quantitative developers

-

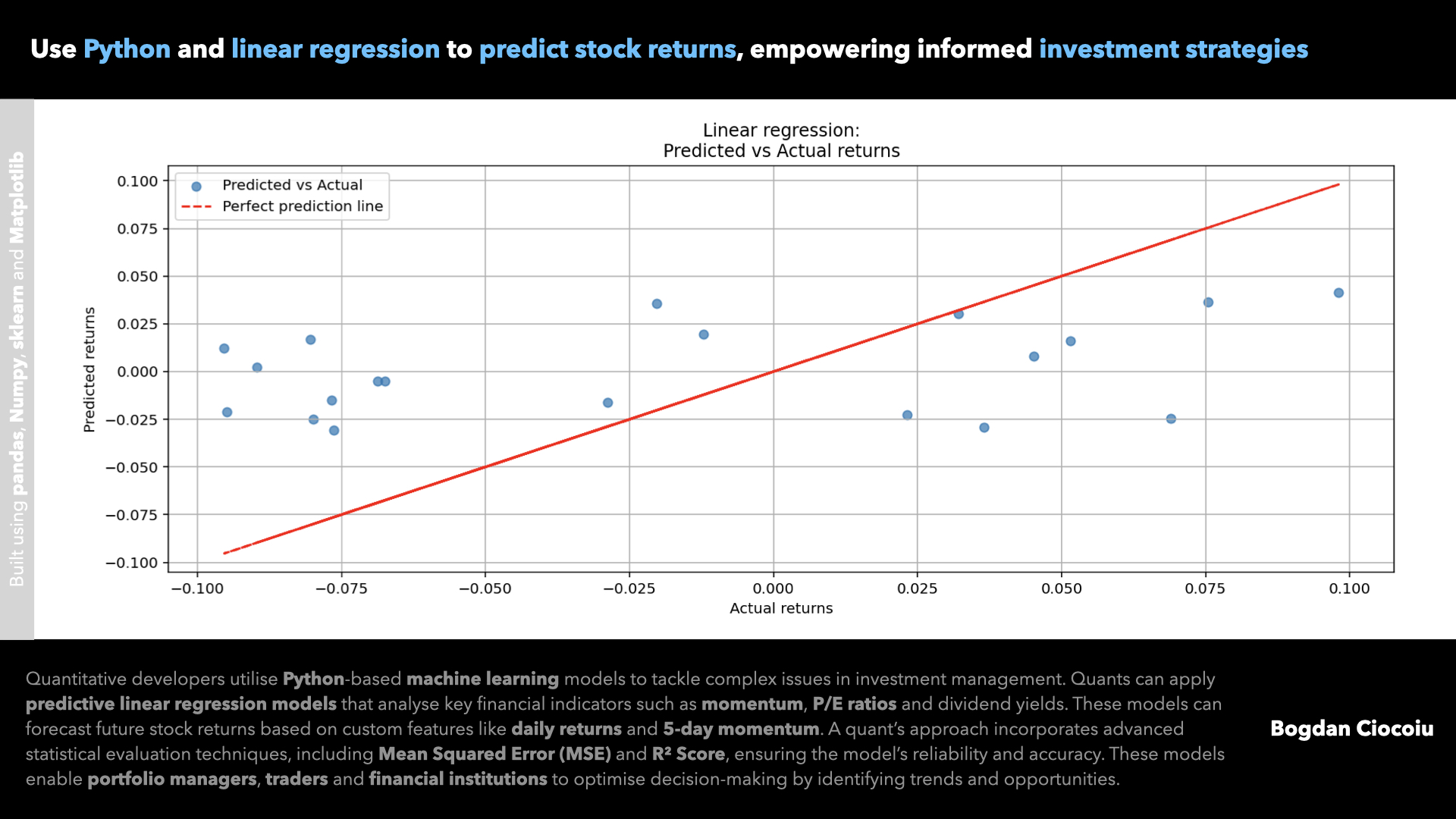

Supervised machine learning – Linear regression

Investment decisions demand a blend of precision, speed, and foresight. Quantitative developers play a pivotal role in enabling financial firms to stay ahead by designing predictive models that extract actionable insights from vast amounts of data. Leveraging Python’s capabilities, one…

