financial modelling

-

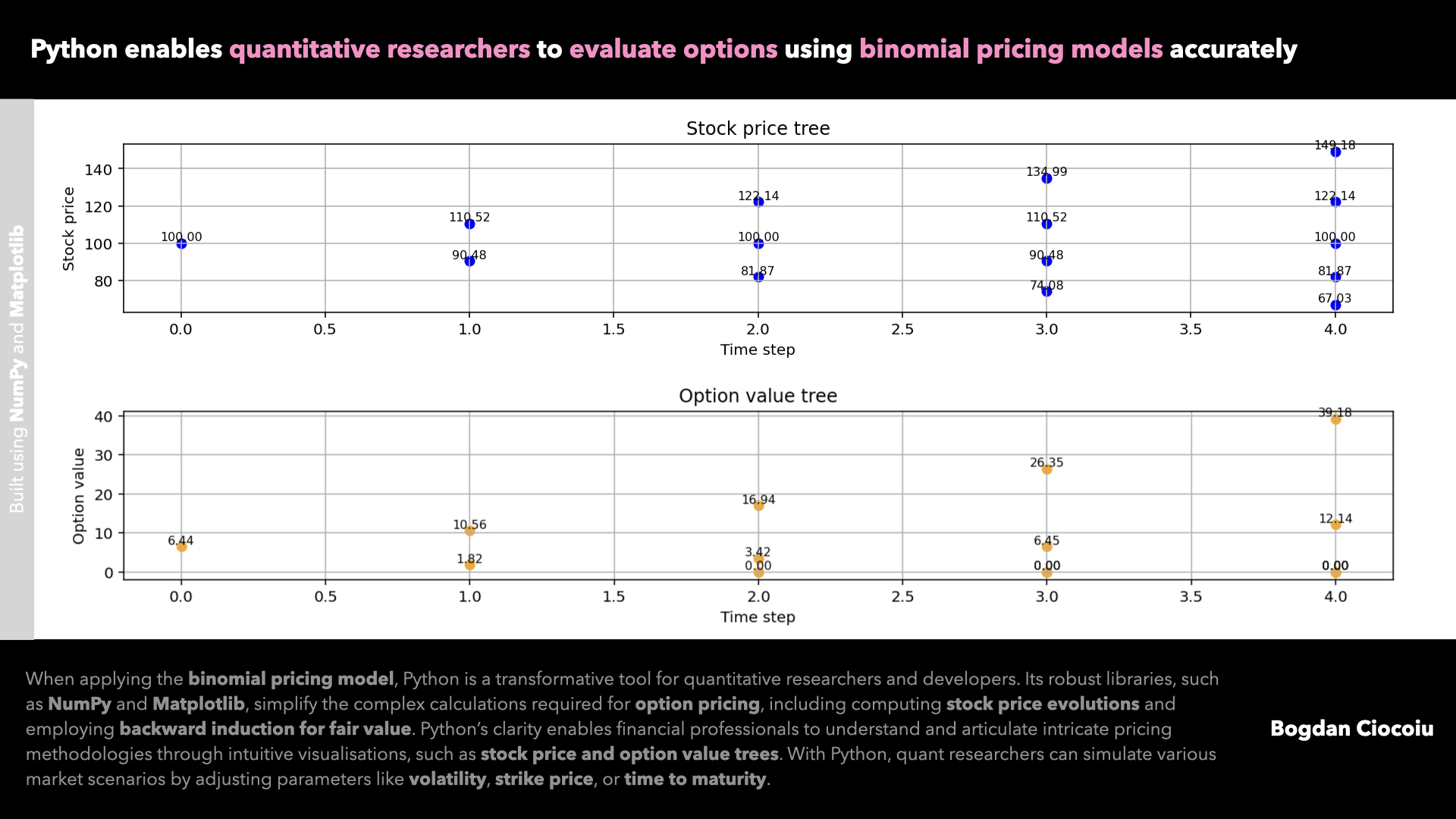

Binomial options pricing model

The ability to price derivatives accurately and efficiently is paramount. The binomial pricing model is one of the most widely used methods for option pricing, providing a structured approach to evaluating potential outcomes under various market conditions. With its powerful…

