NumPy

-

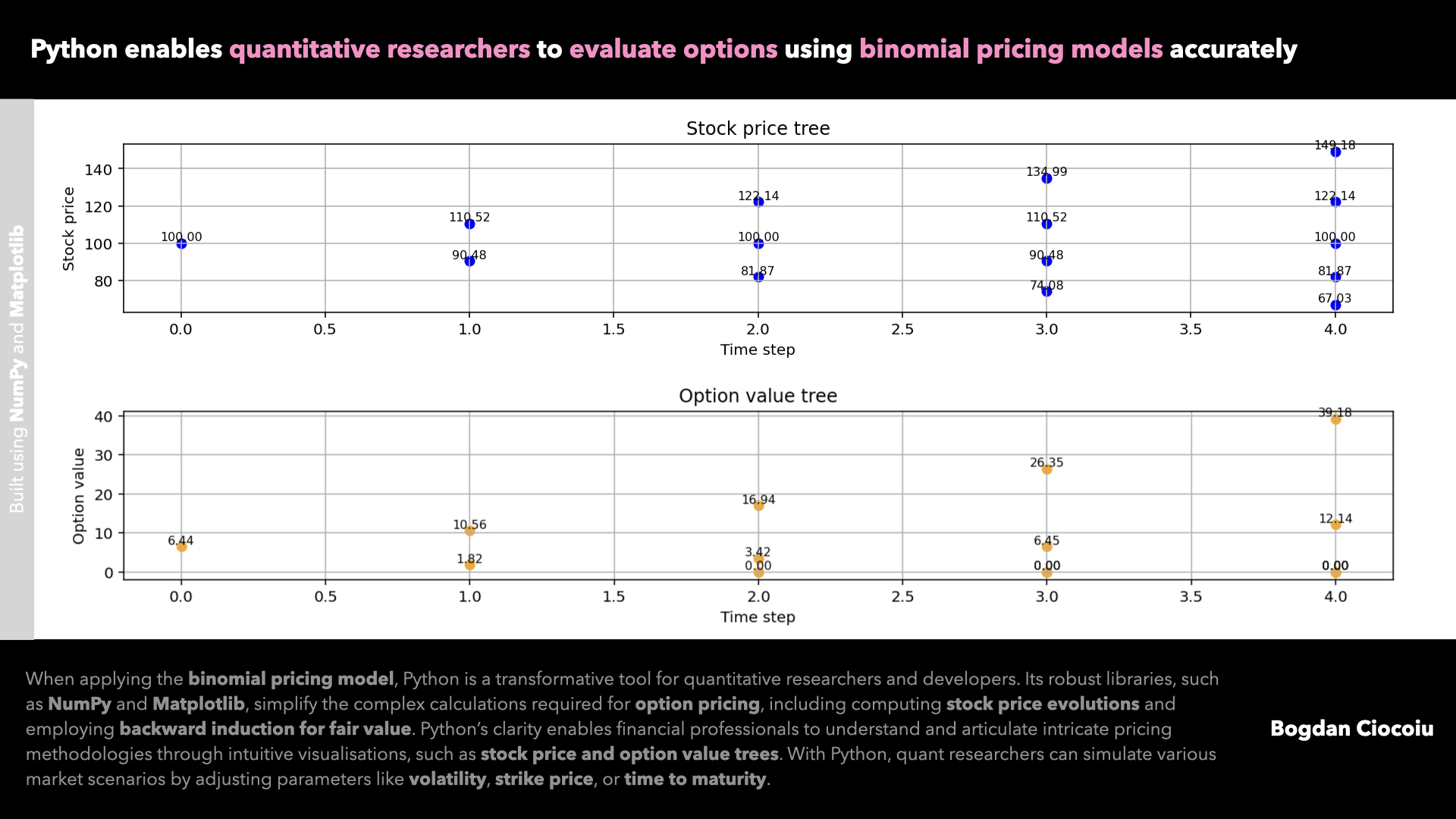

Binomial options pricing model

The ability to price derivatives accurately and efficiently is paramount. The binomial pricing model is one of the most widely used methods for option pricing, providing a structured approach to evaluating potential outcomes under various market conditions. With its powerful…

