Investment decisions demand a blend of precision, speed, and foresight. Quantitative developers play a pivotal role in enabling financial firms to stay ahead by designing predictive models that extract actionable insights from vast amounts of data. Leveraging Python’s capabilities, one can implement linear regression models that solve real-world investment challenges.

Predicting stock returns has always been a core challenge for investment managers. While traditional methods are insightful, they often fail to capture the complexity of modern markets.

Using Python and libraries like yfinance, quant developers can fetch real stock data to build predictive models tailored to specific investment needs. For example, one can develop a solution for stock data using features like daily returns, 5-day momentum, and simulated P/E ratios to predict future returns.

Steps to apply linear regression

- Extract historical stock via yfinance, including prices, returns, and simulated financial indicators like P/E ratios and dividend yields.

- Create key predictors, such as momentum and forward returns, to effectively capture market dynamics and trends.

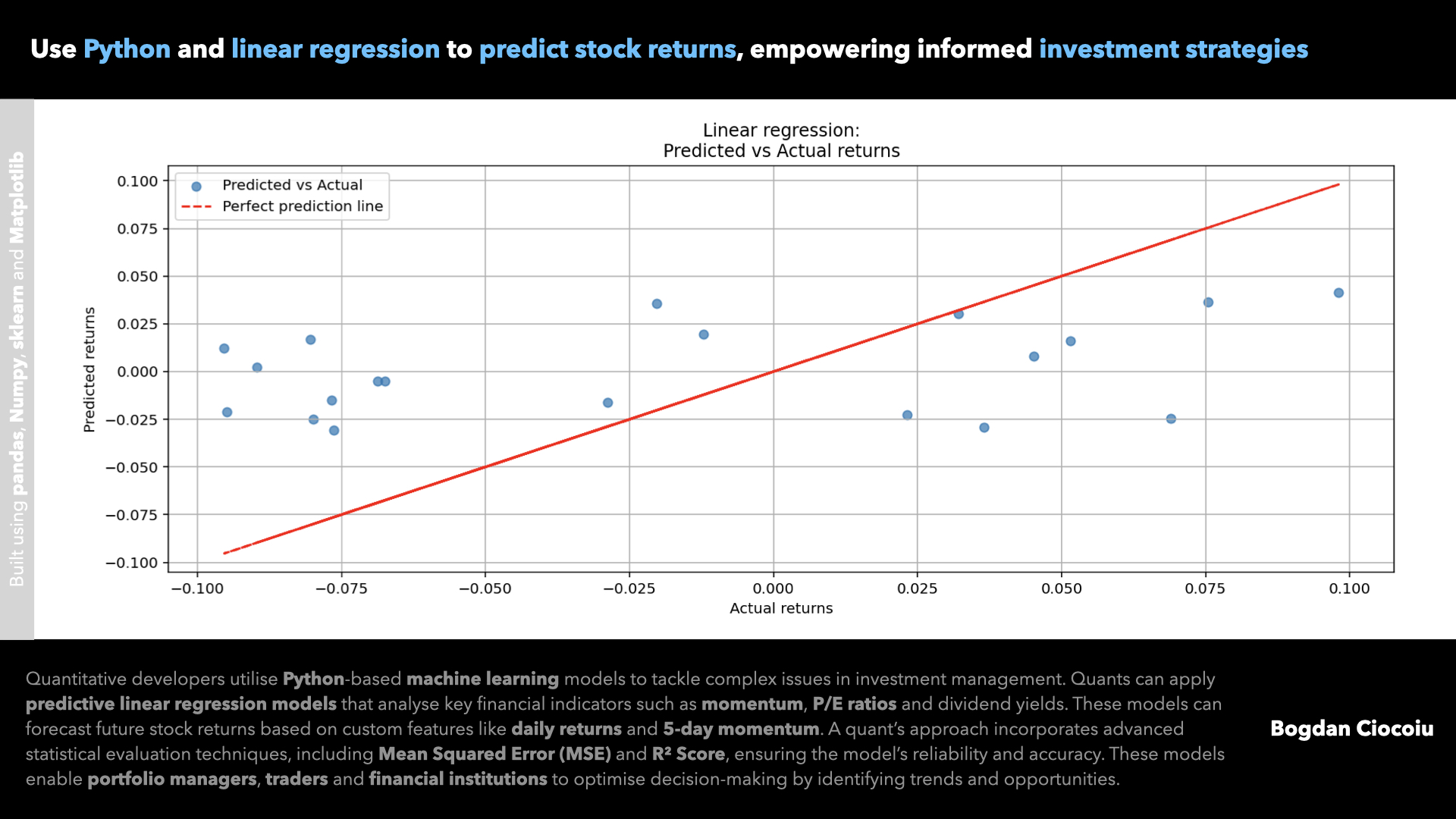

- Using Python’s LinearRegression model, train on historical data to identify relationships between features and future returns.

- The model’s performance is measured using metrics like Mean Squared Error (MSE) and R² Score, ensuring reliability.

Automating these steps can provide financial analysts and portfolio managers with predictive models capable of optimising trading strategies.

Key benefits of using linear regression

- Linear regression highlights the quantitative relationships between financial indicators, empowering banks and financial institutions to make informed decisions.

- Python allows seamless integration with large datasets, enabling firms to scale predictions across multiple stocks or markets.

- Firms can anticipate market movements, optimise portfolios, and reduce risk exposure by predicting future stock returns.

- Whether incorporating advanced features like volatility or adapting to specific industries, I tailor solutions to meet unique client needs.

Next steps

Investment managers can enhance their strategies by:

- Replace simulated financial indicators with live data feeds to improve model accuracy.

- Expanding feature sets to include advanced visualisation like RSI, volatility, and moving averages for deeper insights.

- Scaling the model across portfolios to multiple stocks, industries, or indices for comprehensive portfolio optimisation.

As a quantitative developer, I combine deep financial expertise with Python’s technical capabilities to deliver cutting-edge solutions. From model development to implementation, I bring clarity, optimisation, and efficiency to every project.

Leave a Reply

You must be logged in to post a comment.