quantitative analysis

-

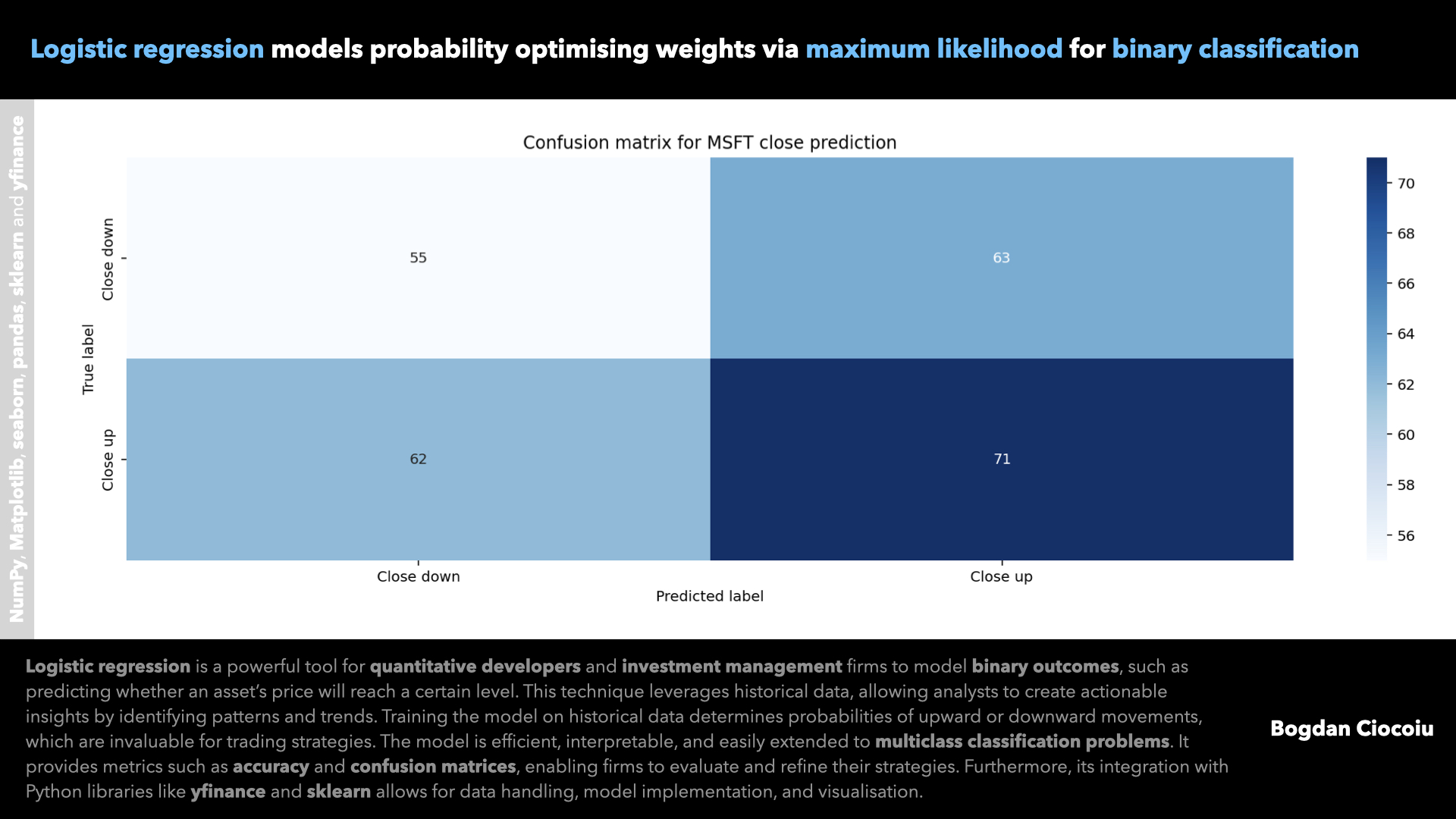

Supervised machine learning – Logistic regression

Predictive models are at the heart of decision-making in quantitative finance. Logistic regression, a fundamental machine learning algorithm, offers quantitative developers a robust and interpretable tool for classification problems. By leveraging logistic regression, financial institutions and developers can predict market…

