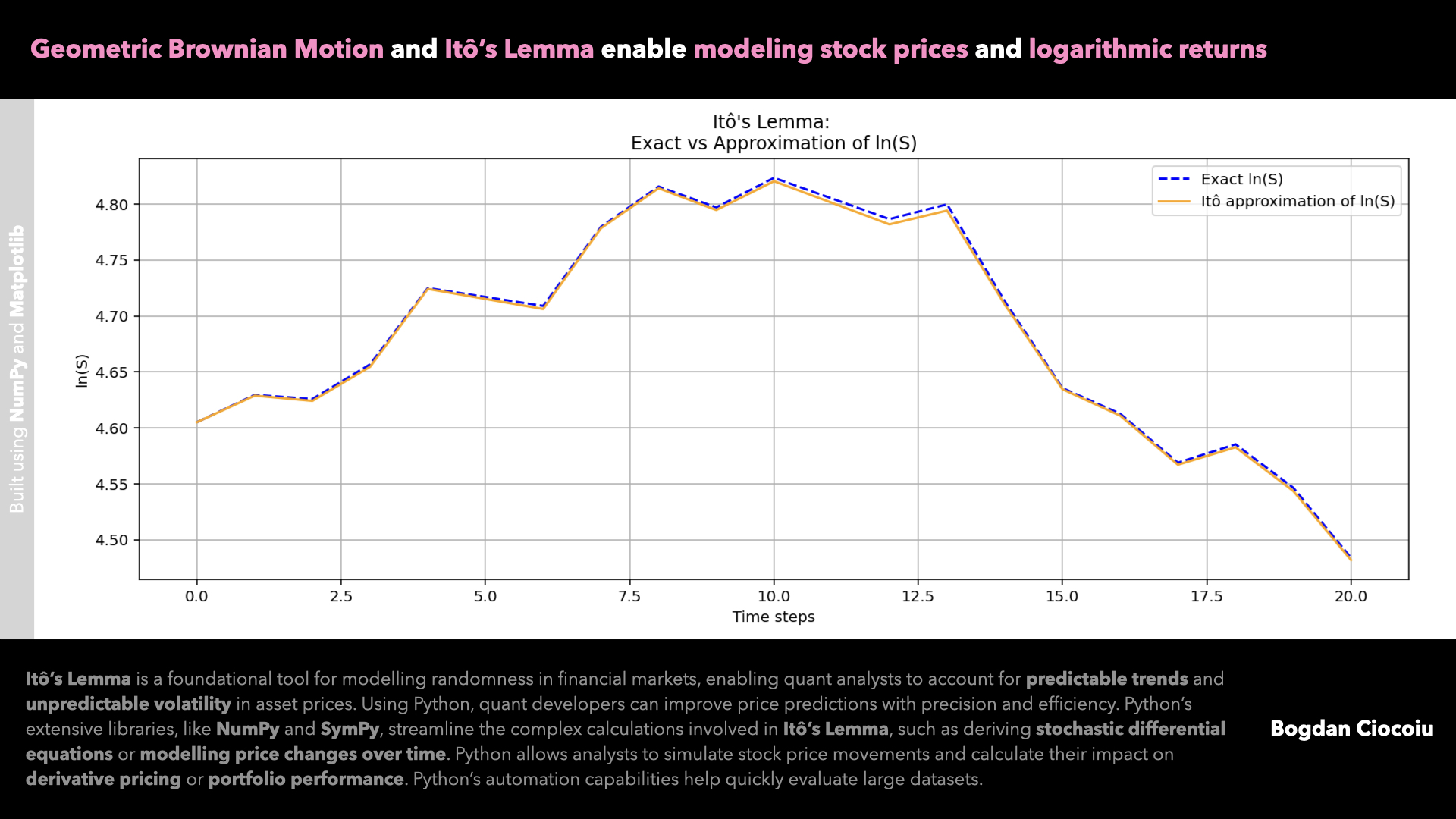

Price modelling – Itô’s Lemma – Geometric Brownian Motion

Quantitative analysts constantly seek robust methods to model and predict asset price movements. One such powerful tool is Itô’s Lemma, a cornerstone of stochastic calculus. By leveraging this mathematical framework alongside Python, quants can enhance their analytical toolkit, making strides in…

