Python

-

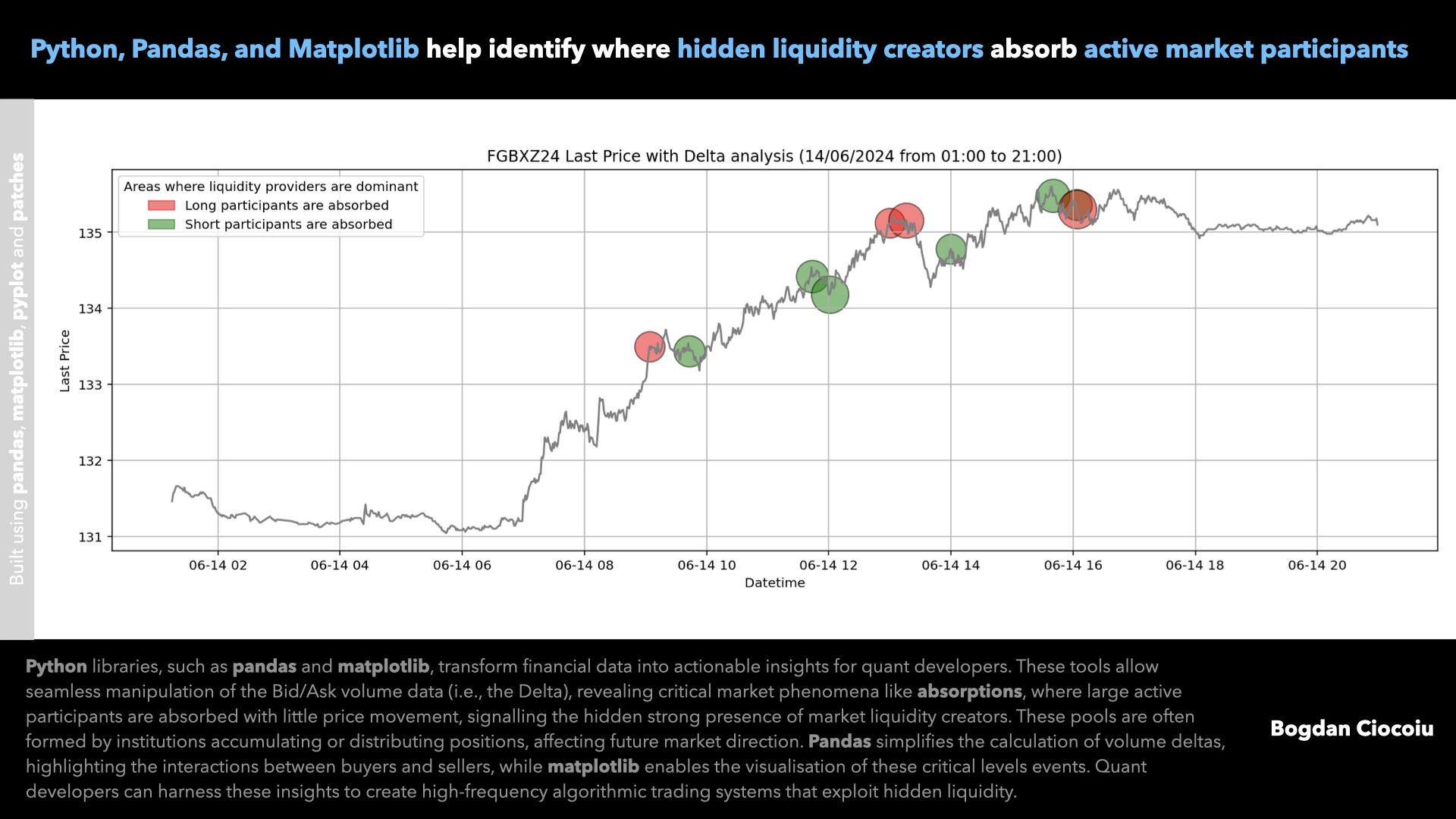

Absorptions

Leveraging Python and its powerful libraries like pandas and matplotlib provides a significant advantage in analysing financial data, especially when interpreting data feeds from centralised exchanges that include bid and ask data. The pandas library is paramount for managing and manipulating structured data in financial markets. A centralised…