-

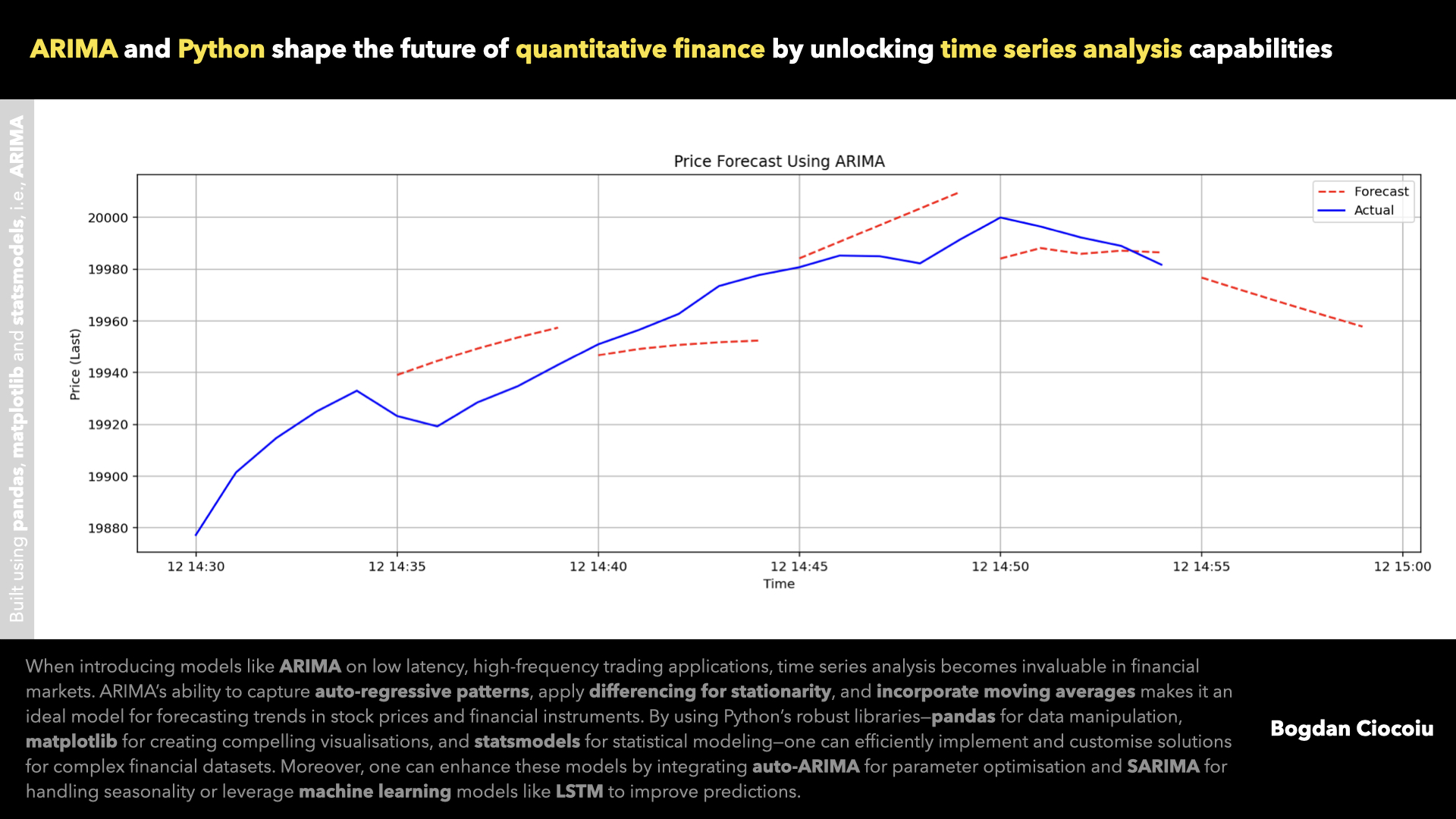

Time series analysis

Understanding time series data is crucial for making informed investment decisions in financial markets and the quantum analysis space. Time series analysis allows financial professionals to model and forecast market movements, identify trends, and detect underlying patterns in asset prices,…