-

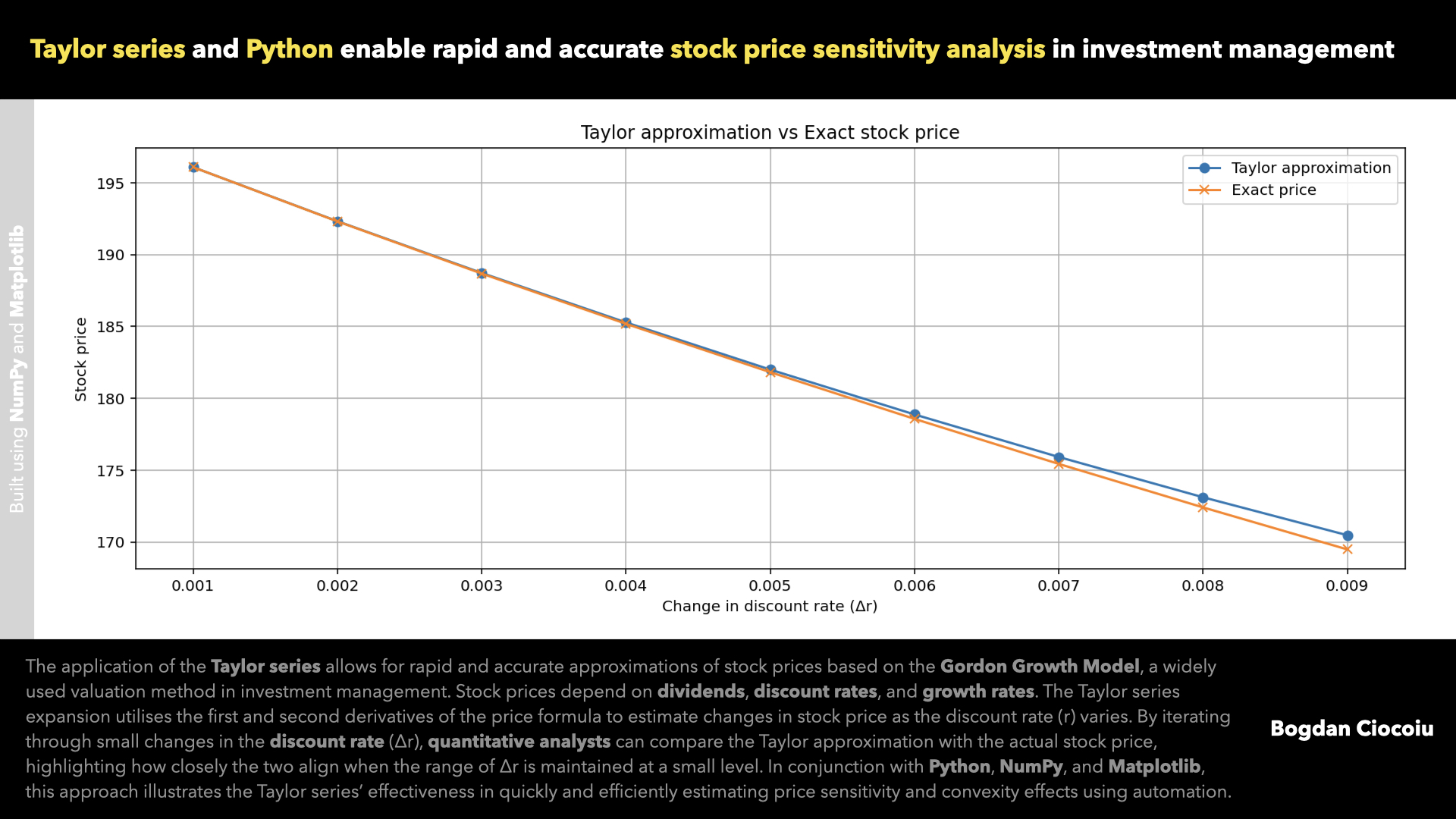

Approximations – Taylor series – Gordon Growth Model

In investment management, precision and efficiency are paramount when analysing how market variables impact stock prices. The Taylor series, a powerful mathematical tool, provides a robust framework for understanding price sensitivities and convexity effects. One application for the Taylor series…

