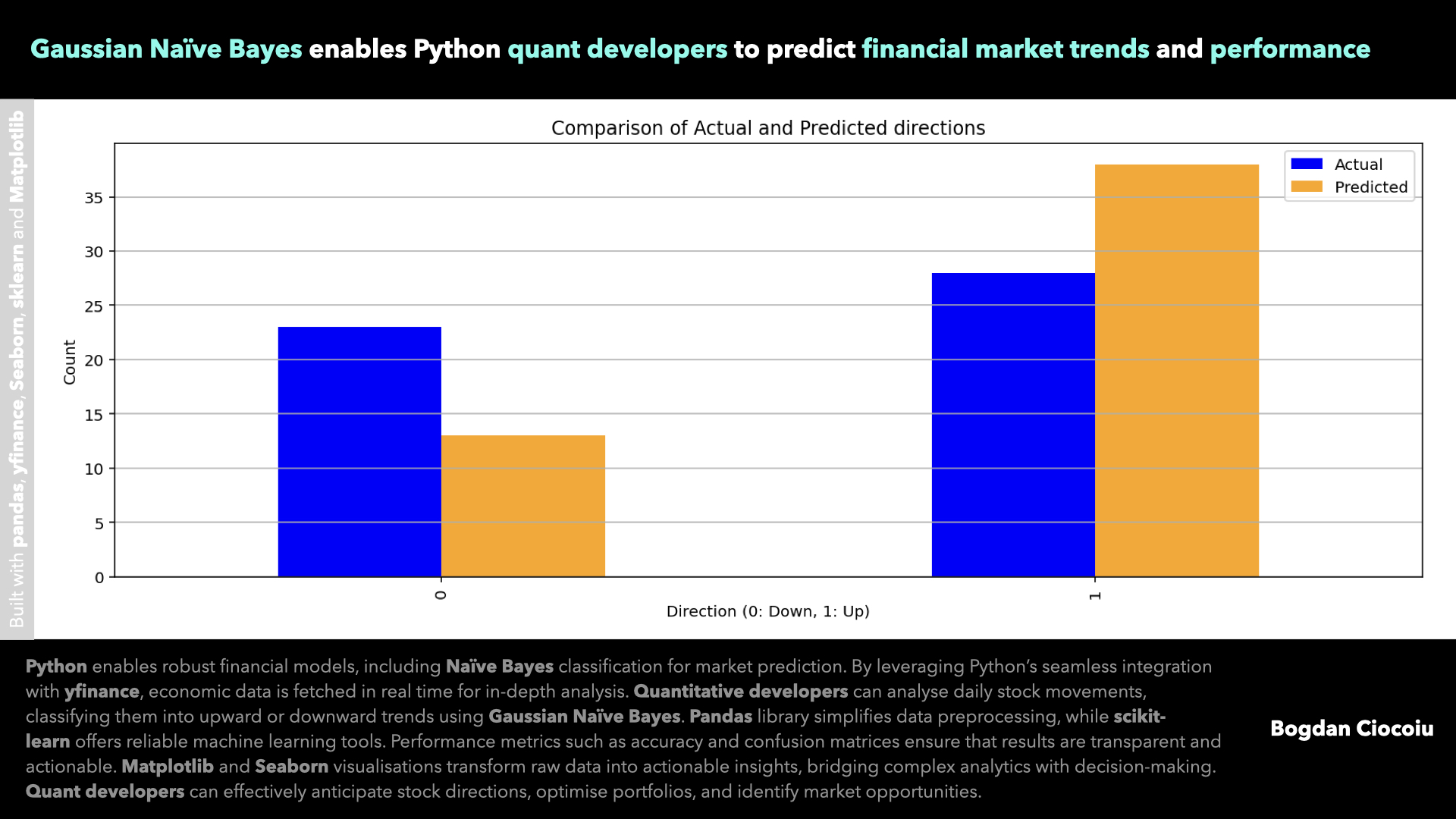

In quantitative finance, having access to precise data analytics and advanced predictive models is key. With its versatile ecosystem, Python has emerged as an indispensable tool for quantitative developers seeking to optimise investment strategies and forecast market movements.

One such powerful application is using Python to implement the Naïve Bayesclassification model, a statistical method rooted in Bayes’ Theorem, ideal for classifying financial market trends.

Market predictions

Predicting stock movements—whether the market closes higher or lower—is a perennial challenge in financial markets. Traditional statistical models often struggle to handle complex datasets, but Python’s integration of machine learning libraries like scikit-learn makes it easy to build sophisticated models.

By leveraging Naïve Bayes, Python allows developers to classify daily stock directions based on historical data, identifying patterns that traditional methods may overlook.