-

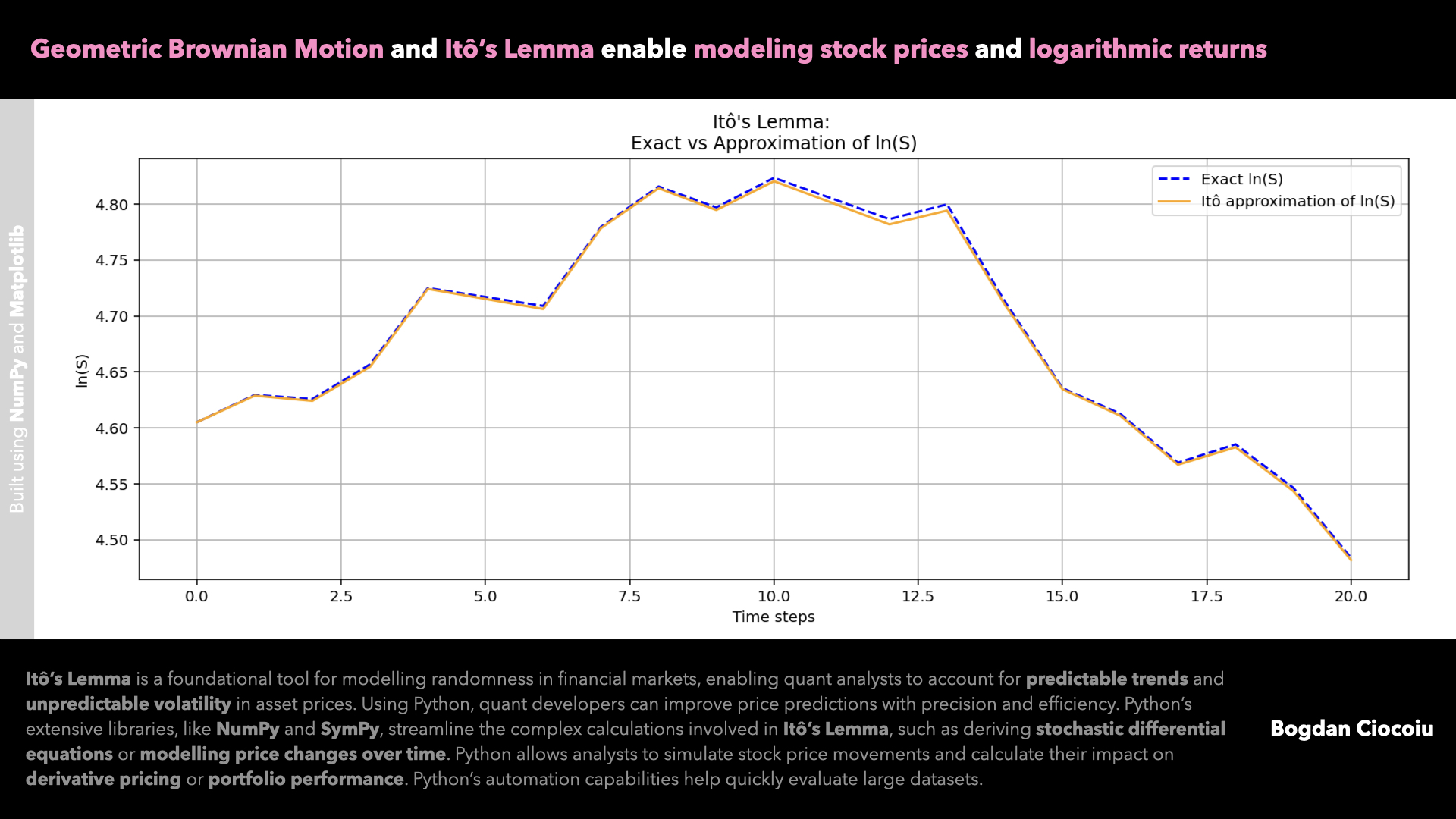

Price modelling – Itô’s Lemma – Geometric Brownian Motion

Quantitative analysts constantly seek robust methods to model and predict asset price movements. One such powerful tool is Itô’s Lemma, a cornerstone of stochastic calculus. By leveraging this mathematical framework alongside Python, quants can enhance their analytical toolkit, making strides in…

