scikit-learn

-

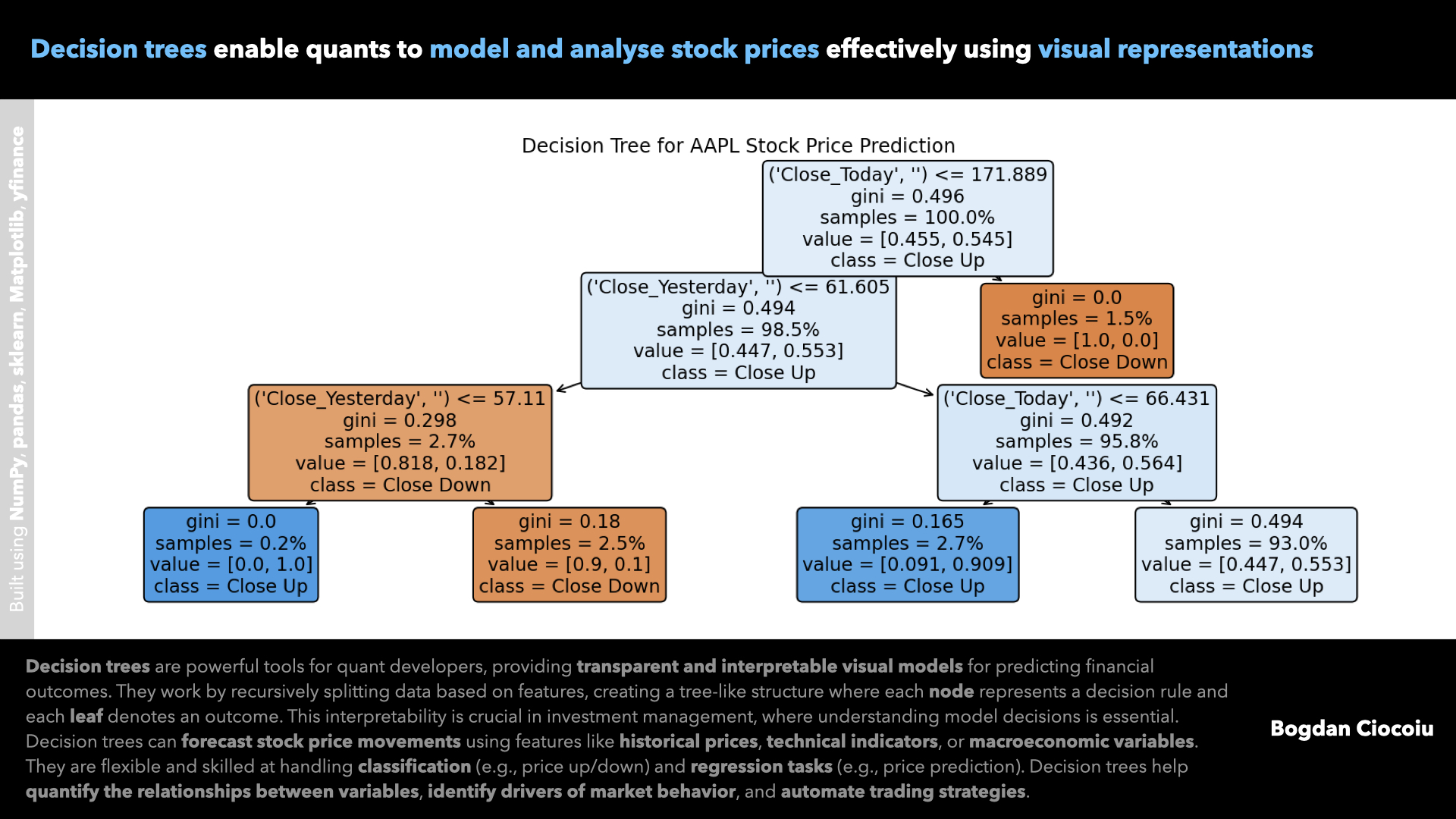

Supervised machine learning – Decision trees

Quantitative developers are pivotal in leveraging data to make informed investment decisions. Among the array of analytical tools available, decision trees are a powerful, interpretable, and versatile method for solving financial problems. Their ability to model decisions based on structured…