-

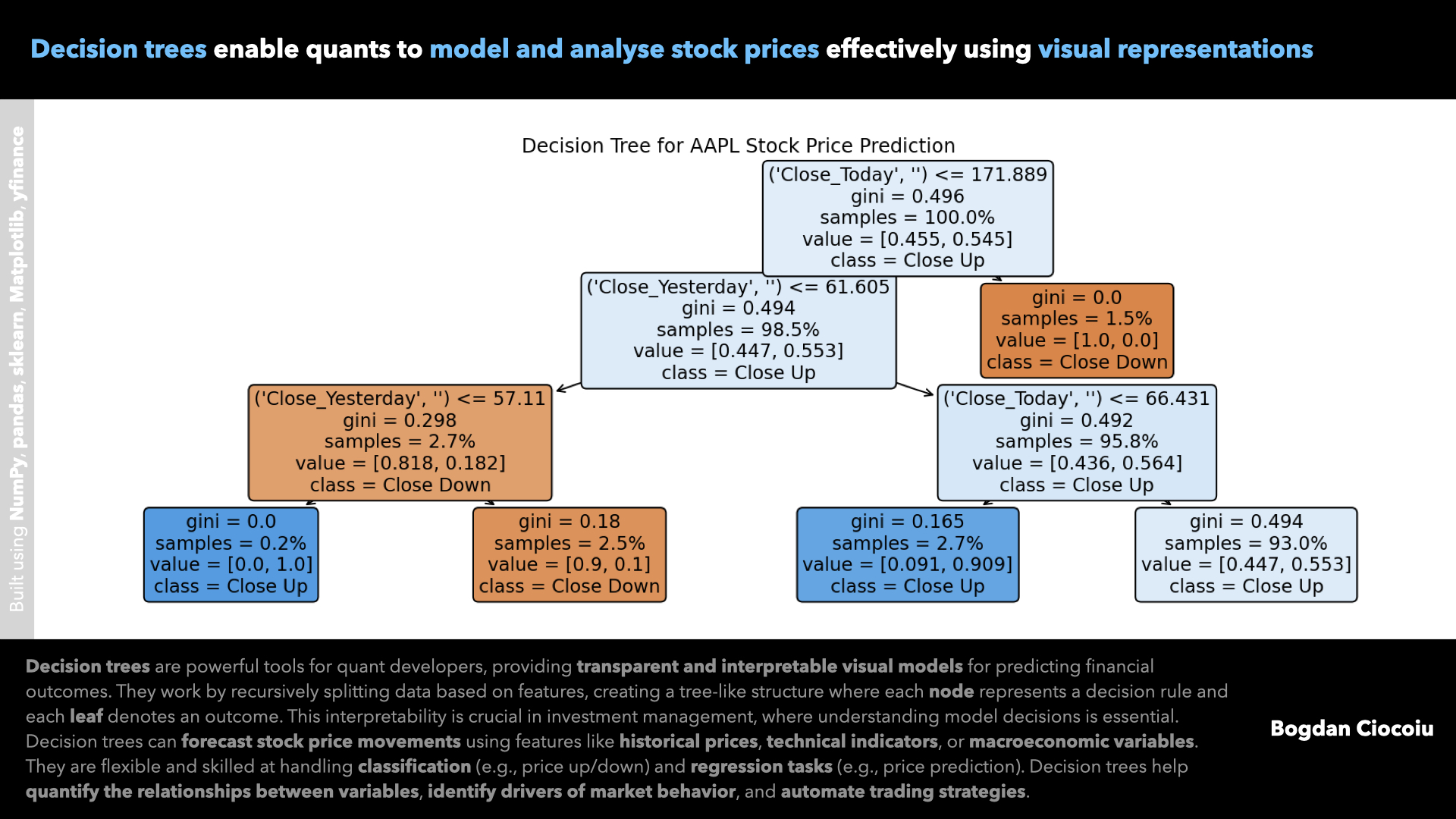

Supervised machine learning – Decision trees

Quantitative developers are pivotal in leveraging data to make informed investment decisions. Among the array of analytical tools available, decision trees are a powerful, interpretable, and versatile method for solving financial problems. Their ability to model decisions based on structured…

