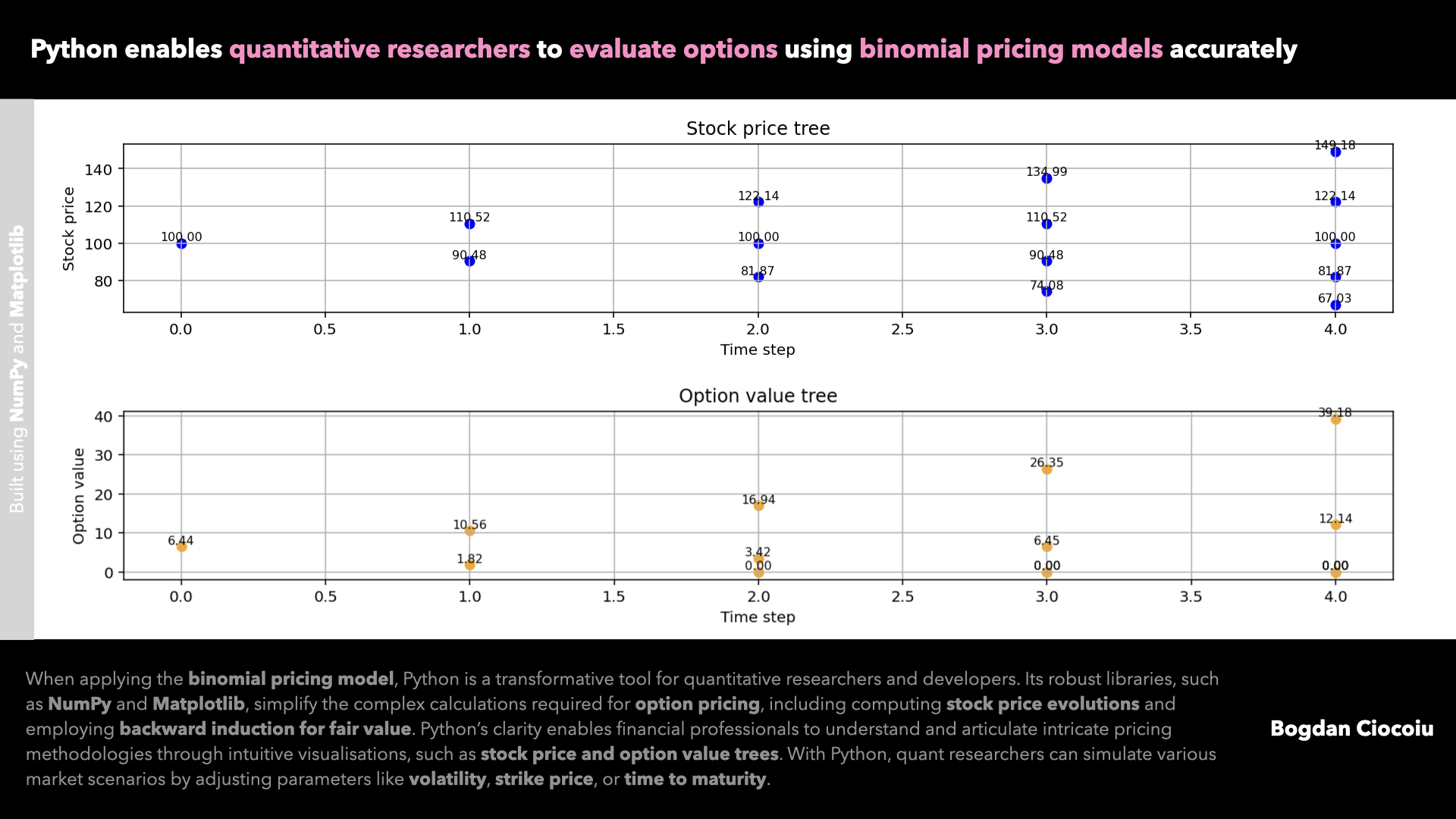

time to maturity

-

Binomial options pricing model

The ability to price derivatives accurately and efficiently is paramount. The binomial pricing model is one of the most widely used methods for option pricing, providing a structured approach to evaluating potential outcomes under various market conditions. With its powerful…