-

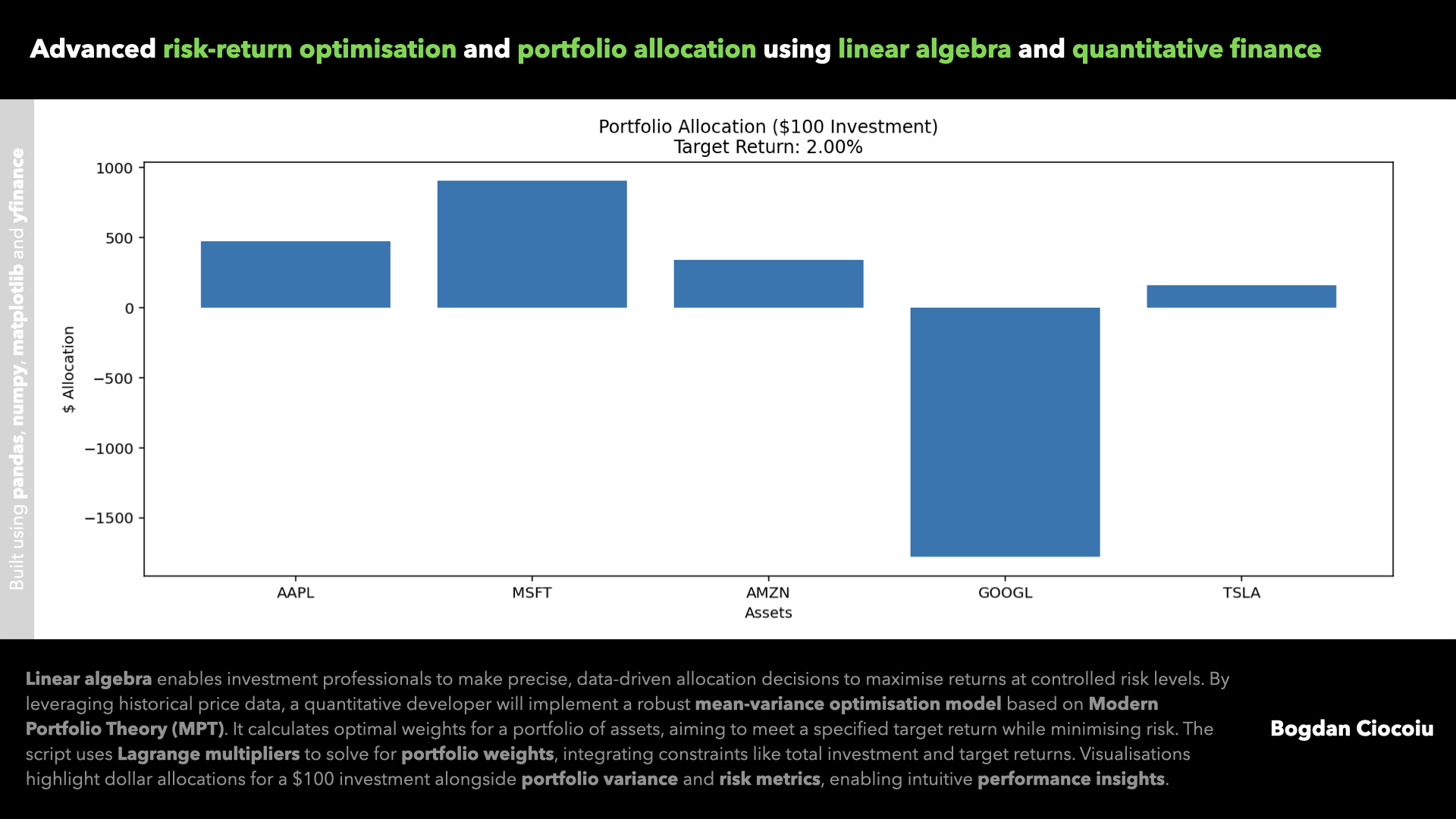

Portfolio optimisation – Linear algebra

Making investment decisions based on intuition or limited data can often lead to suboptimal outcomes. Quantitative analysis revolutionises how investors and portfolio managers approach asset allocation, enabling precise, data-backed strategies that optimise returns while controlling risks. One example of this…