-

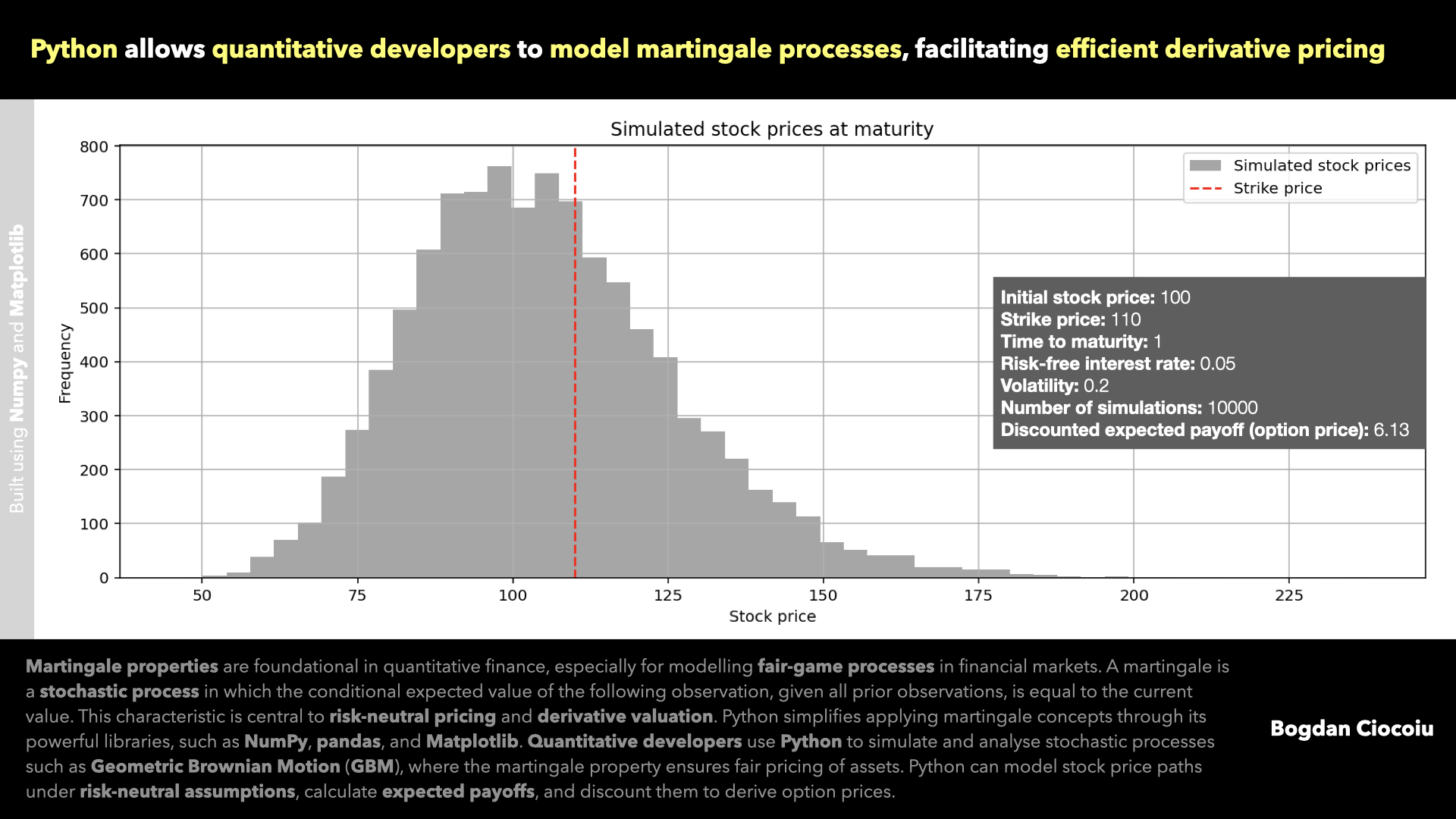

Martingale properties

Martingale properties lie at the core of modern financial theory and quantitative analysis. These properties describe stochastic processes where the conditional expected value of the next observation, given the current and past values, equals the current observation. In simple terms, martingales represent “fair games” where…