-

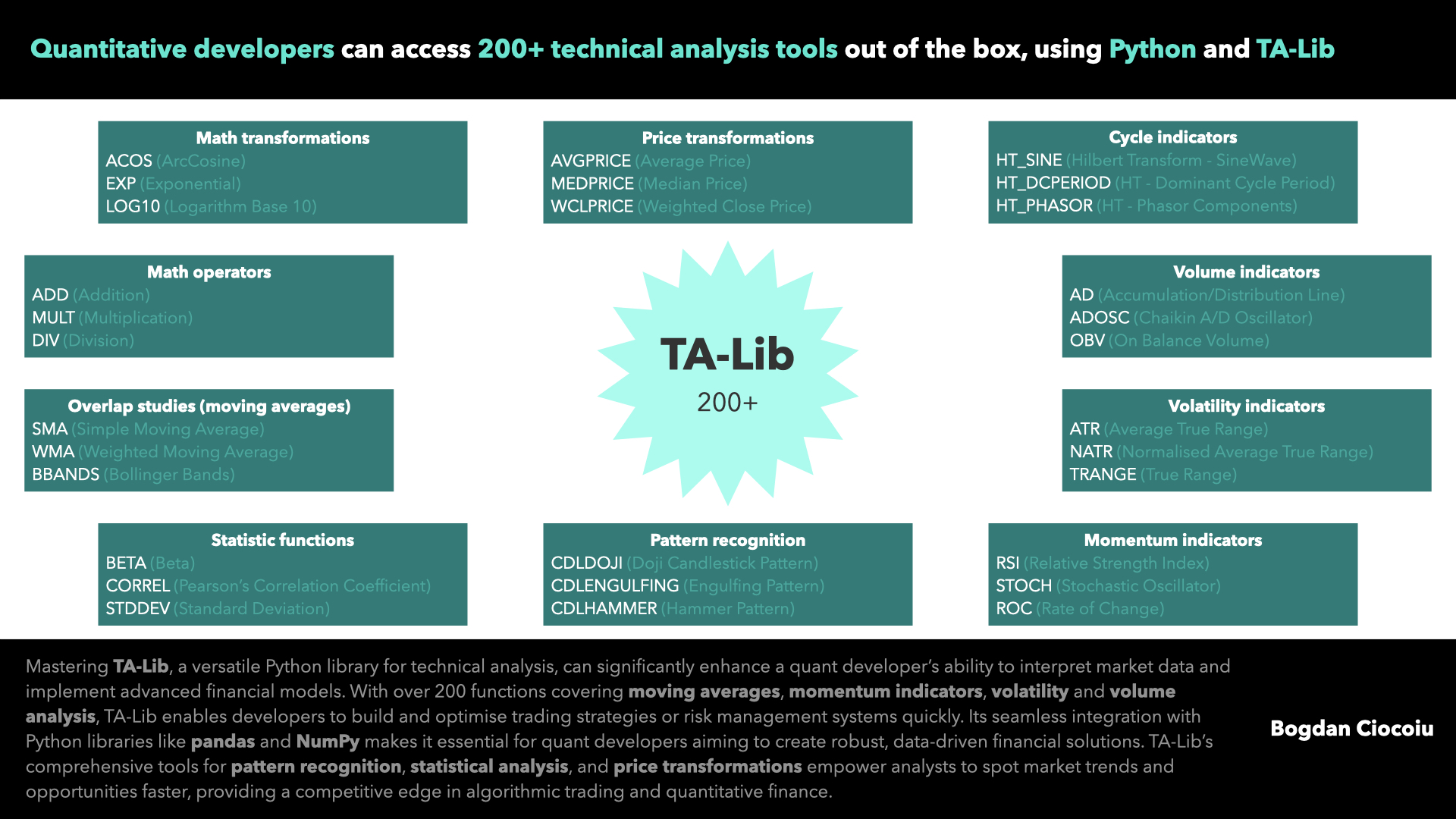

TA-Lib

In quantitative finance, having the right tools is crucial to success. The TA-Lib (Technical Analysis Library) is a powerful resource that every quant developer and quantitative analyst should be familiar with. TA-Lib allows users to seamlessly integrate advanced financial analytics into their workflow by providing a…