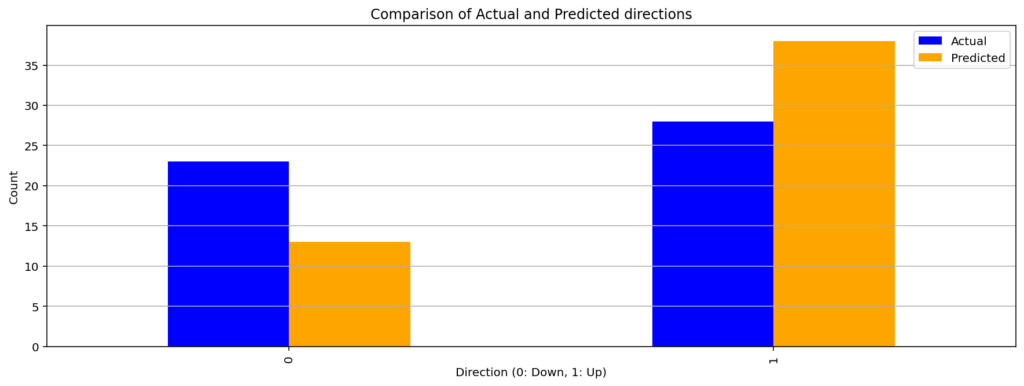

Through yfinance, quants can download historical data, eliminating manual input and human error. The model then calculates daily returns and categorises them into upward (1) or downward (0) trends, creating a binary target variable for classification.

Data preprocessing

Quantitative analysis begins with data cleaning and preparation. Applying Naïve Bayes in this example requires calculating daily returns and creating features like the opening, high, low, and closing prices.

Quants must drop missing values to ensure data integrity, allowing the model to train on consistent and accurate datasets.

Implementing Naïve Bayes

Naïve Bayes is a simple yet effective classification algorithm that assumes independence between predictors. Using Python’s GaussianNB from scikit-learn, the model analyses the relationship between daily stock prices and their directional changes.

This method excels in financial data due to its speed and reliability, even with smaller datasets.

Model evaluation

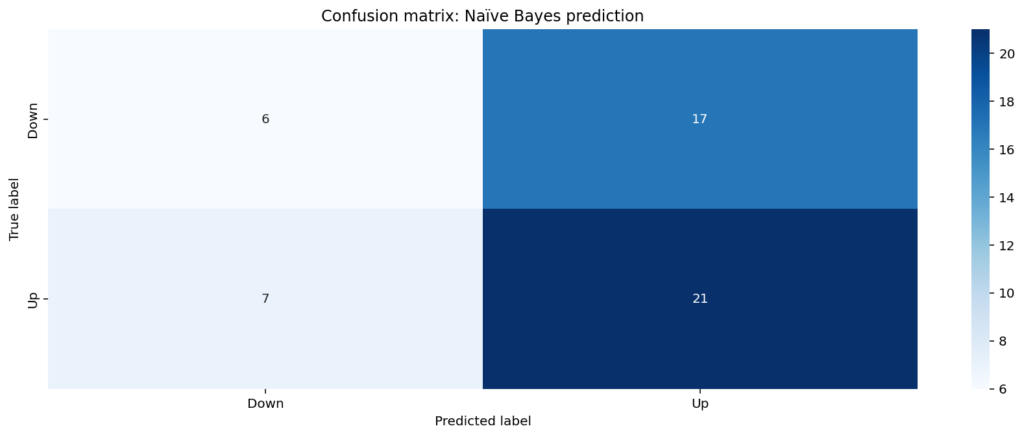

Python simplifies performance evaluation through metrics like accuracy, precision, recall, and F1 scores. A confusion matrix clearly visualises true positives, false positives, and other classification metrics, ensuring transparency in model outputs. This step is crucial for quant developers who need actionable insights to drive investment decisions.

Visualisations

Visual representation is essential for interpreting data effectively. Using Matplotlib and Seaborn, quants can generate a heatmap of the confusion matrix and a comparative bar chart of actual versus predicted results.

These visualisations make it easier for developers to communicate findings to stakeholders, bridging the gap between analytics and strategy formulation.

Benefits

- Python’s extensive libraries, such as pandas for data manipulation and scikit-learn for machine learning, streamline workflows. This efficiency allows developers to process vast datasets and generate real-time predictions, enabling rapid decision-making in fast-paced financial markets.

- Naïve Bayes is easy to implement and interpret, making it ideal for finance professionals seeking transparency in their models. Python also supports extensive customisation, allowing developers to tailor features and parameters to specific investment strategies.

- Python’s ability to handle large datasets ensures the scalability of predictive models across multiple stocks, industries, or even indices. Developers can expand their analysis to include complex financial metrics like volatility, moving averages, or momentum indicators, enhancing the model’s robustness.

- As an open-source language, Python reduces the need for expensive proprietary software, making advanced analytics accessible to firms of all sizes. This democratisation of technology empowers even smaller firms to compete effectively in data-driven markets.

Real-world applications

Quantitative developers can leverage Naïve Bayes in various applications:

- Portfolio optimisation

- Risk management

- Algorithmic trading

Python has transformed the landscape of quantitative finance by enabling developers to implement sophisticated models like Naïve Bayes with minimal overhead.

From seamless data integration using yfinance to intuitive visualisations with Matplotlib and Seaborn, Python offers tools that are both powerful and accessible. Quant developers can harness these capabilities to gain a competitive edge, translating raw data into actionable insights that drive better investment decisions.

Leave a Reply

You must be logged in to post a comment.