statsmodels

-

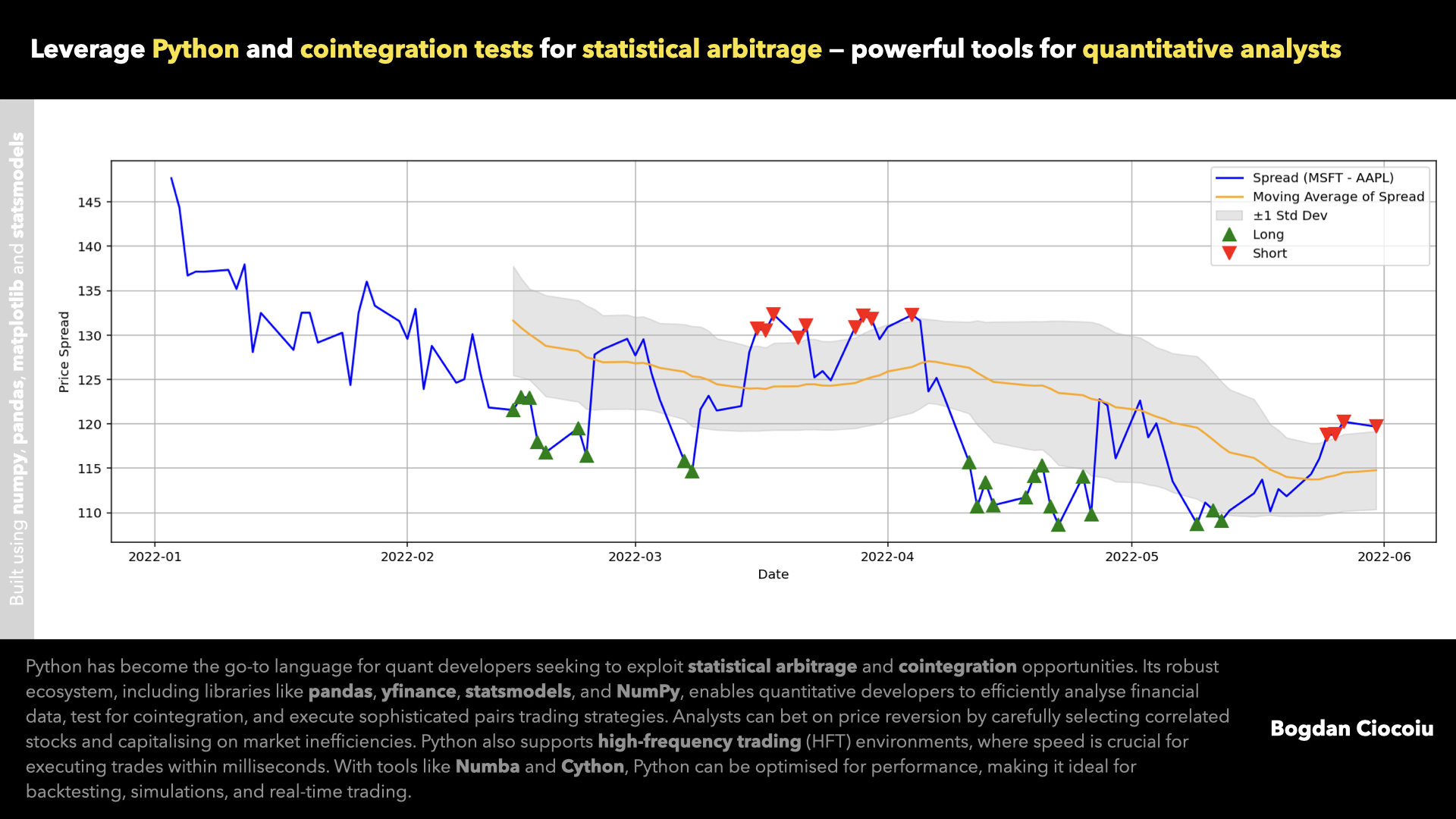

Statistical arbitrage – Cointegration – Pairs

Statistical arbitrage (or stat-arb) has become a powerful strategy for quantitative traders to exploit price discrepancies between financial instruments. By harnessing Python’s robust data analysis and statistical libraries, quantitative developers can implement sophisticated trading strategies, including pairs trading, to find and profit from…