-

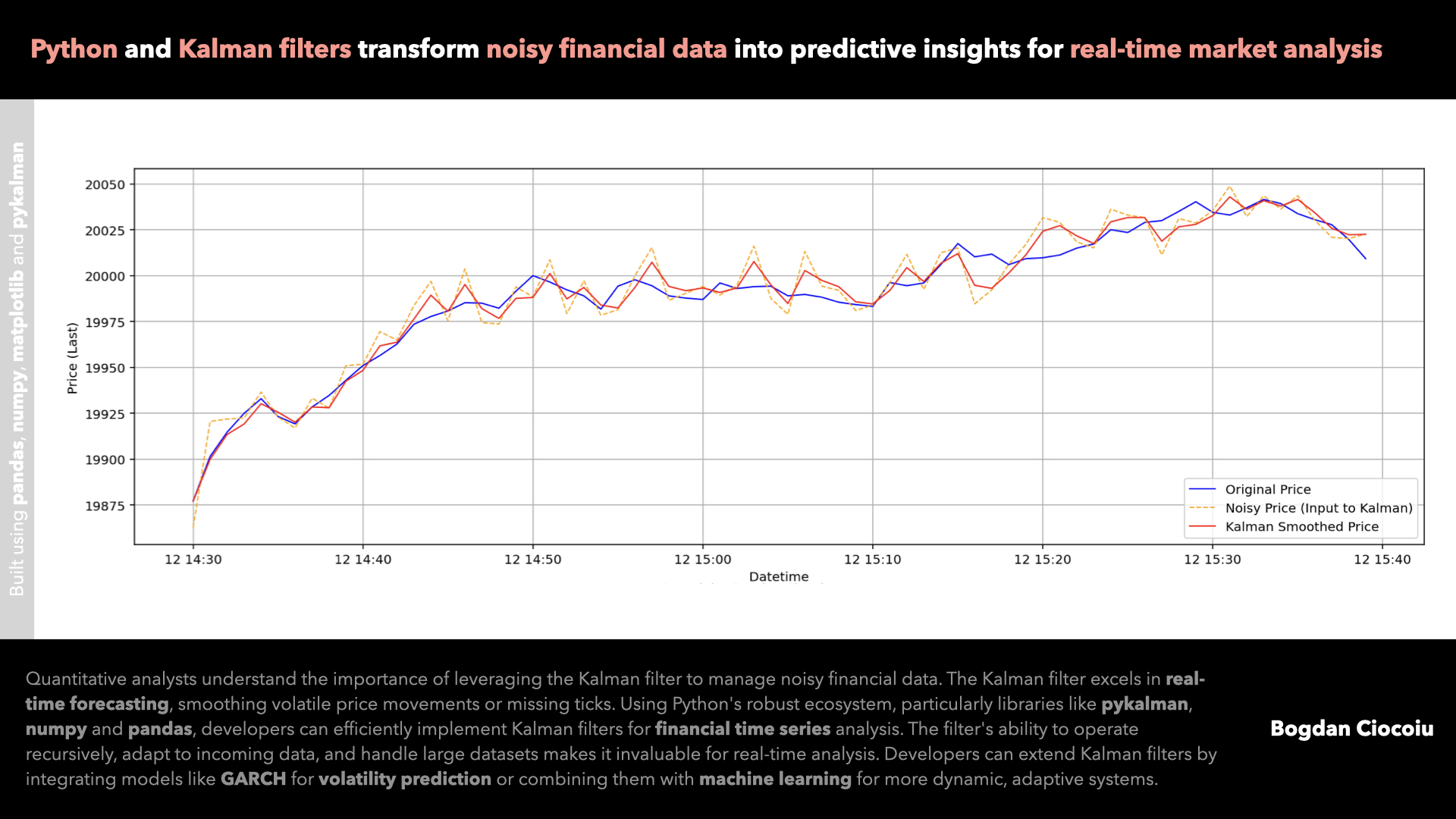

Kalman filter

As a quantitative analyst in financial markets, it is crucial to deploy models that can efficiently manage missing or noisy data and extract meaningful trends. The Kalman filter is one of the most robust tools for this purpose. Originating from control theory,…