-

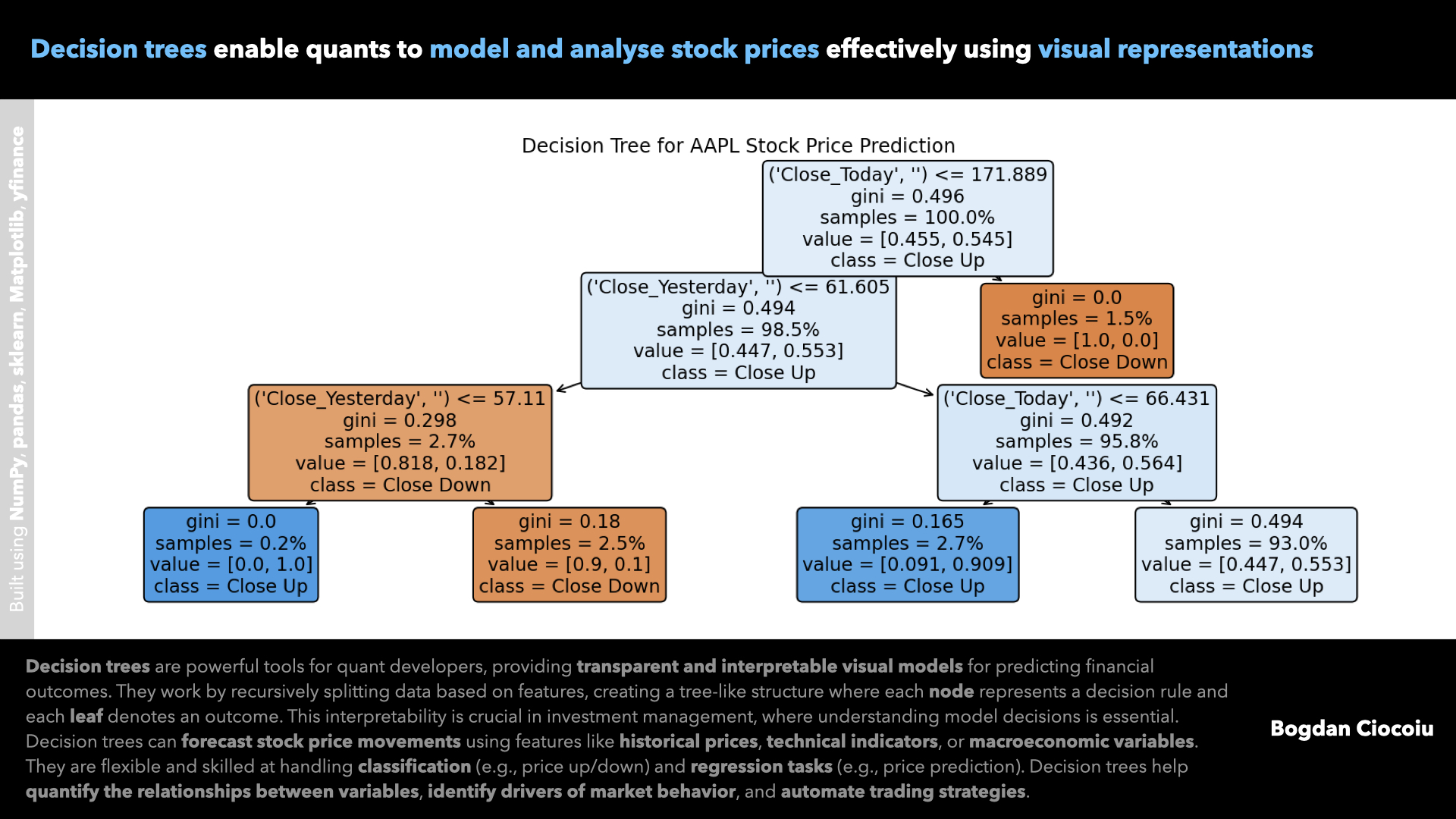

Supervised machine learning – Decision trees

Quantitative developers are pivotal in leveraging data to make informed investment decisions. Among the array of analytical tools available, decision trees are a powerful, interpretable, and versatile method for solving financial problems. Their ability to model decisions based on structured…