-

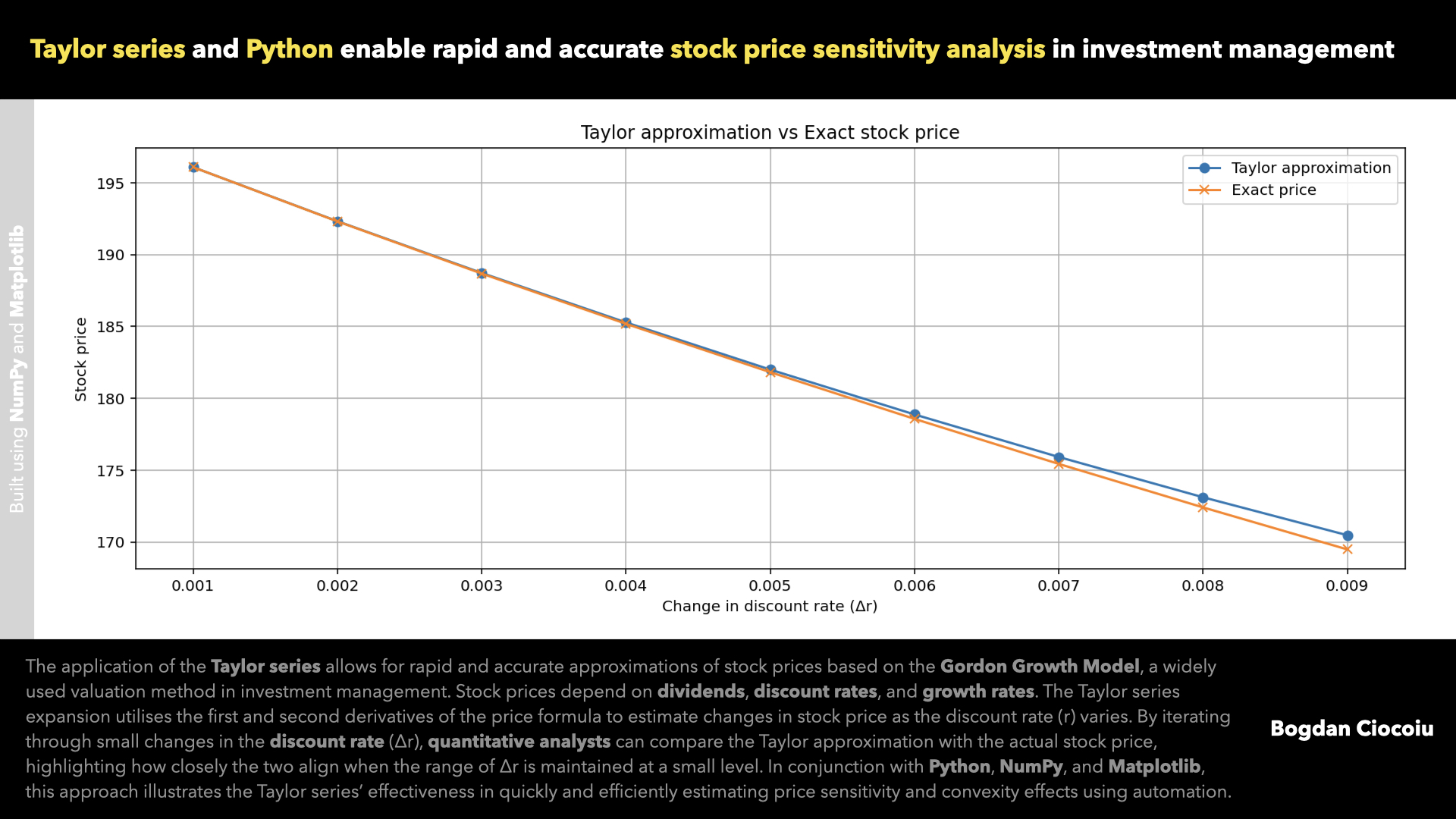

Approximations – Taylor series – Gordon Growth Model

In investment management, precision and efficiency are paramount when analysing how market variables impact stock prices. The Taylor series, a powerful mathematical tool, provides a robust framework for understanding price sensitivities and convexity effects. One application for the Taylor series…