-

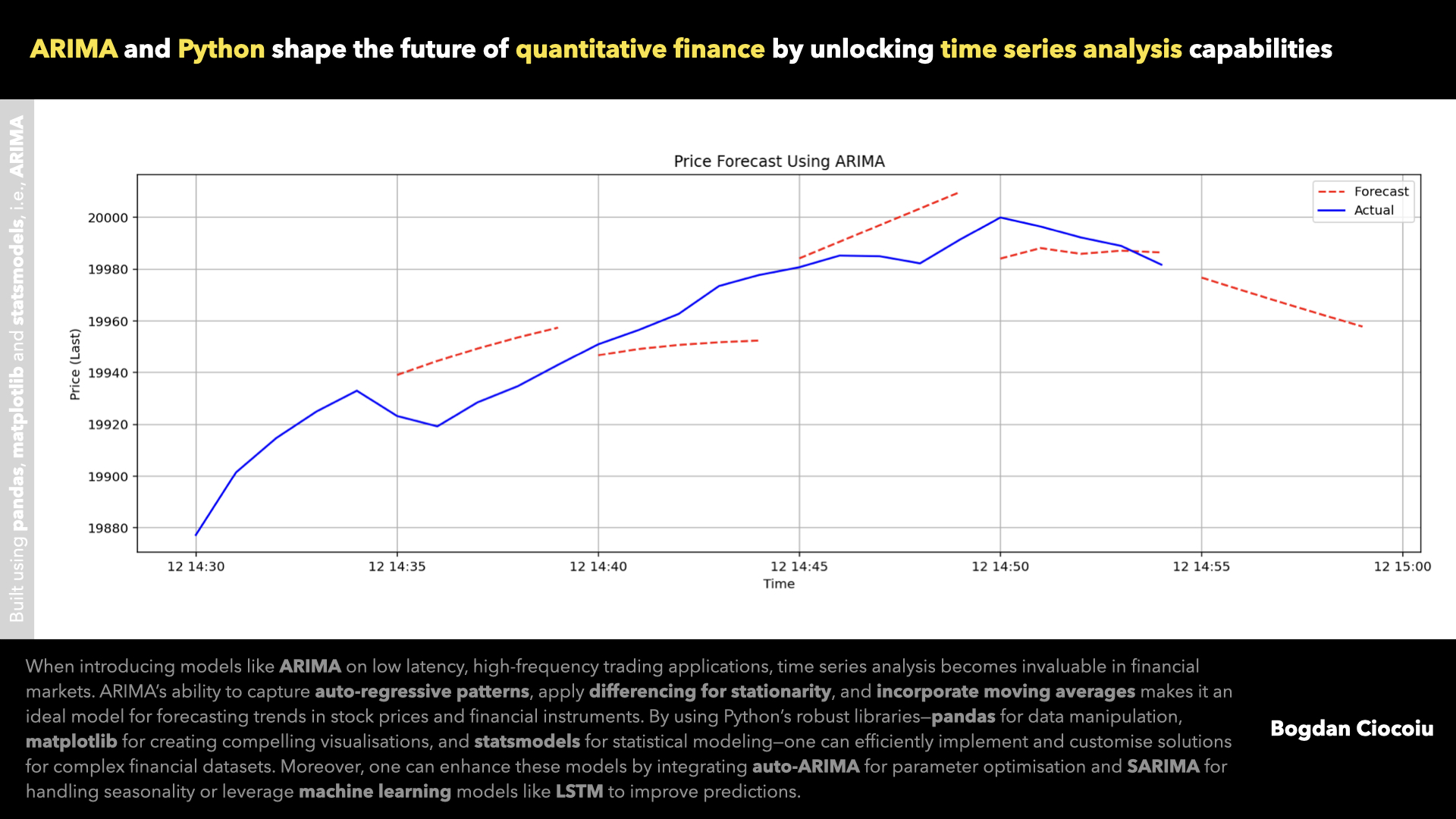

Time series analysis

Understanding time series data is crucial for making informed investment decisions in financial markets and the quantum analysis space. Time series analysis allows financial professionals to model and forecast market movements, identify trends, and detect underlying patterns in asset prices,…