-

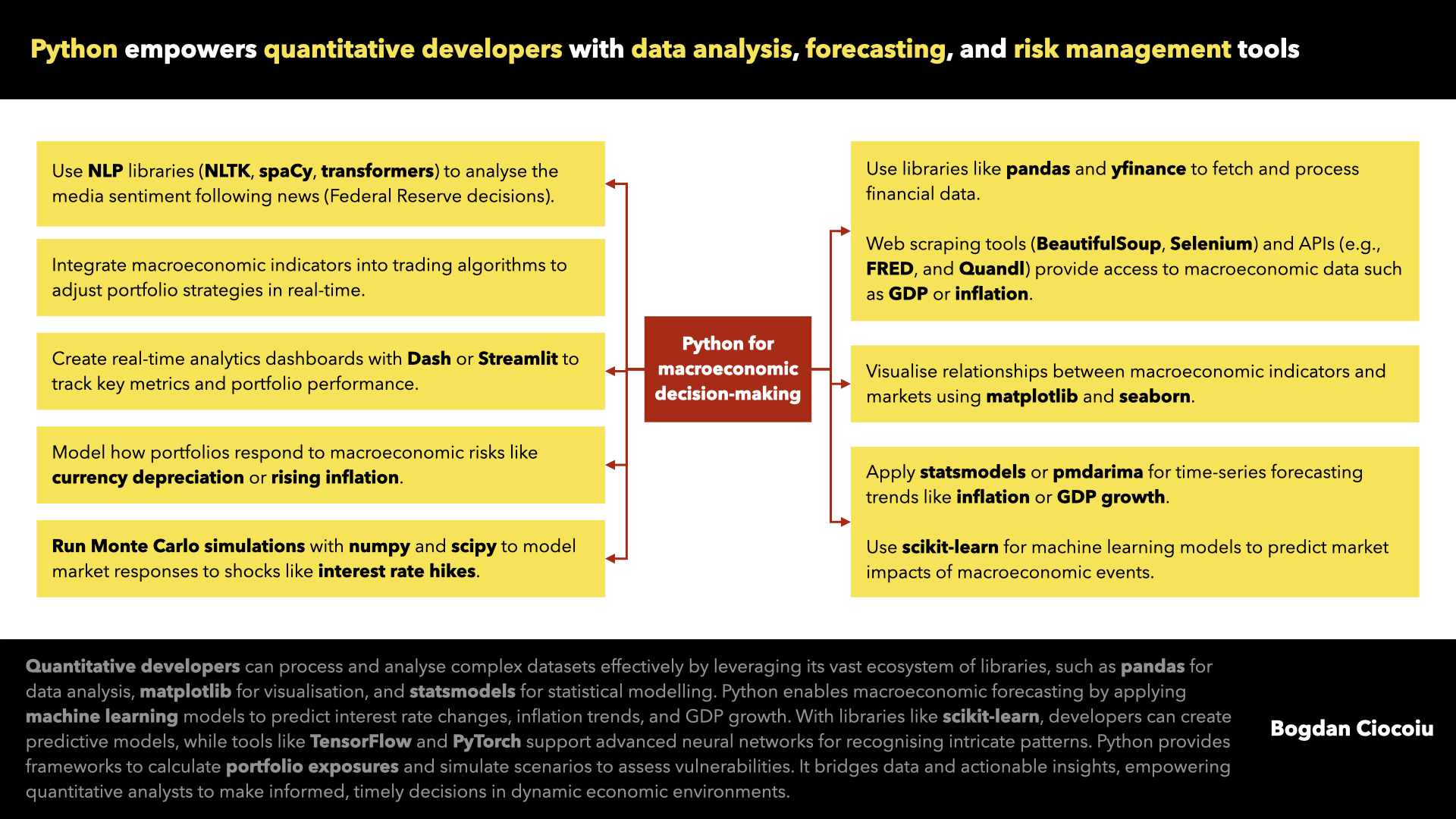

Macroeconomic decision-making

Macroeconomic events are pivotal in influencing market dynamics. Understanding and responding to these events can make the difference between profit and loss for investment professionals. Python, with its extensive ecosystem and user-friendly capabilities, has become a go-to tool for quantitative…