-

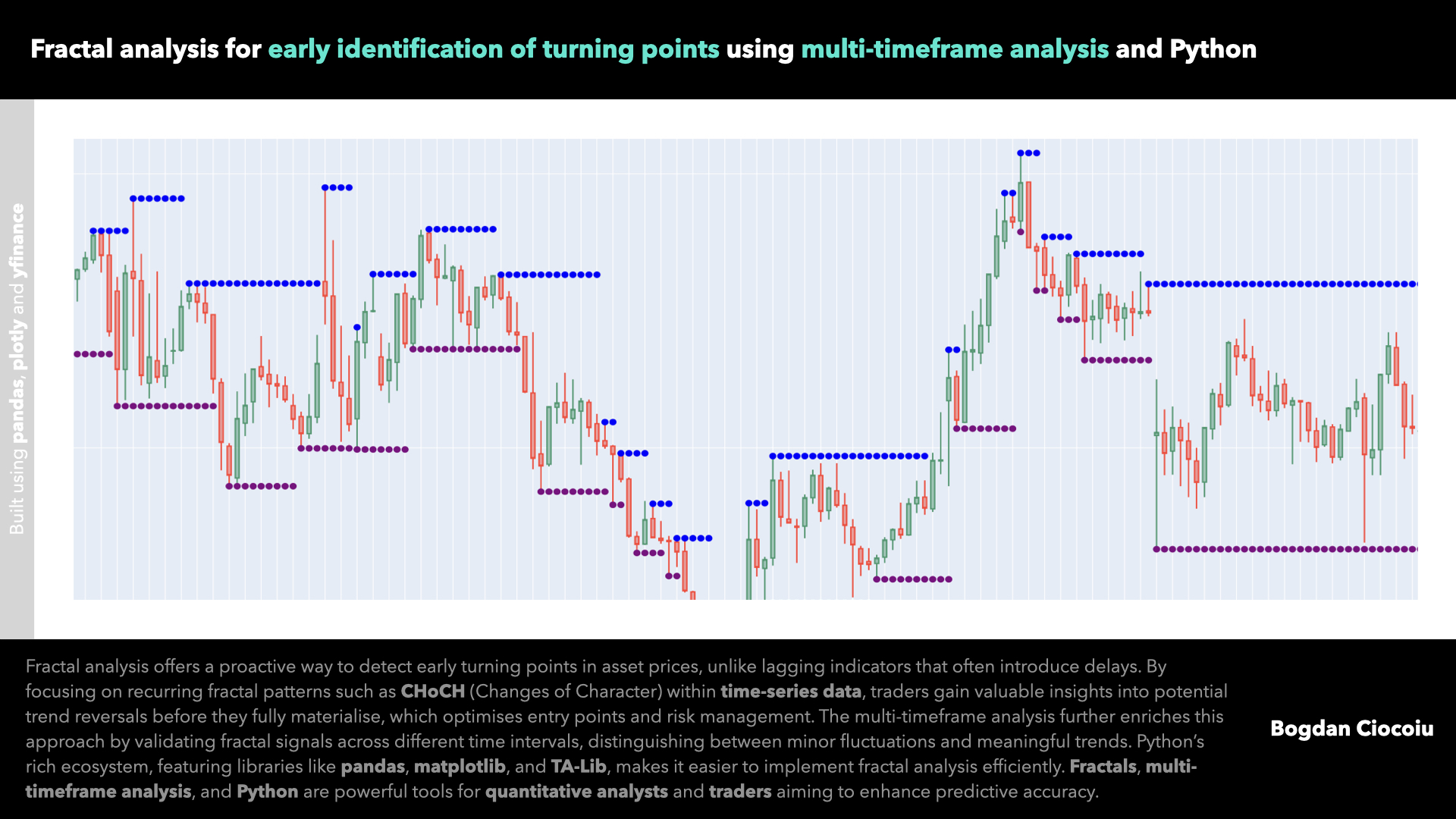

Market structure – Fractal microstructures

In financial markets, the ability to accurately and timely identify turning points in floating assets such as stocks, commodities, or forex pairs can spell the difference between profit and loss. Fractal analysis, a technical approach focusing on repetitive patterns and…

