Geometric Brownian Motion

-

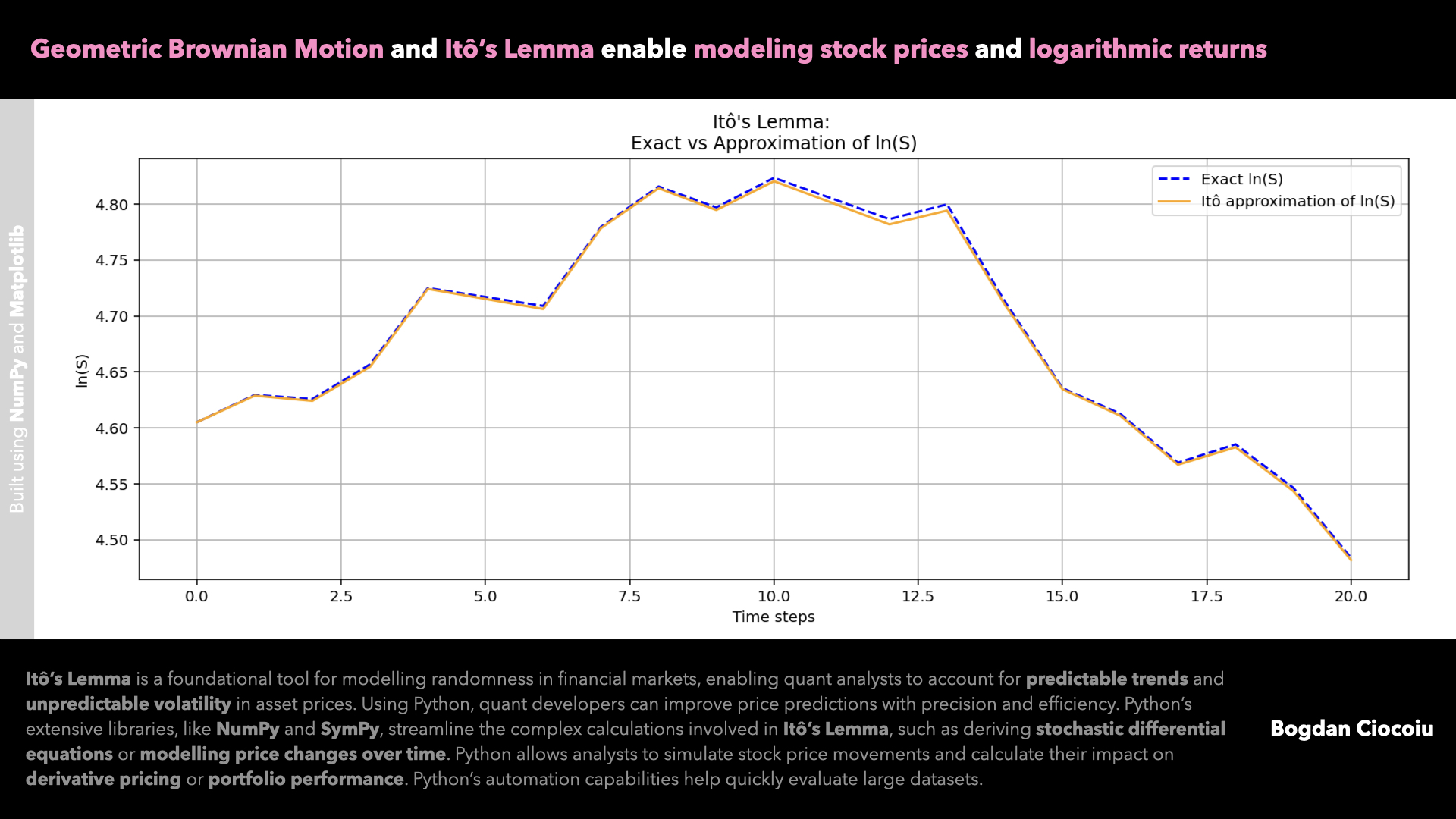

Price modelling – Itô’s Lemma – Geometric Brownian Motion

Quantitative analysts constantly seek robust methods to model and predict asset price movements. One such powerful tool is Itô’s Lemma, a cornerstone of stochastic calculus. By leveraging this mathematical framework alongside Python, quants can enhance their analytical toolkit, making strides in…