-

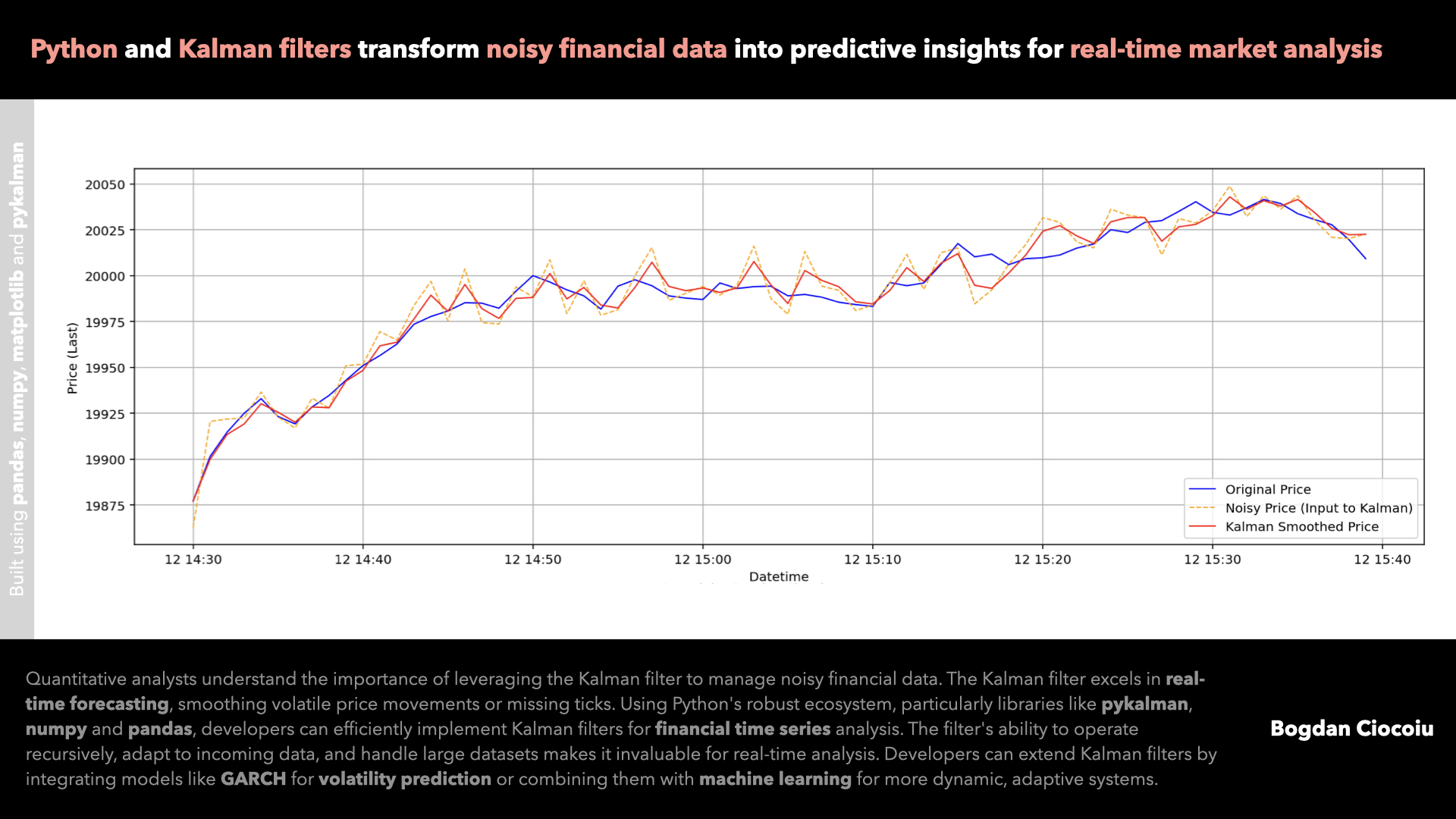

Kalman filter

As a quantitative analyst in financial markets, it is crucial to deploy models that can efficiently manage missing or noisy data and extract meaningful trends. The Kalman filter is one of the most robust tools for this purpose. Originating from control theory,…