-

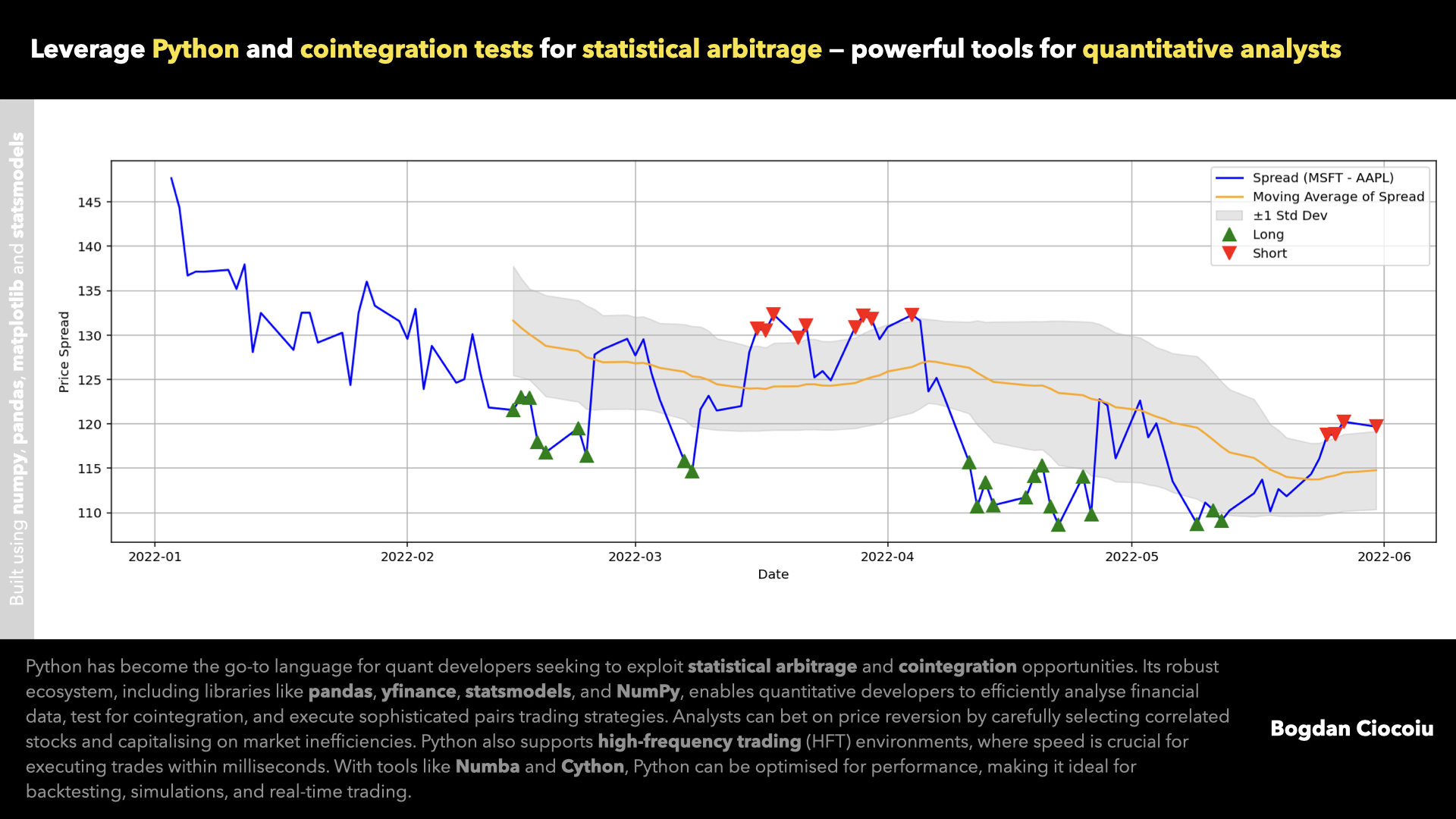

Statistical arbitrage – Cointegration – Pairs

Statistical arbitrage (or stat-arb) has become a powerful strategy for quantitative traders to exploit price discrepancies between financial instruments. By harnessing Python’s robust data analysis and statistical libraries, quantitative developers can implement sophisticated trading strategies, including pairs trading, to find and profit from…