-

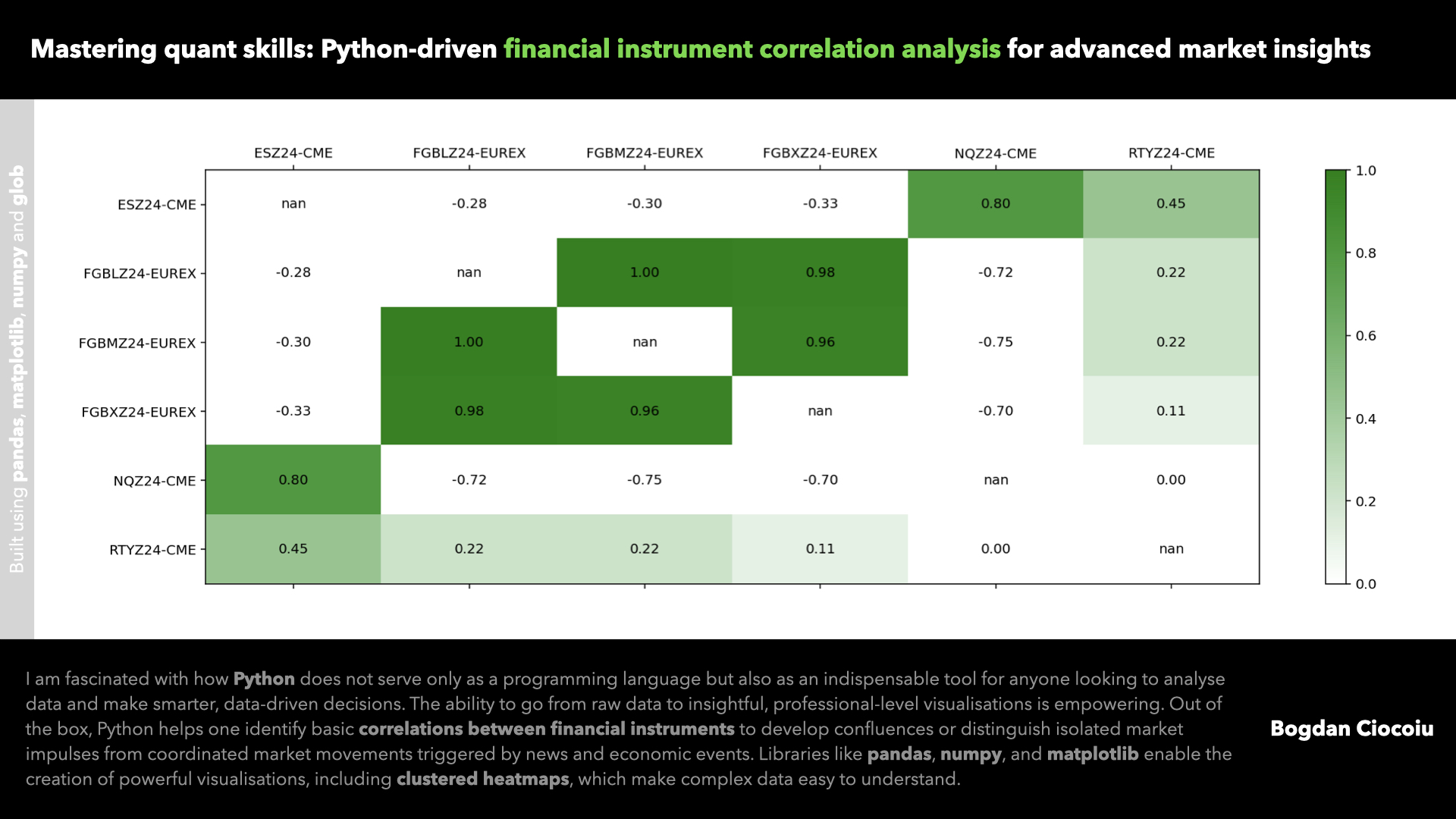

Correlations – Matrices

Identifying correlations between assets in financial markets is vital in constructing diversified portfolios, managing risk, and improving returns. Correlation, in its simplest form, measures the relationship between two assets and how they move respectively to each other. A high positive…

