Macroeconomic events are pivotal in influencing market dynamics. Understanding and responding to these events can make the difference between profit and loss for investment professionals. Python, with its extensive ecosystem and user-friendly capabilities, has become a go-to tool for quantitative developers looking to enhance decision-making processes in the context of macroeconomic factors.

Processing, analysing, and interpreting vast amounts of economic data is essential for informed decision-making, as demonstrated by Seeking Alpha, Benzinga, TipRanks, Trade Ideas, TrendSpider, Zacks, Fool and other platforms.

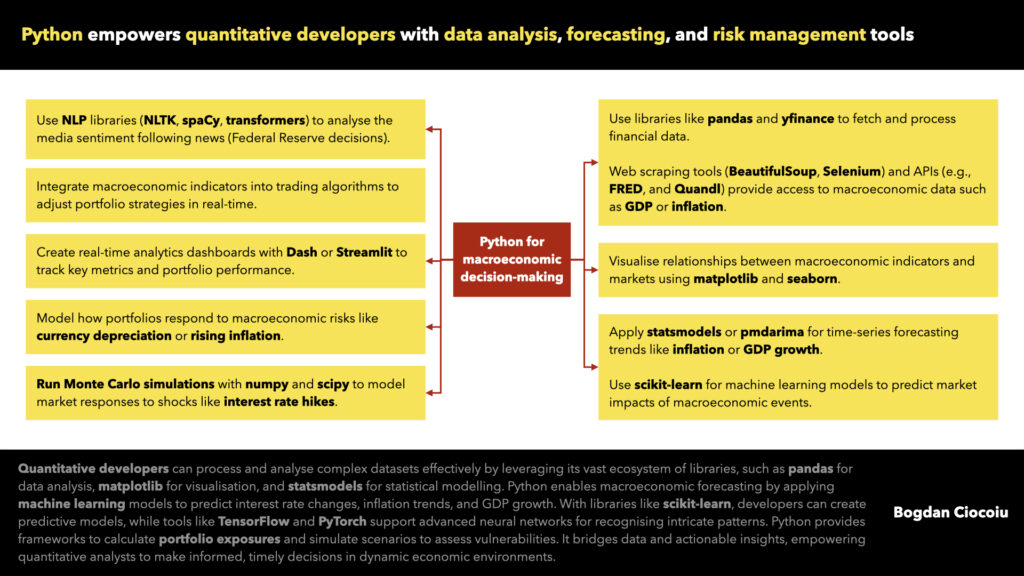

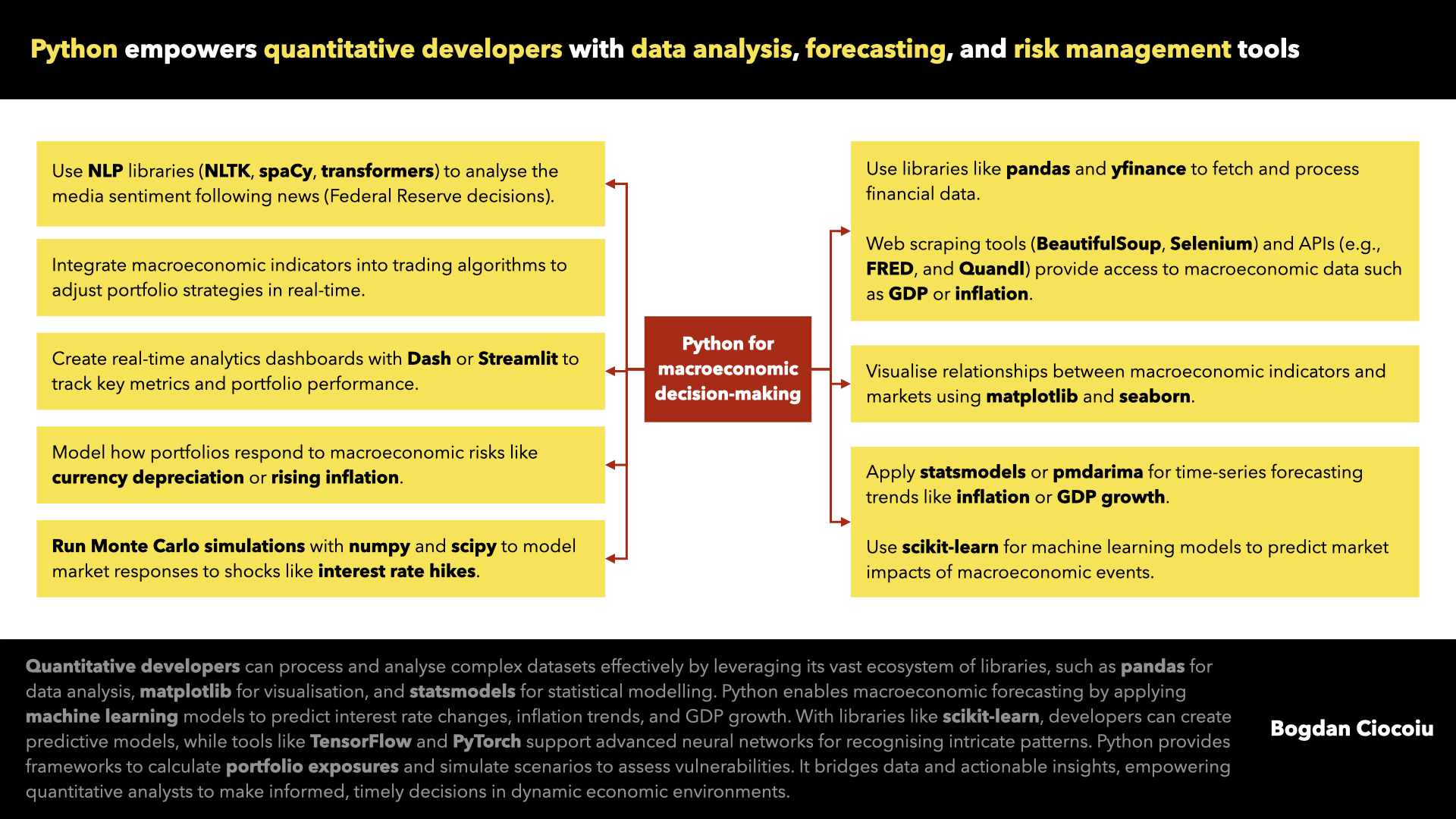

Python’s data manipulation libraries, such as pandas and NumPy, empower developers to organise and explore datasets ranging from GDP growth figures to employment statistics. Using Python, financial institutions can streamline the preparation of macroeconomic data, identify trends, and uncover patterns critical to forecasting future market movements.

A quantitative developer might analyse historical interest rate data to predict the market reactions following an incoming central bank decision. By combining Python’s data wrangling tools with statistical libraries like statsmodels, developers can construct regression models to understand the relationships between key economic indicators, such as inflation and bond yields.

Predictive modelling with Machine Learning

Python’s machine learning libraries, such as scikit-learn, enable developers to apply predictive techniques to macroeconomic data. These models can forecast key indicators like inflation rates, unemployment trends, and monetary policy changes. Developers can use historical data and supervised learning models to predict how GDP growth will impact equity markets.

Advanced deep learning frameworks, including TensorFlow and PyTorch, allow for the analysing of more complex relationships, such as the interplay between consumer sentiment, international trade policies, and currency fluctuations. One can train neural networks to detect hidden patterns that traditional statistical methods might miss, providing firms with a competitive edge in decision-making.

Risk management and scenario analysis