-

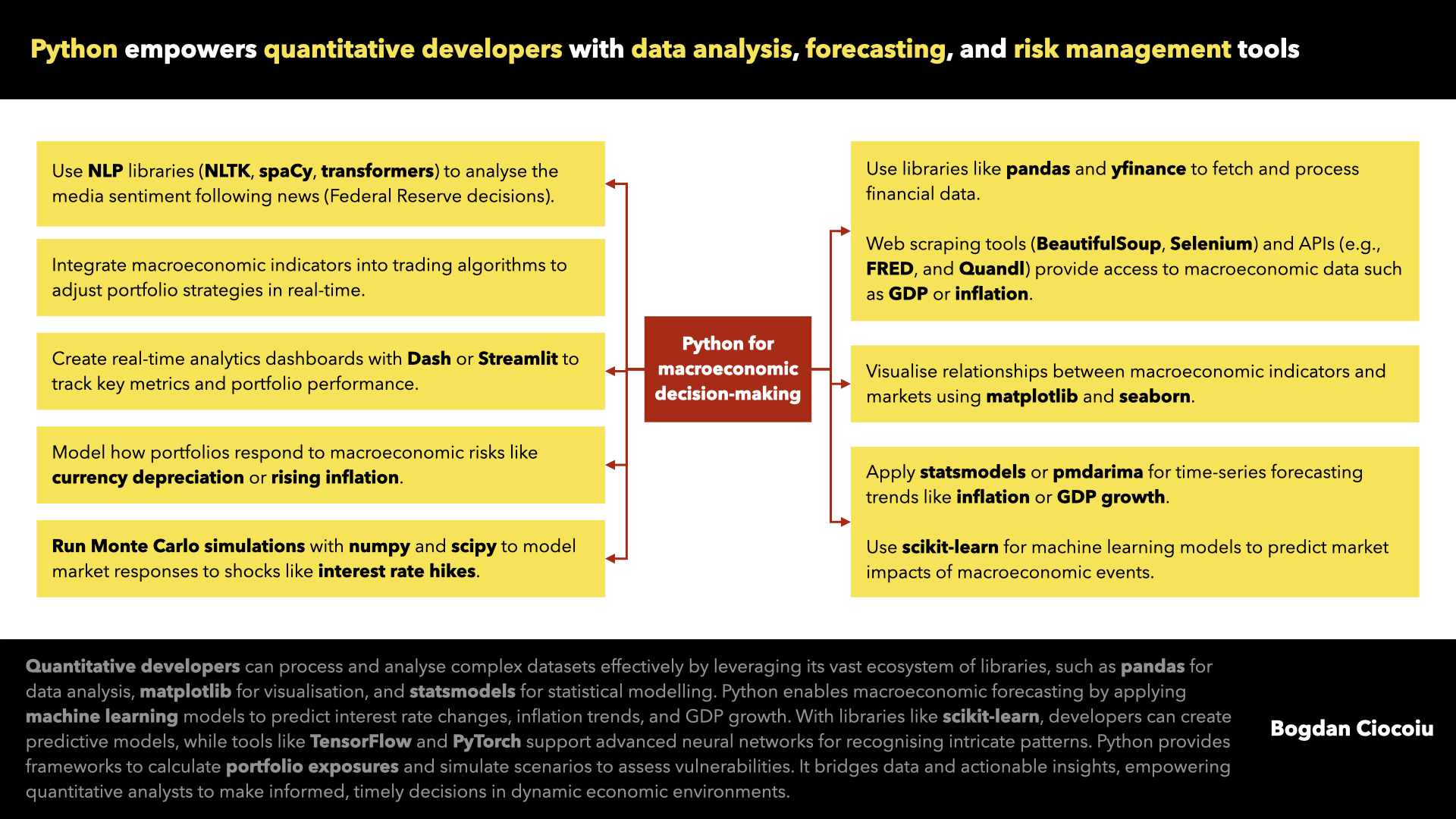

Macroeconomic decision-making

Macroeconomic events are pivotal in influencing market dynamics. Understanding and responding to these events can make the difference between profit and loss for investment professionals. Python, with its extensive ecosystem and user-friendly capabilities, has become a go-to tool for quantitative…