-

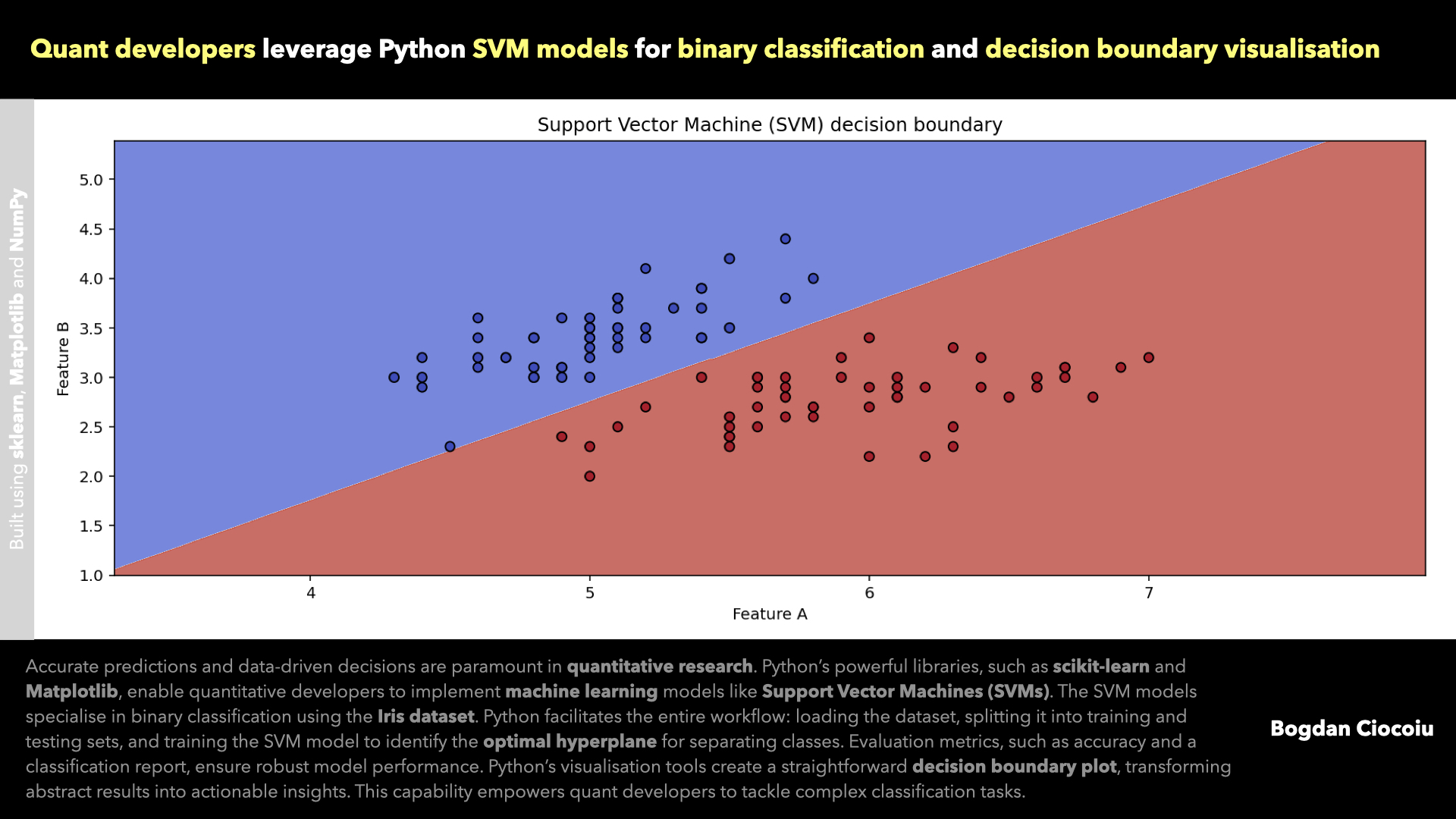

Supervised machine learning – Support vector machine

Machine learning has become an indispensable tool for tackling complex problems in quantitative analysis. Among the arsenal of algorithms, Support Vector Machines (SVM) stand out for their robustness in classification and regression tasks. With powerful libraries like sklearn and Matplotlib, Python empowers quant developers to build, evaluate,…