-

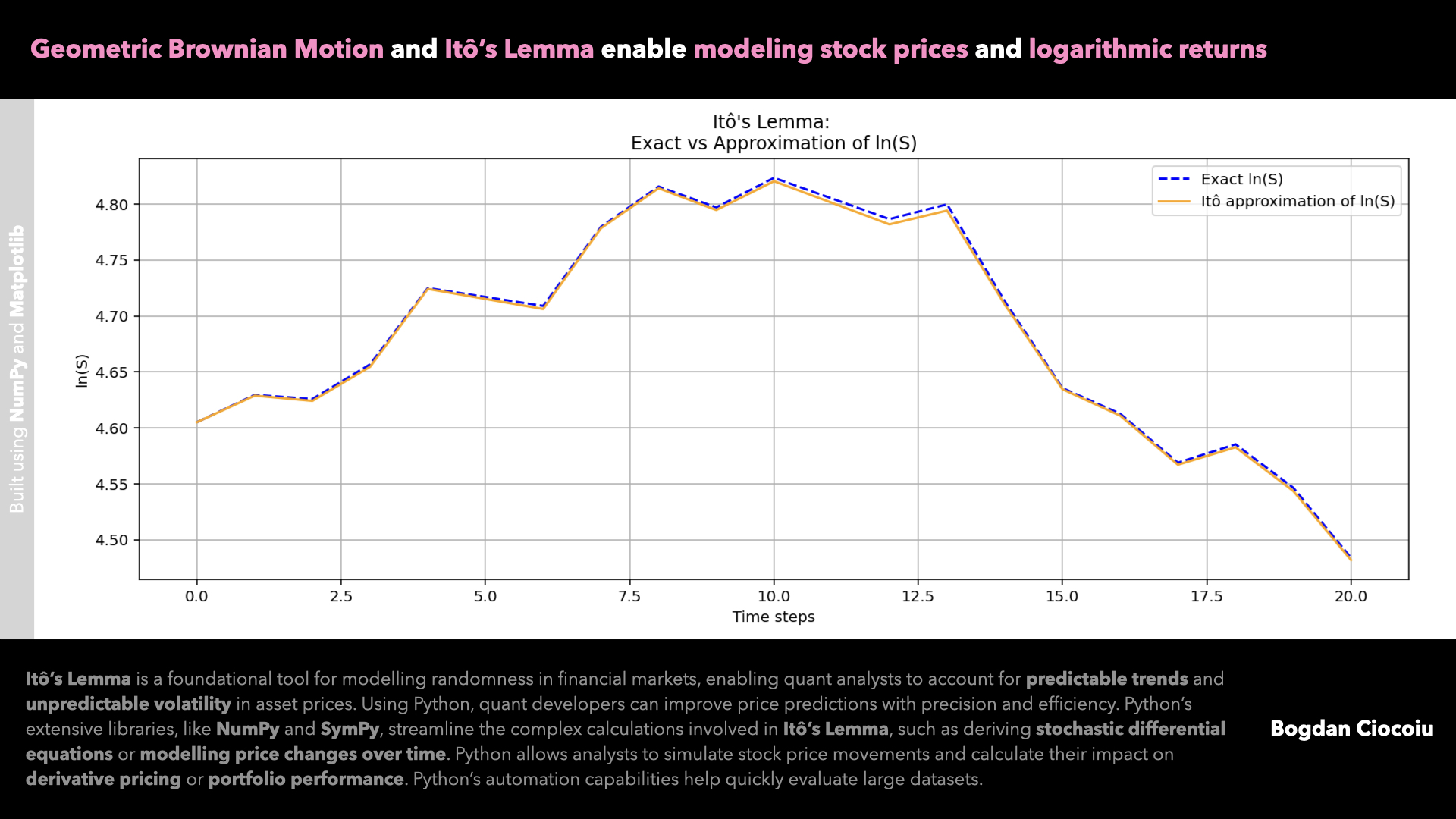

Price modelling – Itô’s Lemma – Geometric Brownian Motion

Quantitative analysts constantly seek robust methods to model and predict asset price movements. One such powerful tool is Itô’s Lemma, a cornerstone of stochastic calculus. By leveraging this mathematical framework alongside Python, quants can enhance their analytical toolkit, making strides in…