-

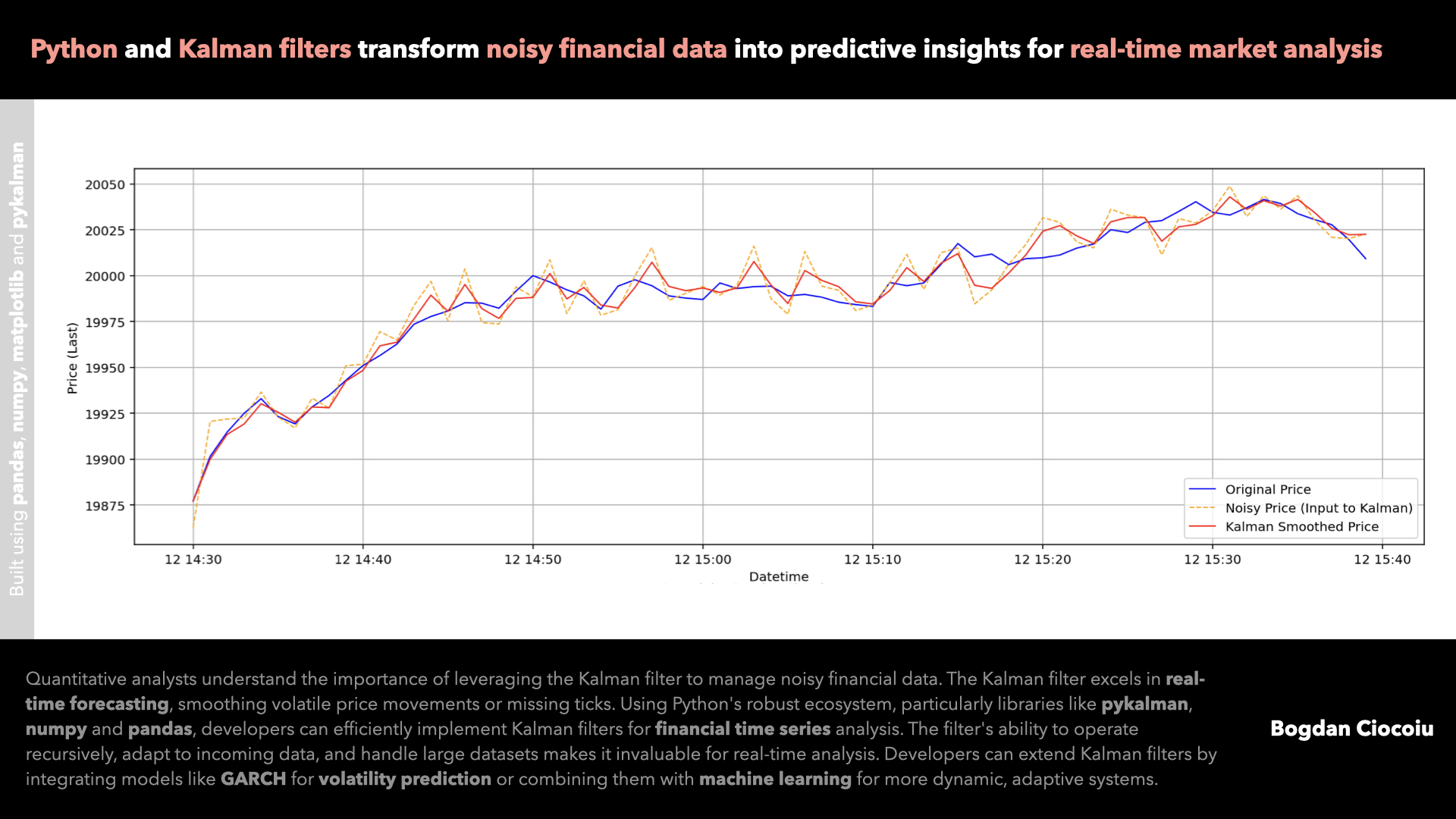

Kalman filter

As a quantitative analyst in financial markets, it is crucial to deploy models that can efficiently manage missing or noisy data and extract meaningful trends. The Kalman filter is one of the most robust tools for this purpose. Originating from control theory,…