-

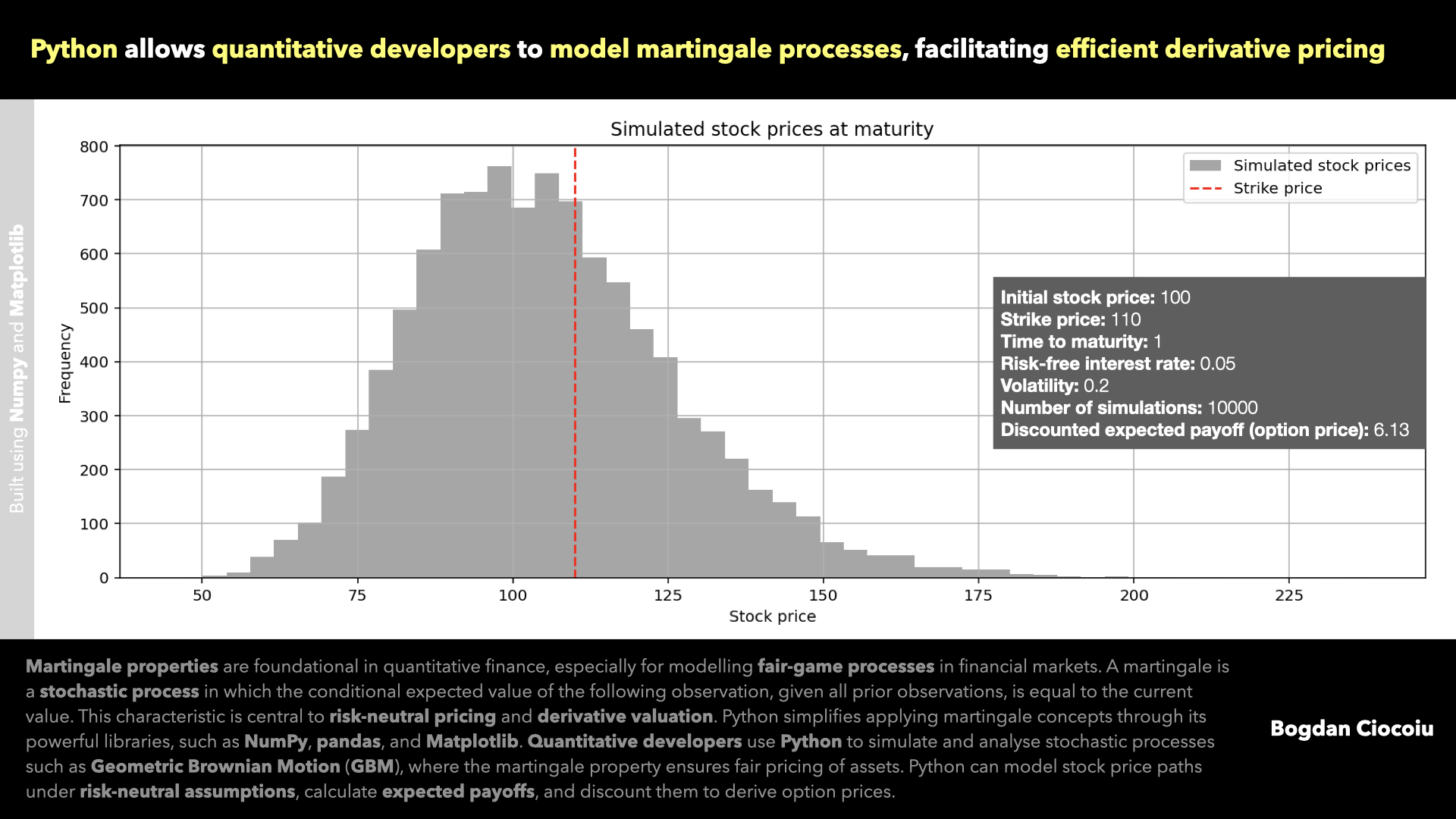

Martingale properties

Martingale properties lie at the core of modern financial theory and quantitative analysis. These properties describe stochastic processes where the conditional expected value of the next observation, given the current and past values, equals the current observation. In simple terms, martingales represent “fair games” where…