-

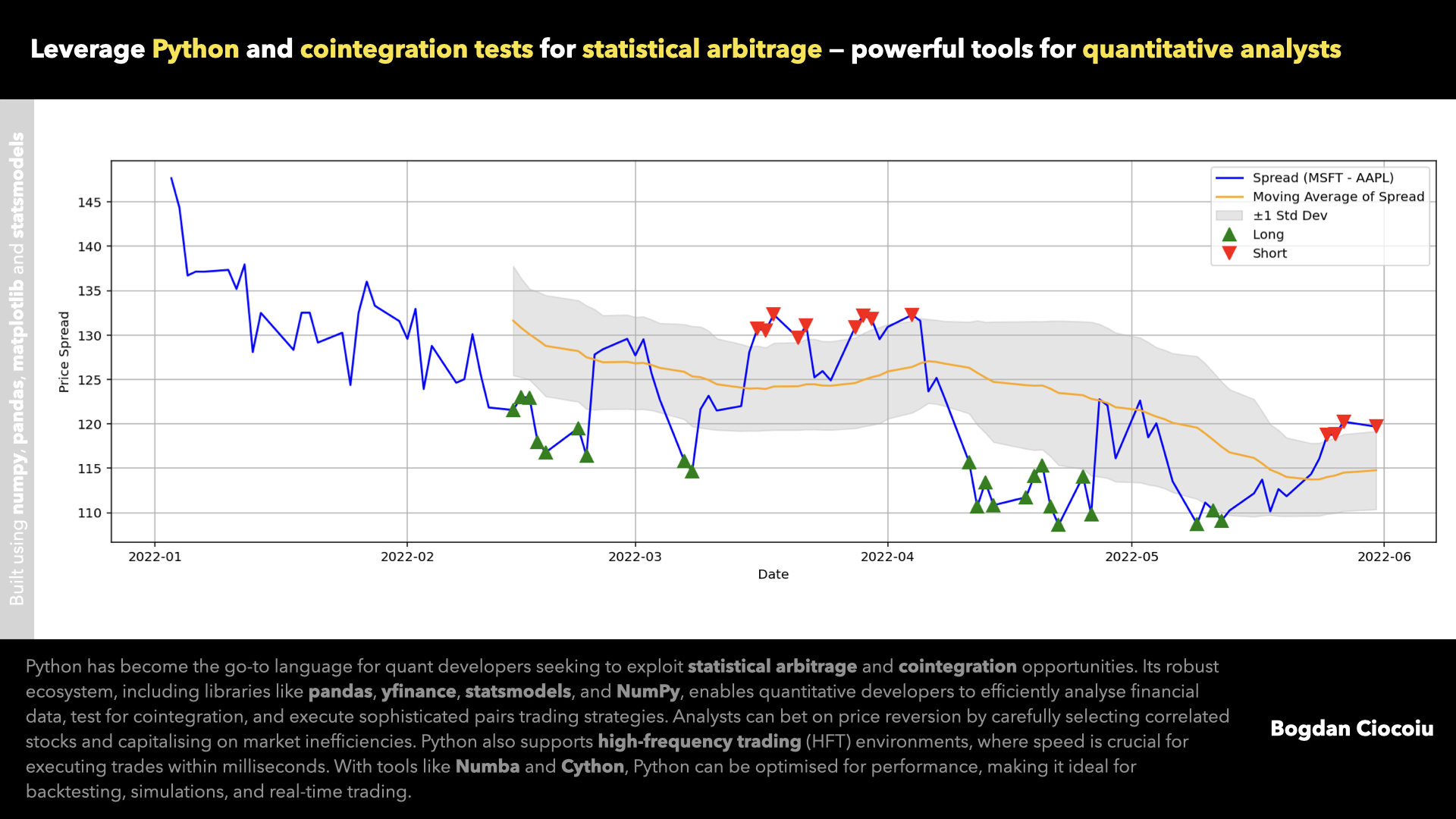

Statistical arbitrage – Cointegration – Pairs

Statistical arbitrage (or stat-arb) has become a powerful strategy for quantitative traders to exploit price discrepancies between financial instruments. By harnessing Python’s robust data analysis and statistical libraries, quantitative developers can implement sophisticated trading strategies, including pairs trading, to find and profit from…

