The ability to price derivatives accurately and efficiently is paramount. The binomial pricing model is one of the most widely used methods for option pricing, providing a structured approach to evaluating potential outcomes under various market conditions.

With its powerful computational capabilities and user-friendly libraries, Python has become the go-to tool for implementing this model.

Efficient implementation

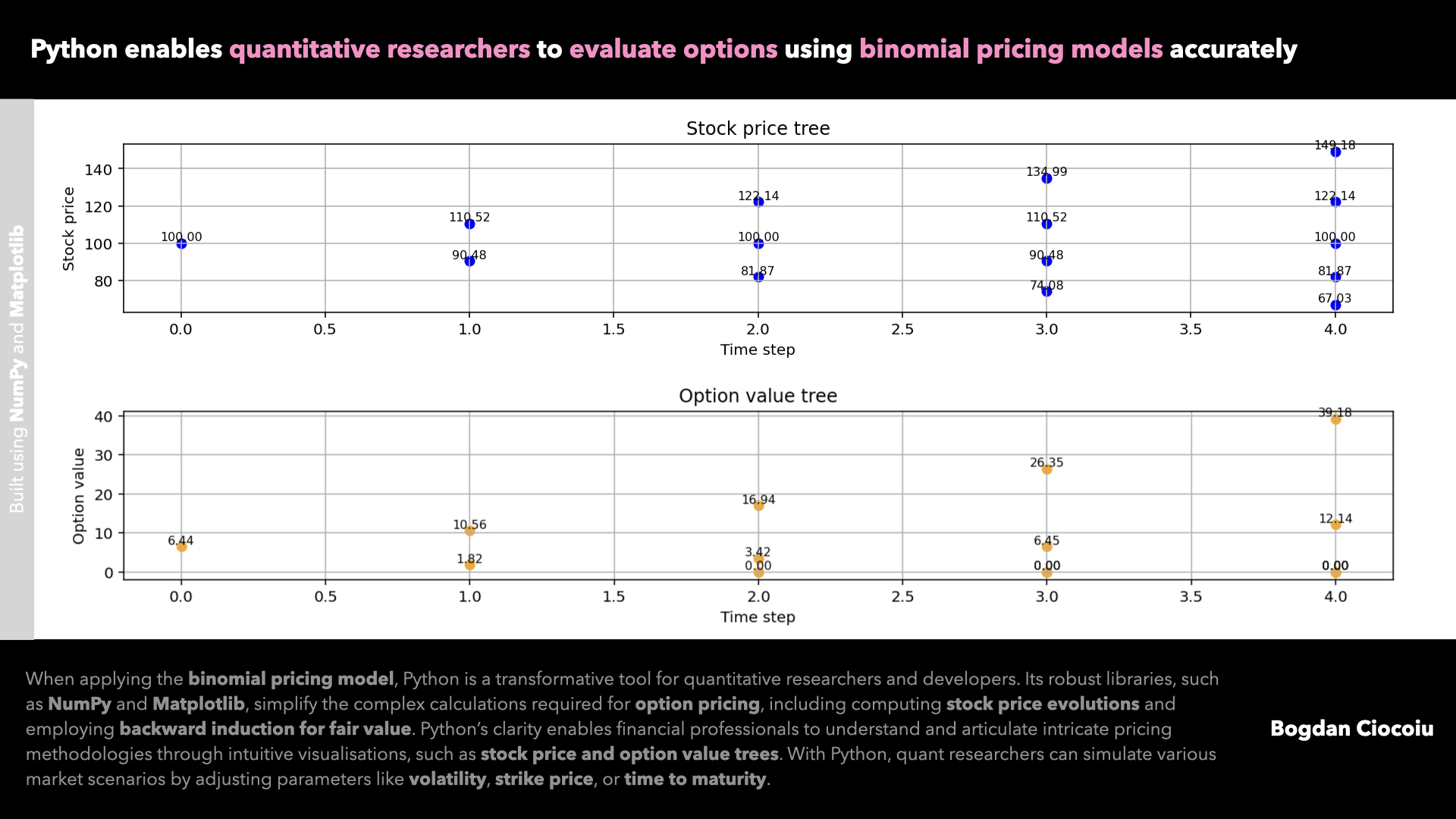

The binomial pricing model requires iterative calculations to simulate possible stock price paths, calculate option values at maturity, and work backwards to determine fair prices at earlier steps.

Python excels at handling such iterative processes, and libraries like NumPy make array operations seamless. Developers can create compact, readable code to compute stock price trees, option value trees, and risk-neutral probabilities. These efficient implementations free up valuable time for researchers to focus on more profound insights and strategy development.

Intuitive visualisations

Python’s Matplotlib library enables the creation of intuitive visualisations that transform abstract concepts into tangible insights. By plotting stock price trees and option value trees, quant developers can showcase the evolution of asset prices and option values over time. These visuals are helpful for internal analysis and are powerful tools for communicating complex financial concepts to stakeholders and decision-makers.

A stock price tree visual shows all potential price movements at each time step, helping analysts understand the underlying asset’s dynamics. Similarly, an option value tree illustrates how the option’s value evolves backwards through the binomial tree.

Customisable models

Python offers unparalleled flexibility in customising the binomial pricing model to match real-world scenarios. Researchers can easily adjust parameters like strike price, volatility, or time to maturity to simulate various market conditions. This adaptability is crucial for stress-testing portfolios and developing strategies tailored to specific financial goals.

A quant developer might adjust volatility parameters to evaluate how market uncertainty impacts option values or explore different interest rate scenarios to optimise hedging strategies. This level of customisation ensures that Python-powered models remain relevant in ever-changing financial landscapes.

The bridge between academia and industry

Python’s accessibility bridges the gap between academic theories and practical implementation in the financial industry. The binomial pricing model, often taught in finance courses, can be implemented in Python scripts and then deployed in real-world trading systems. This alignment ensures emerging quant professionals can quickly adapt their knowledge to solve pressing industry challenges.

Cost-effectiveness

Unlike proprietary software, Python is open-source, making it a cost-effective choice for banks and financial institutions seeking to develop sophisticated pricing models without incurring high licensing fees. Its extensive community support ensures continuous improvements and the availability of resources for troubleshooting and learning. This democratisation of technology empowers even tiny firms to compete with more significant players in the market.

Leave a Reply

You must be logged in to post a comment.