-

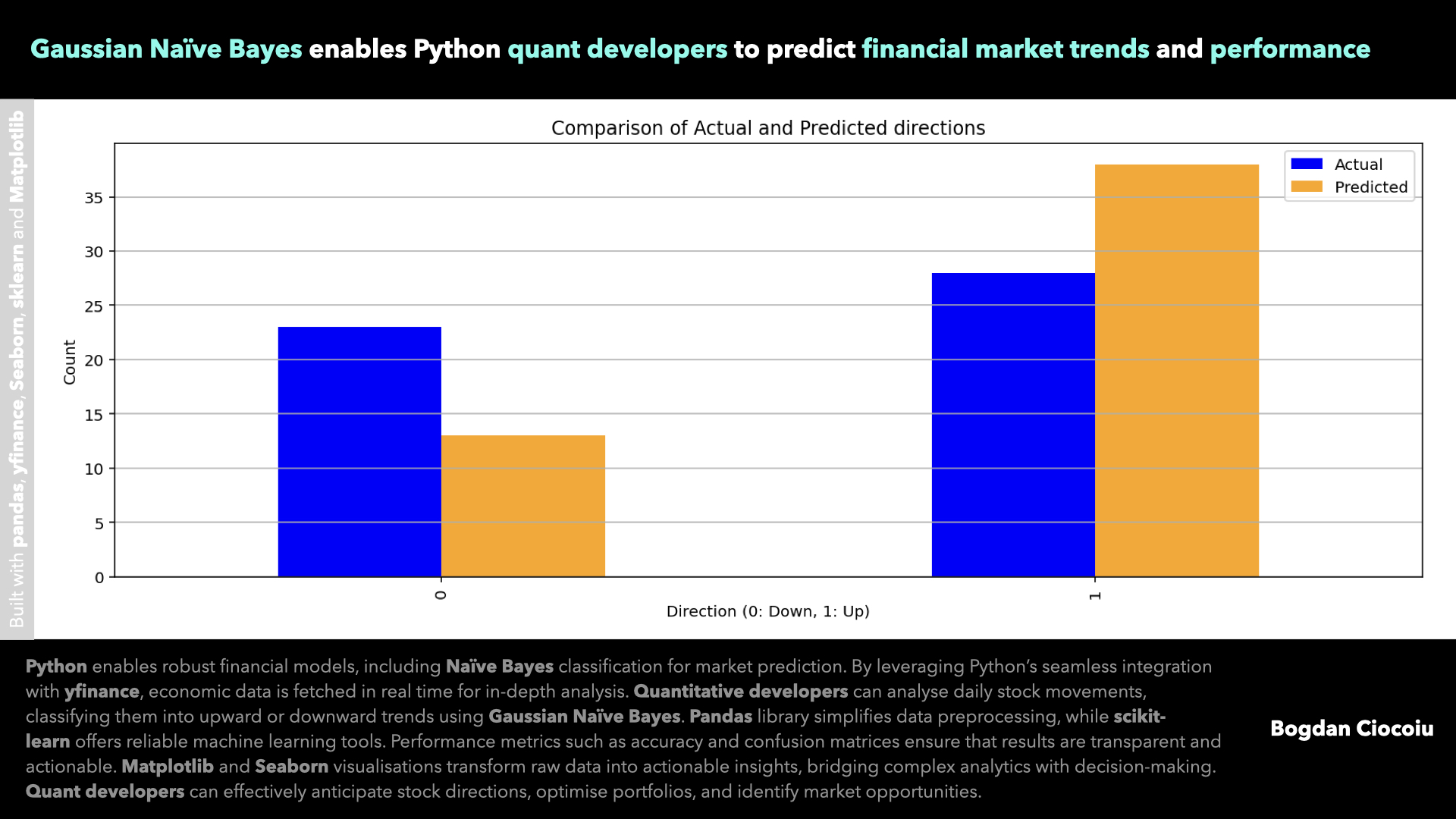

Supervised machine learning – Gaussian Naïve Bayes

In quantitative finance, having access to precise data analytics and advanced predictive models is key. With its versatile ecosystem, Python has emerged as an indispensable tool for quantitative developers seeking to optimise investment strategies and forecast market movements. One such…