-

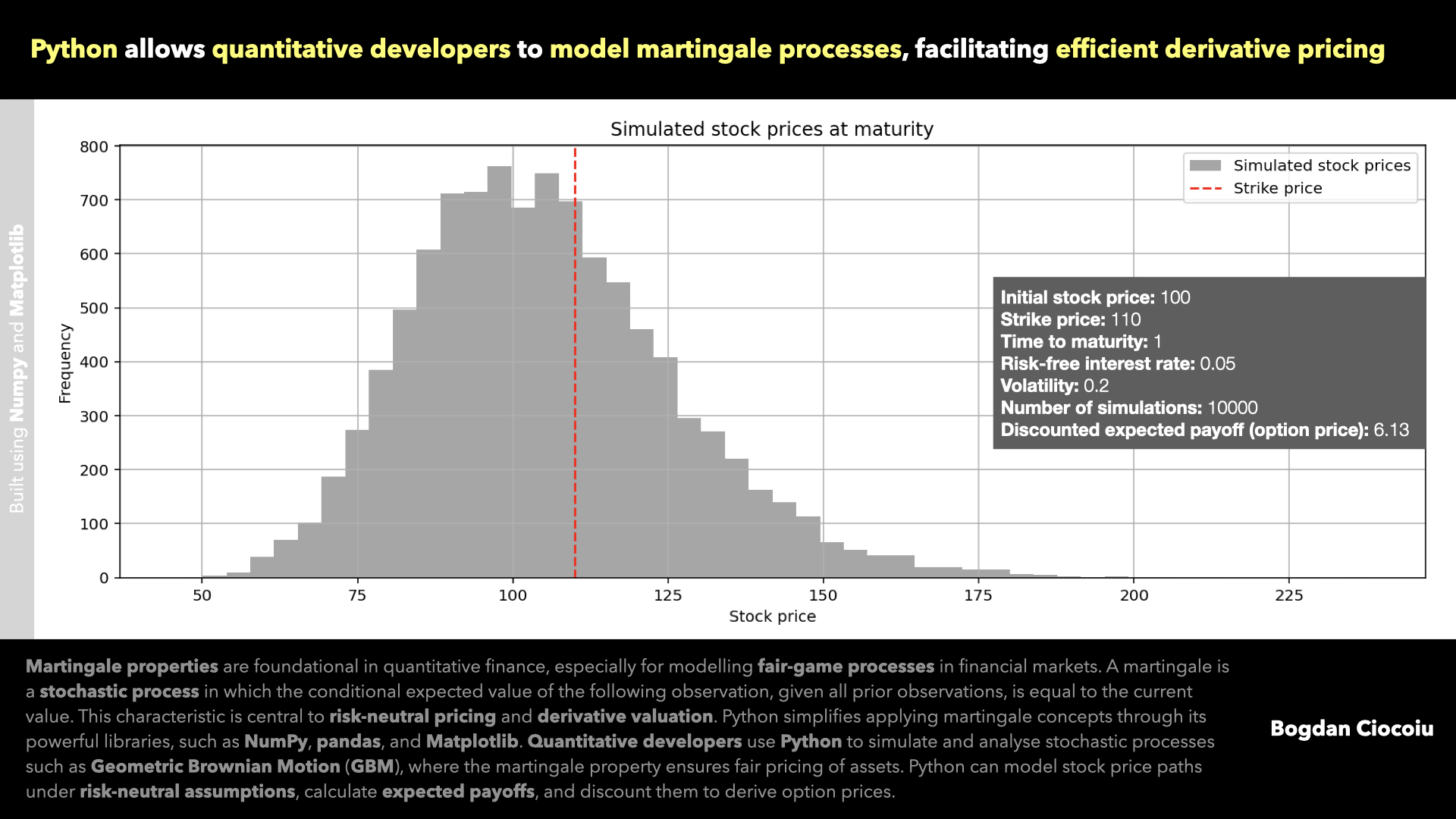

Martingale properties

Martingale properties lie at the core of modern financial theory and quantitative analysis. These properties describe stochastic processes where the conditional expected value of the next observation, given the current and past values, equals the current observation. In simple terms, martingales represent “fair games” where…