-

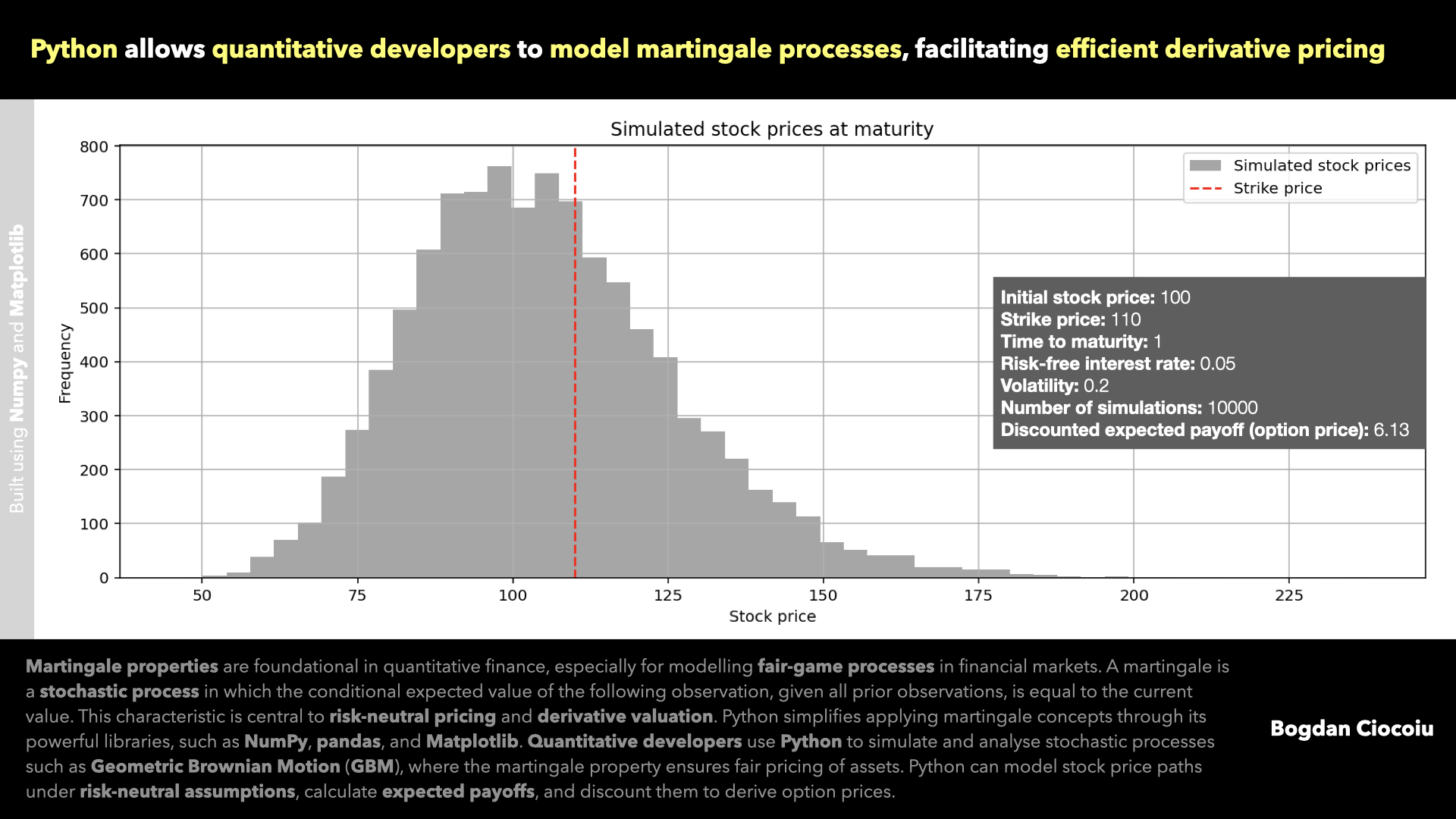

Martingale properties

Martingale properties lie at the core of modern financial theory and quantitative analysis. These properties describe stochastic processes where the conditional expected value of the next observation, given the current and past values, equals the current observation. In simple terms, martingales represent “fair games” where…

-

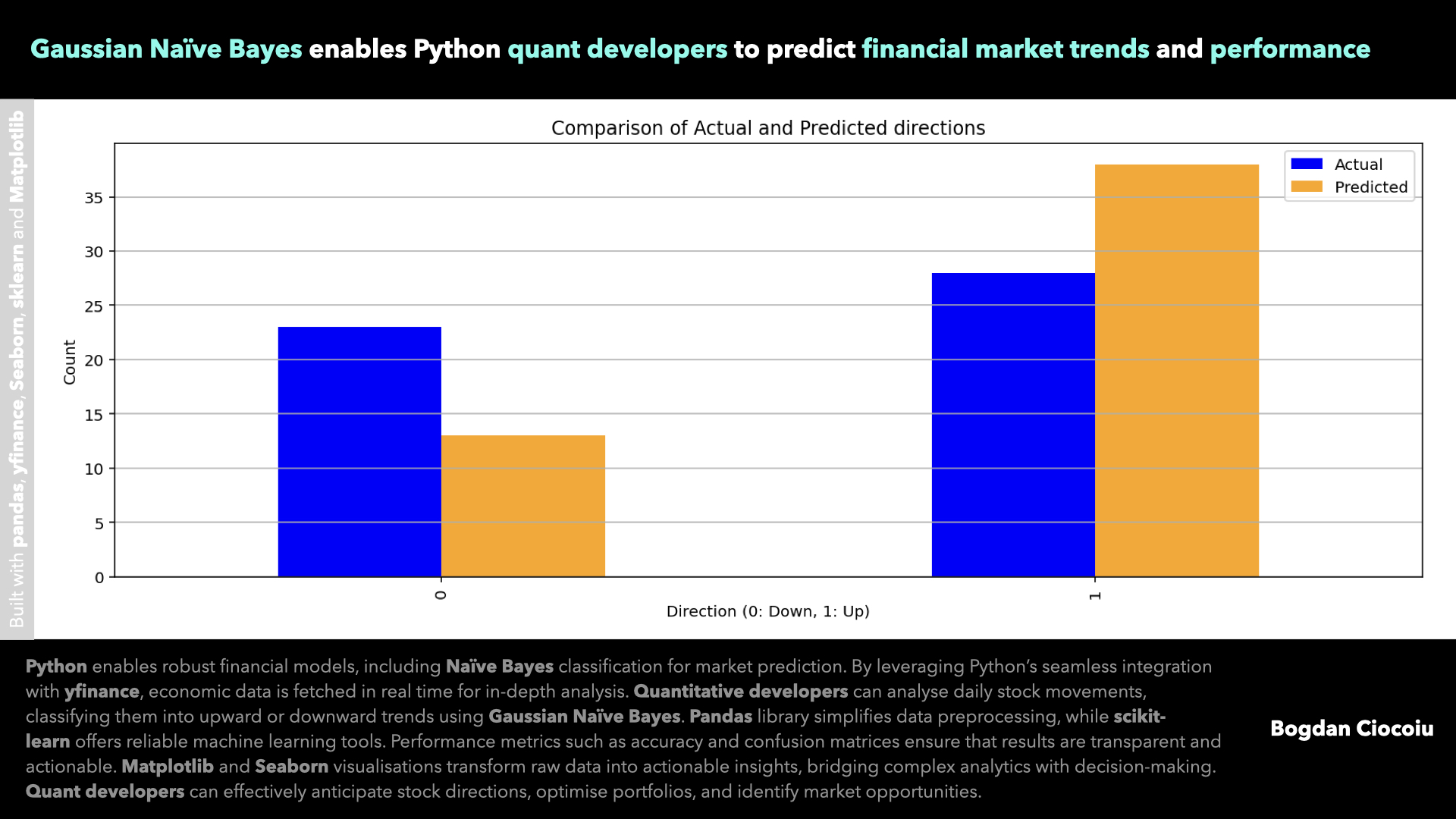

Supervised machine learning – Gaussian Naïve Bayes

In quantitative finance, having access to precise data analytics and advanced predictive models is key. With its versatile ecosystem, Python has emerged as an indispensable tool for quantitative developers seeking to optimise investment strategies and forecast market movements. One such…