-

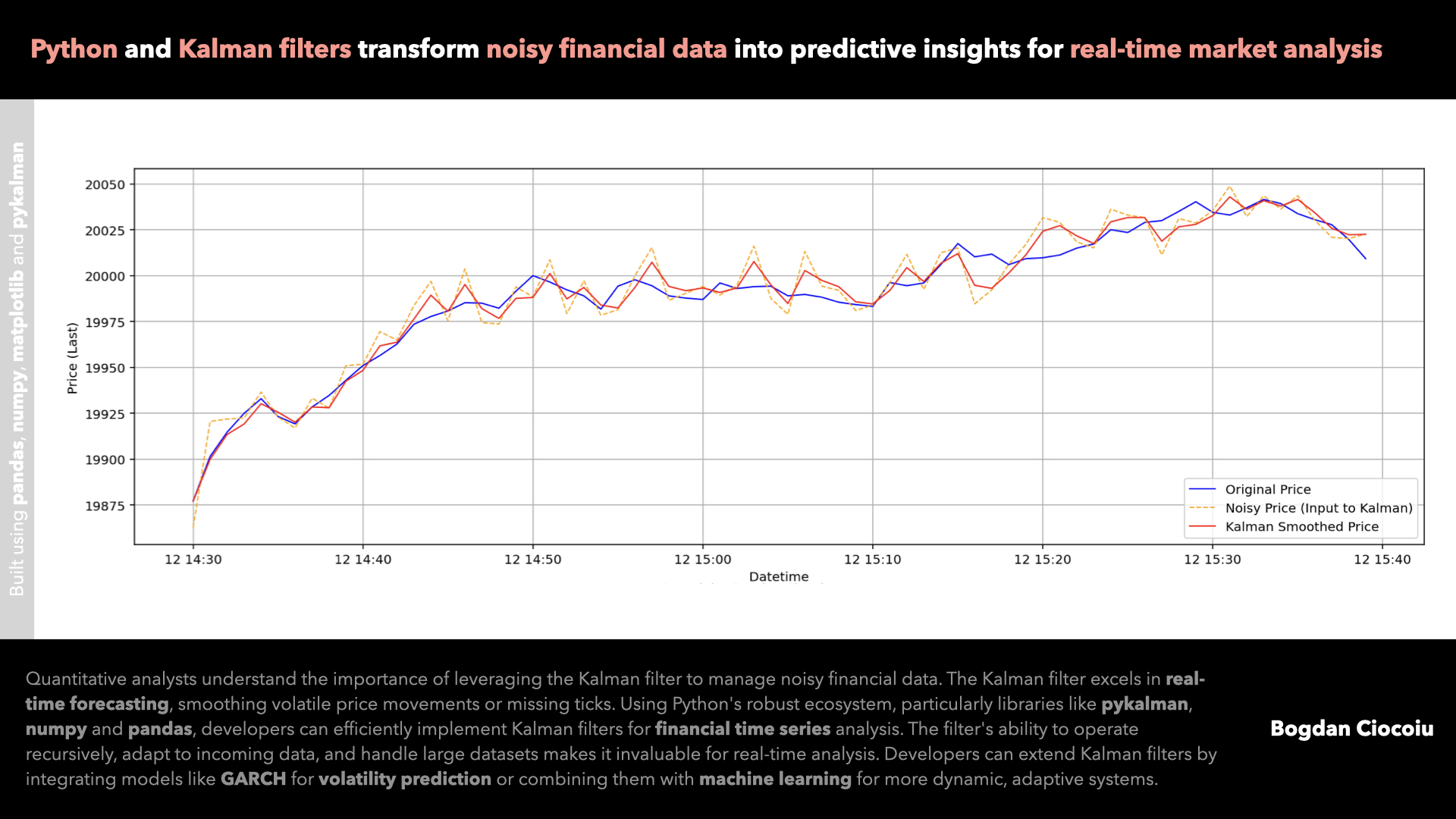

Kalman filter

As a quantitative analyst in financial markets, it is crucial to deploy models that can efficiently manage missing or noisy data and extract meaningful trends. The Kalman filter is one of the most robust tools for this purpose. Originating from control theory,…