-

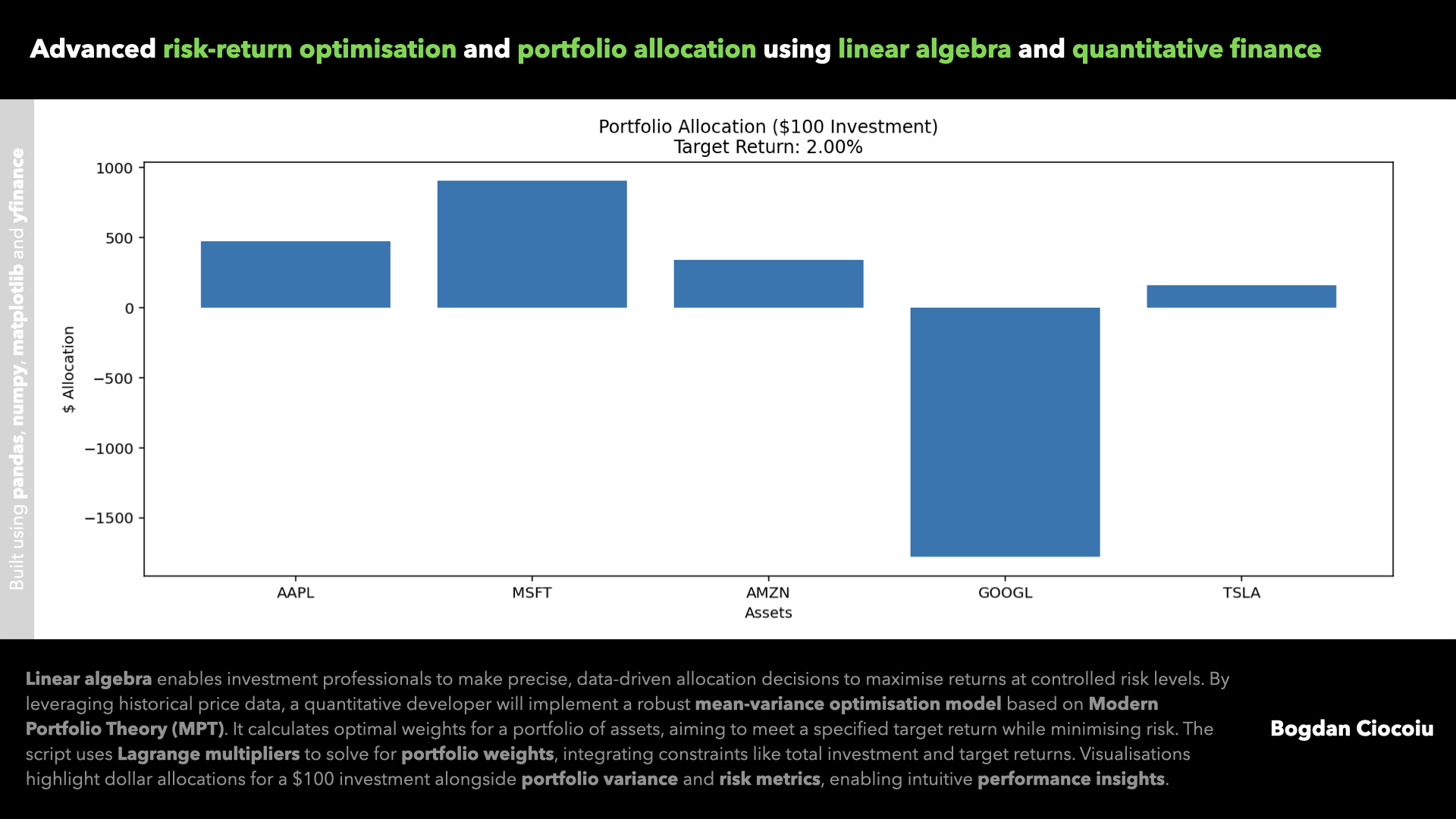

Portfolio optimisation – Linear algebra

Making investment decisions based on intuition or limited data can often lead to suboptimal outcomes. Quantitative analysis revolutionises how investors and portfolio managers approach asset allocation, enabling precise, data-backed strategies that optimise returns while controlling risks. One example of this…