Predictive models are at the heart of decision-making in quantitative finance. Logistic regression, a fundamental machine learning algorithm, offers quantitative developers a robust and interpretable tool for classification problems. By leveraging logistic regression, financial institutions and developers can predict market trends, assess risks, and build more efficient trading systems.

How logistic regression works

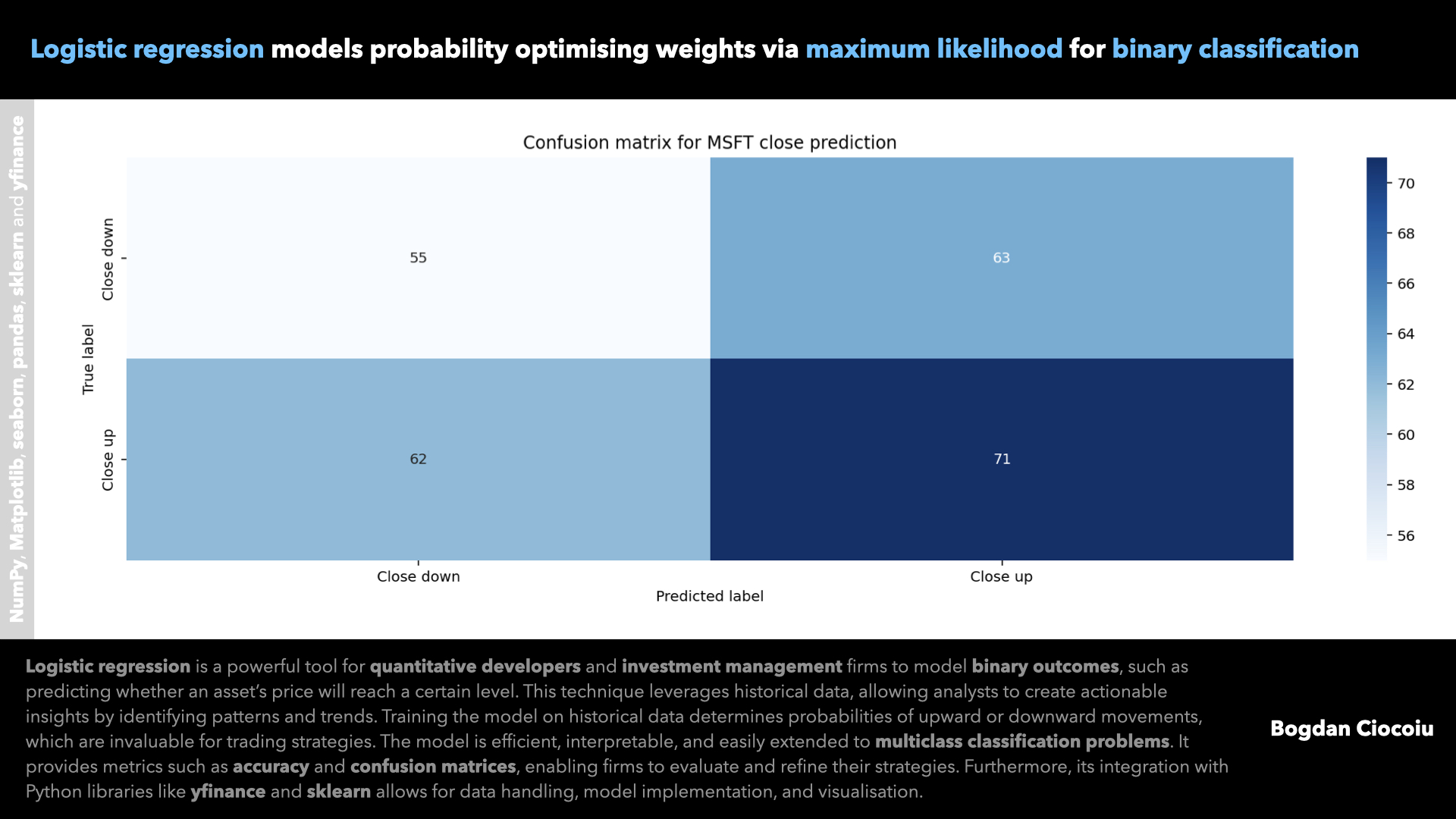

Logistic regression is a statistical method for binary classification designed to model the relationship between one or more independent variables (features) and a binary dependent variable (target). Unlike linear regression, which predicts continuous values, logistic regression outputs probabilities confined to the range [0, 1]. This makes it ideal for predicting categorical outcomes, such as whether a stock will close higher or lower than a given threshold.

Advantages of logistic regression

Logistic regression is highly interpretable compared to more complex machine learning models. Each coefficient represents the effect of a feature on the log odds of the target variable, making it easier for developers and analysts to understand and explain the model’s predictions.

Logistic regression is computationally lightweight, making it ideal for large-scale financial datasets. Developers can train and deploy models quickly, which is critical for real-time trading applications.

While primarily a binary classifier, logistic regression can be extended to handle multiclass problems using techniques like one-vs-rest (OvR) or multinomial logistic regression. This flexibility is valuable for modelling complex financial scenarios.

Logistic regression performs well even when the relationship between the features and the target is approximately linear in the log-odds space. It is less prone to overfitting if one applies regularisation to more complex models.

Applications in quantitative finance

- Based on historical data, quantitative developers often use logistic regression to predict whether a stock’s price will increase or decrease. Logistic regression models can capture short-term trends by creating lagged features such as prior closing prices, volume, and technical indicators.

- Logistic regression is widely used to classify risk categories in portfolios. For example, it can predict whether a given stock will likely breach a predefined volatility threshold, allowing firms to rebalance their portfolios.

- In high-frequency trading, logistic regression can classify market conditions, such as identifying when certain technical thresholds (e.g., moving averages or Bollinger Bands) are breached, triggering automated trades.

- In wealth management, logistic regression helps segment customers into risk-averse, balanced, or aggressive investors based on their transaction history and demographic data.

Workflow for implementation

A typical workflow for deploying logistic regression in quantitative finance involves the following steps:

- Data preparation

- Feature engineering

- Model training

- Evaluation

- Deployment

Scalable impact on investment firms

When deployed at scale, logistic regression becomes a powerful enabler for:

- Generating real-time predictions across thousands of stocks.

- Classifying assets based on risk-reward profiles.

- Reducing model complexity without sacrificing accuracy.

Logistic regression is an efficient, interpretable, and scalable tool for quantitative developers and investment management firms. With Python’s robust ecosystem, implementing logistic regression has never been more accessible, empowering quantitative developers to drive innovation in the financial sector.

Leave a Reply

You must be logged in to post a comment.