Risk management is a cornerstone of investment strategy, especially during volatile macroeconomic periods. Python offers robust tools for simulating scenarios and assessing portfolio exposure to adverse events. Using Monte Carlo simulations, developers can model how sudden interest rate hikes might impact fixed-income portfolios. Python’s flexibility allows for creating stress tests tailored to specific economic events, such as recessions or geopolitical crises.

By integrating real-time data feeds, Python-based tools can also update risk models dynamically, ensuring that decision-makers have the most up-to-date information at their fingertips.

Automating trading strategies

Macroeconomic data plays a critical role in driving automated trading strategies. Python’s ability to integrate with APIs and real-time data sources enables developers to create algorithms that react instantly to economic releases, such as non-farm payroll reports or central bank announcements. For example, a trading bot built in Python can analyse changes in interest rate expectations and adjust a bond portfolio accordingly.

Python’s integration with libraries like TA-Lib and QuantLib allows for the inclusion of technical analysis and quantitative finance models alongside macroeconomic considerations, ensuring a holistic approach to strategy development.

Sentiment analysis

Beyond numerical data, qualitative factors like news sentiment and public opinion also influence markets. Python’s natural language processing (NLP) libraries, such as spaCy and NLTK, empower developers to analyse news articles, social media, and financial reports. Sentiment analysis can gauge the market’s reaction to macroeconomic developments, such as unexpected policy shifts or international trade negotiations.

For instance, a quantitative developer could build a sentiment-based model that adjusts risk exposure when public opinion around a central bank decision turns negative. This additional layer of analysis strengthens the robustness of decision-making frameworks.

Real-time monitoring

Python excels at creating real-time systems that monitor macroeconomic events and alert decision-makers to potential risks or opportunities. By integrating with data providers like Bloomberg or Reuters, Python applications can track indicators in real-time.

Python empowers quantitative developers and investment management firms to confidently navigate the complexities of macroeconomic events. Its data analysis, machine learning, and risk management capabilities enable firms to anticipate market changes, optimise strategies, and mitigate risks effectively.

Leave a Reply

You must be logged in to post a comment.