-

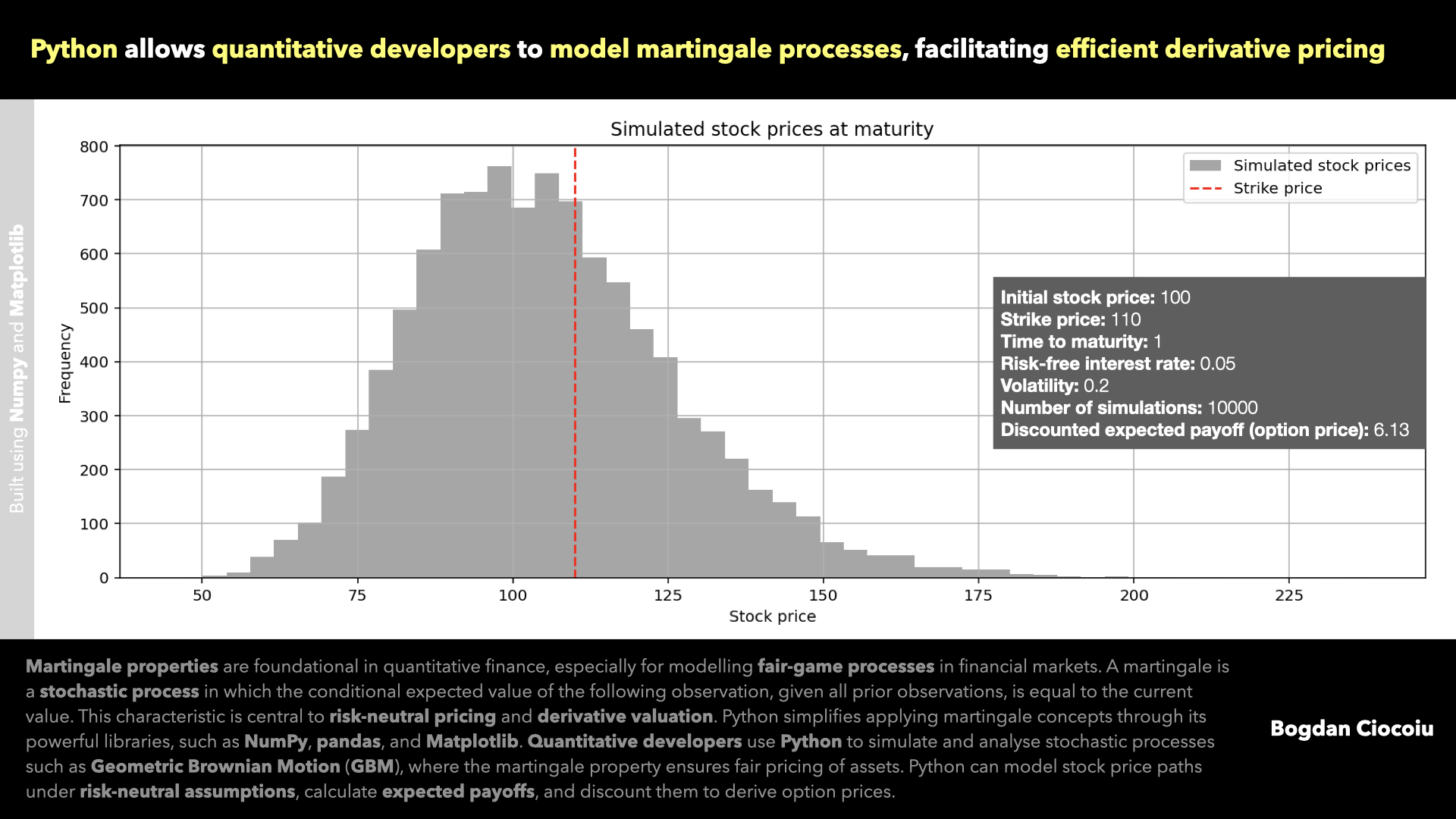

Martingale properties

Martingale properties lie at the core of modern financial theory and quantitative analysis. These properties describe stochastic processes where the conditional expected value of the next observation, given the current and past values, equals the current observation. In simple terms, martingales represent “fair games” where…

