machine learning

-

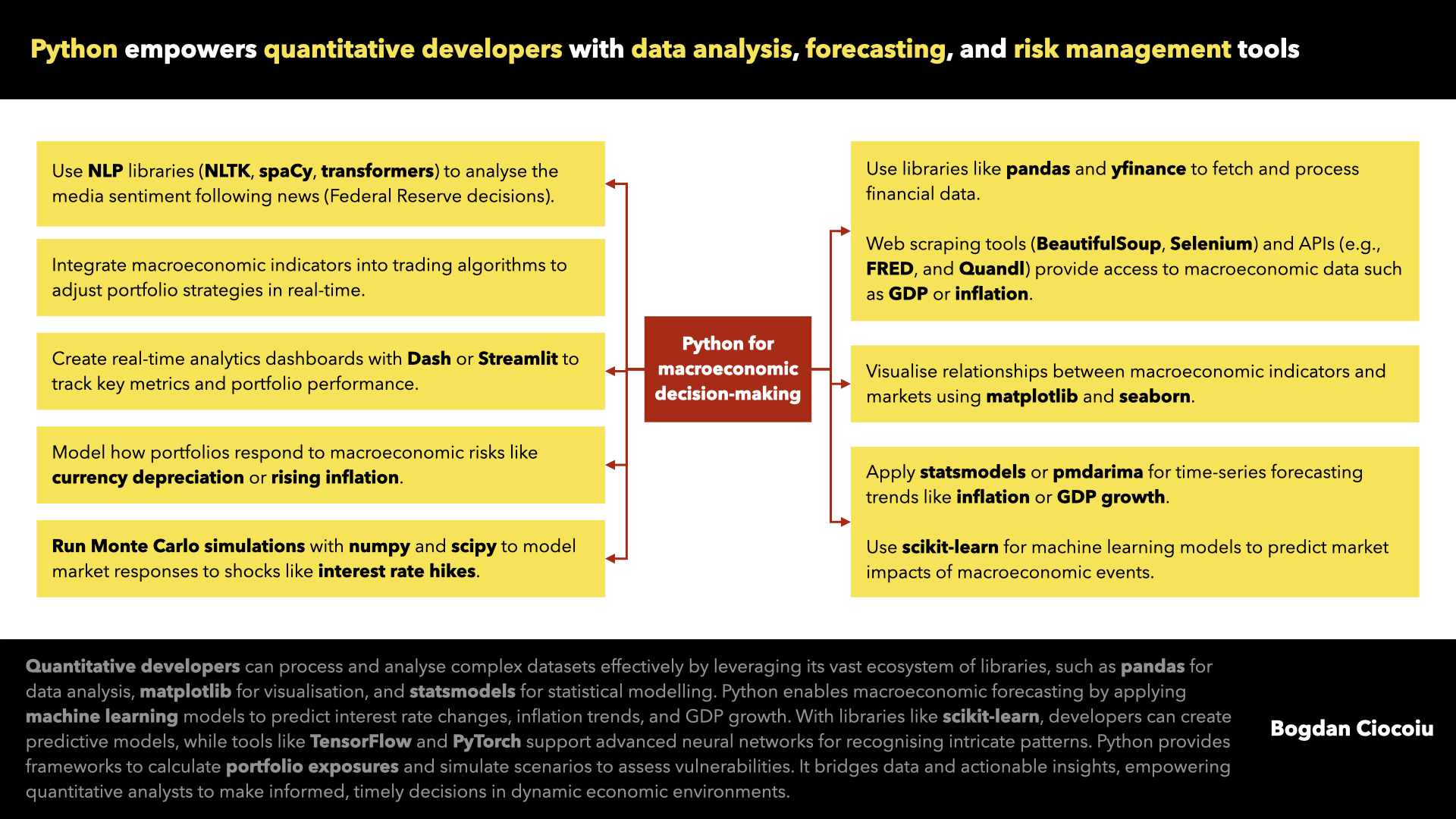

Macroeconomic decision-making

Macroeconomic events are pivotal in influencing market dynamics. Understanding and responding to these events can make the difference between profit and loss for investment professionals. Python, with its extensive ecosystem and user-friendly capabilities, has become a go-to tool for quantitative…