-

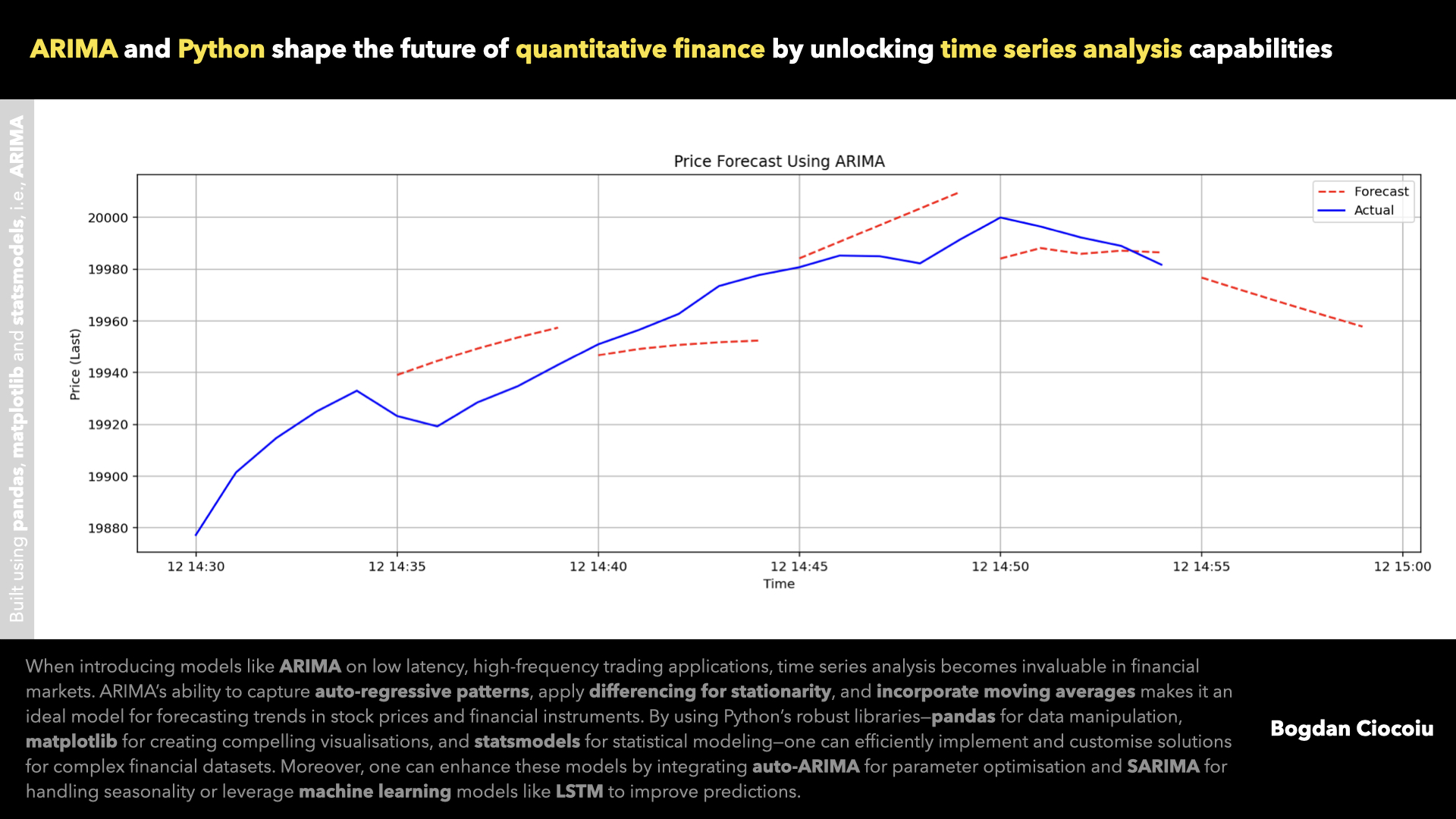

Time series analysis

Understanding time series data is crucial for making informed investment decisions in financial markets and the quantum analysis space. Time series analysis allows financial professionals to model and forecast market movements, identify trends, and detect underlying patterns in asset prices,…