-

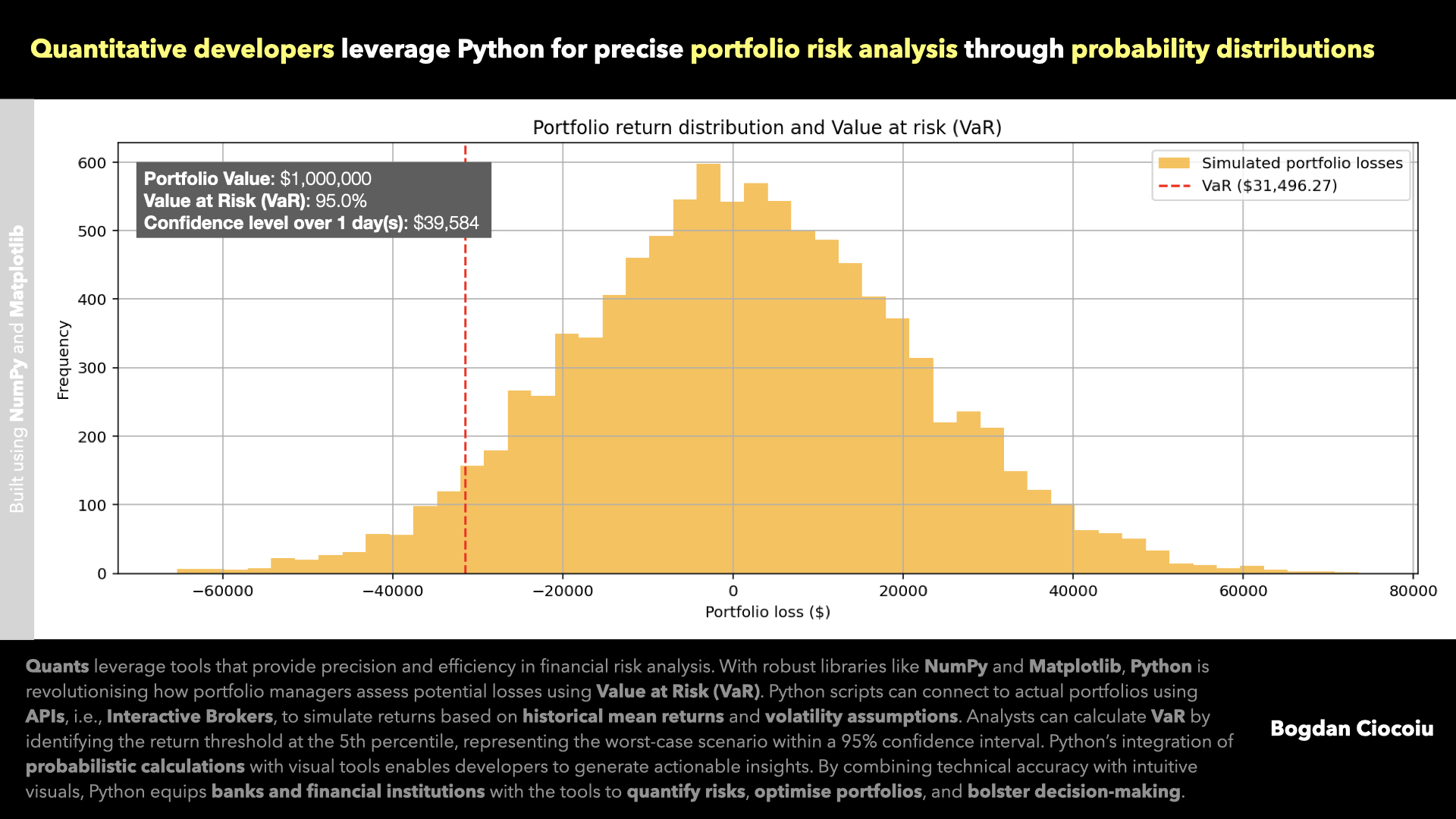

Probability distributions

Risk management is paramount for banks, financial institutions, and investment firms. Accurately predicting potential portfolio losses, especially during market downturns, can mean the difference between resilience and vulnerability. Python has emerged as an indispensable tool for quantitative developers, offering flexibility…