-

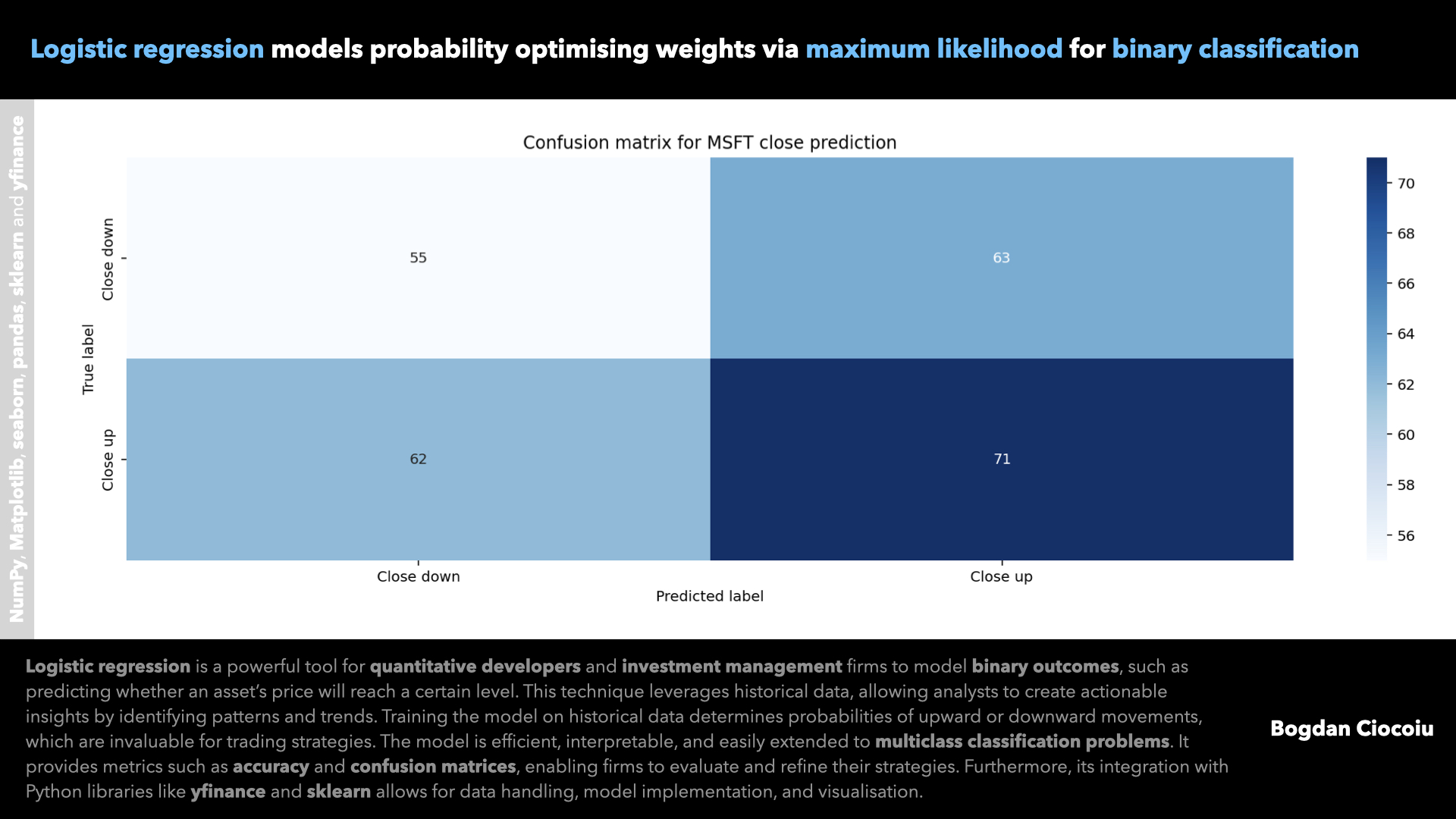

Supervised machine learning – Logistic regression

Predictive models are at the heart of decision-making in quantitative finance. Logistic regression, a fundamental machine learning algorithm, offers quantitative developers a robust and interpretable tool for classification problems. By leveraging logistic regression, financial institutions and developers can predict market…