-

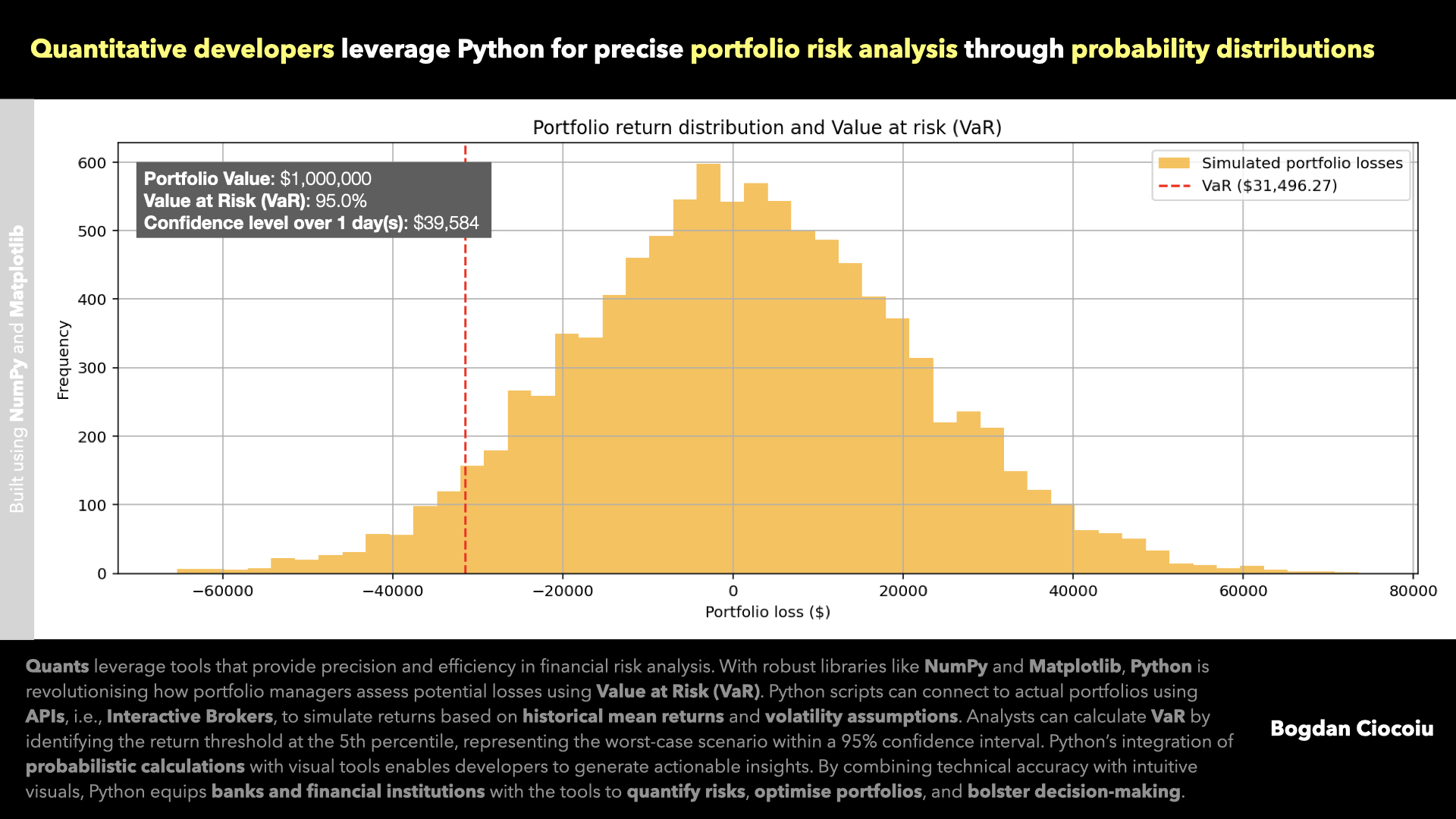

Probability distributions

Risk management is paramount for banks, financial institutions, and investment firms. Accurately predicting potential portfolio losses, especially during market downturns, can mean the difference between resilience and vulnerability. Python has emerged as an indispensable tool for quantitative developers, offering flexibility…