Making investment decisions based on intuition or limited data can often lead to suboptimal outcomes. Quantitative analysis revolutionises how investors and portfolio managers approach asset allocation, enabling precise, data-backed strategies that optimise returns while controlling risks.

One example of this evolution is algorithmic portfolio optimisation. Grounded in Modern Portfolio Theory (MPT), this quantitative analysis tool leverages techniques to determine the ideal asset allocation to achieve a specified target return at minimal risk.

Mean-variance optimisation

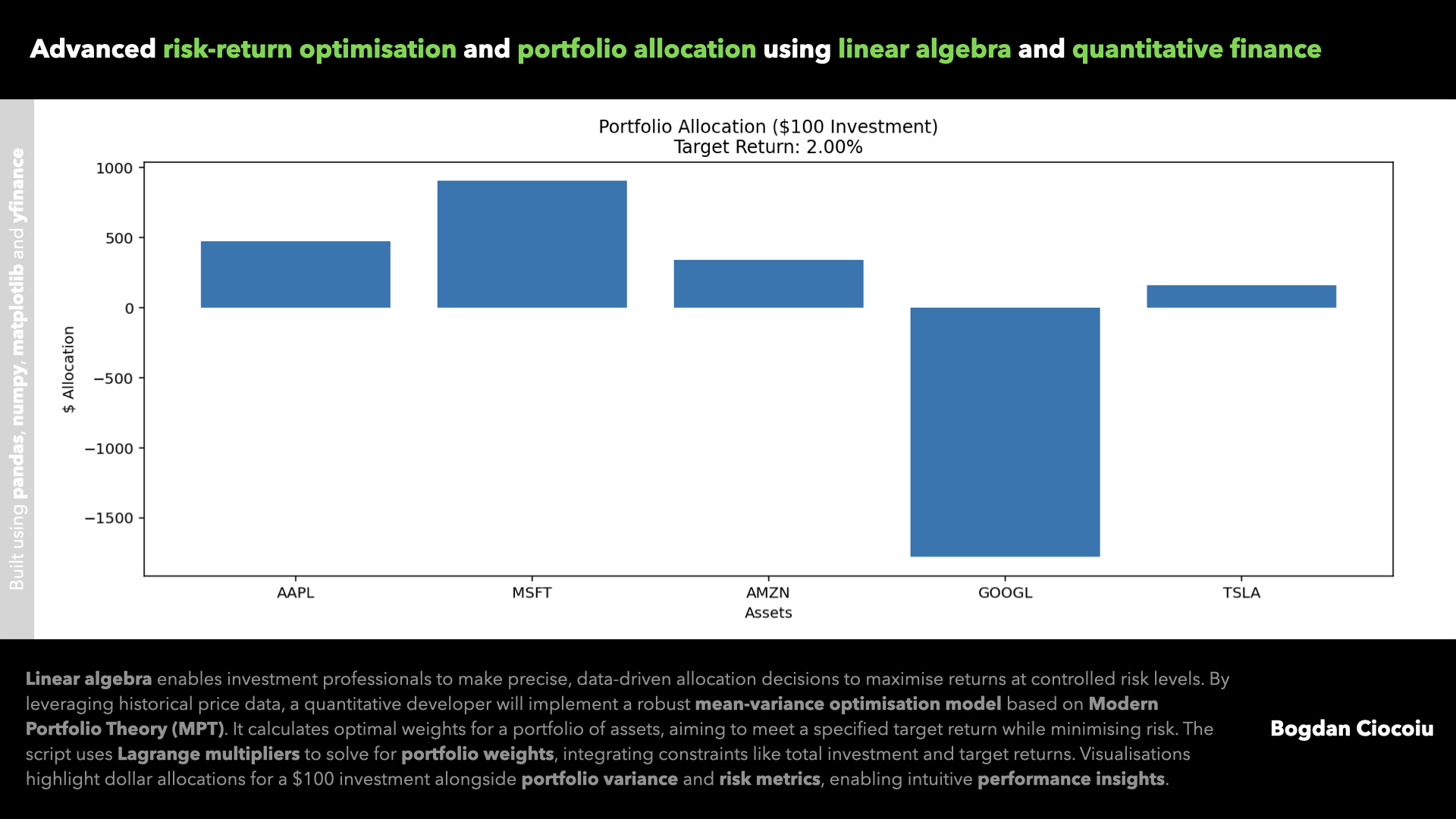

The algorithm calculates the optimal weights for a portfolio by solving a mean-variance optimisation mathematical problem. It uses historical data from Yahoo Finance, processes it into daily returns, and computes statistical measures like mean returns and covariance matrices. This approach allows users to model the relationship between assets and minimise portfolio variance. By integrating Lagrange multipliers, the script ensures that all investments meet specific constraints, such as total capital deployment and target returns.

Quantitative analysis

Quantitative analysis offers significant advantages over traditional methods:

- It removes emotional bias, basing decisions on empirical data.

- The analytical approach minimises unnecessary exposure to correlated risks (by understanding asset covariance principles).

- Investors can set target returns, ensuring their portfolios align with financial goals.

- Automating calculations saves time while improving accuracy and focusing on business outcomes.

While many portfolio optimisation tools exist, this approach is unique in simplicity and power due to its ability to automatically fetch recent data for NYSE stocks and update portfolio allocations with ease.

Enabling tools

- NumPy provides the computational backbone for efficient numerical calculations in portfolio optimisation.

- Pandas simplifies the management of financial time-series data, making it easy to preprocess and transform data for analysis.

- Visualisations make interpreting portfolio allocations and performance metrics easier, offering actionable insights.

- yFinance provides a reliable source for historical market data, enabling real-world analysis.

Next steps

This portfolio optimisation script is a foundation for constructing efficient investment portfolios by minimising risk while targeting desired returns. Several enhancements can be incorporated to increase its utility and relevance for real-world financial applications.

- The script can integrate transaction cost modelling to account for brokerage fees, bid-ask spreads, and taxes, ensuring the portfolio remains realistic and implementable. One can also include short-selling constraints and leverage limits to meet regulatory or institutional requirements.

- One can expand the framework to support multi-asset classes like bonds, commodities, and cryptocurrencies.

- The script can adopt machine learning models to enhance its predictions of returns and volatility, leveraging techniques like regression, neural networks, or ensemble methods.

- Integrating a Monte Carlo simulation module can provide probabilistic forecasts of portfolio performance under various market scenarios, enabling stress testing.

- Automating the entire pipeline—from data retrieval to reporting—via cloud platforms like AWS or Google Cloud can facilitate real-time portfolio monitoring.

When precision and adaptability define success, quantitative analysis is no longer optional—it’s essential. This approach is your gateway to smarter, more informed investment decisions. Whether you’re a portfolio manager, a quantitative analyst, or a savvy investor, this tool provides the analytical firepower to stay ahead in a competitive landscape.

Leave a Reply

You must be logged in to post a comment.