-

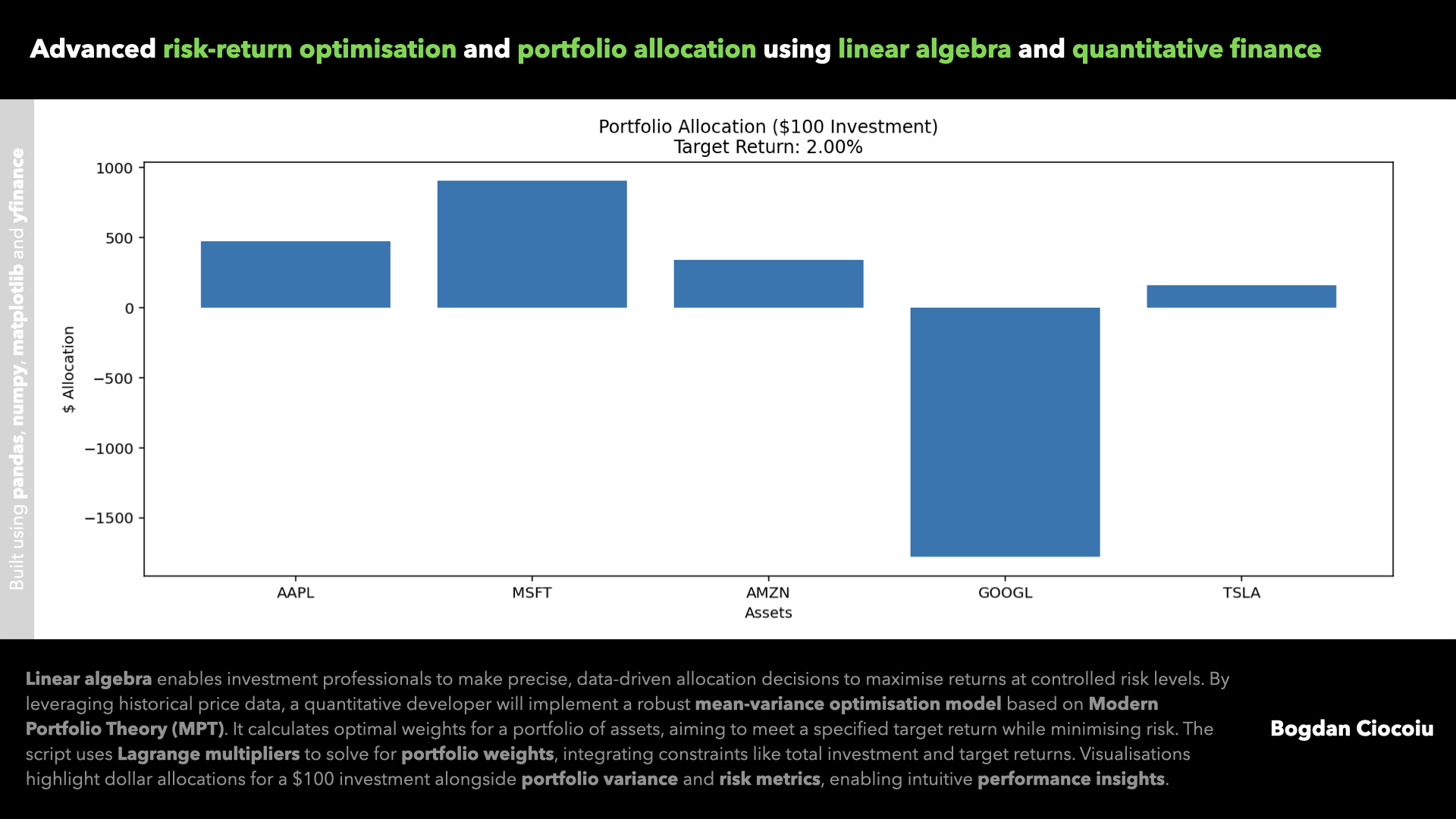

Portfolio optimisation – Linear algebra

Making investment decisions based on intuition or limited data can often lead to suboptimal outcomes. Quantitative analysis revolutionises how investors and portfolio managers approach asset allocation, enabling precise, data-backed strategies that optimise returns while controlling risks. One example of this…