trading strategies

-

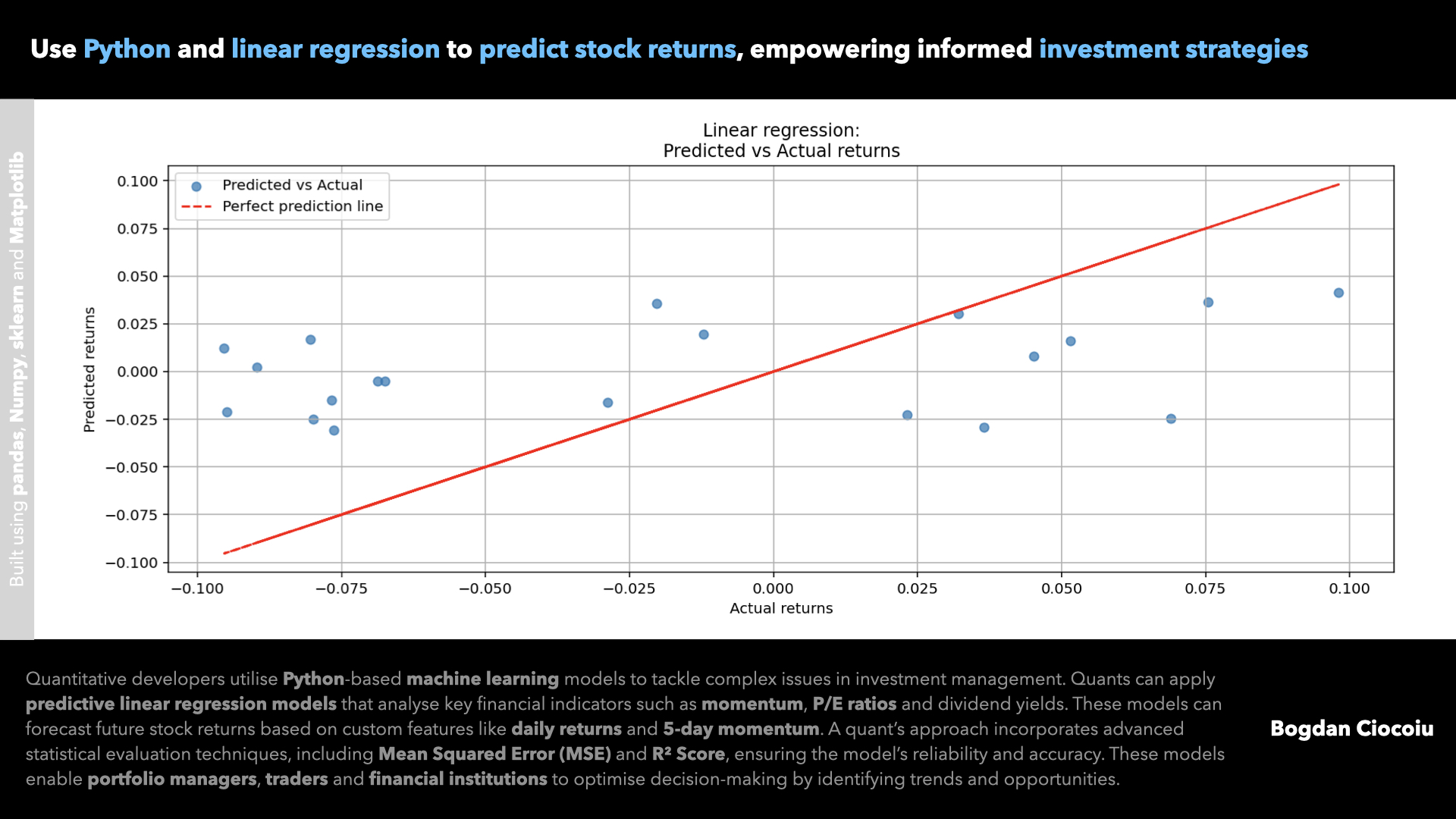

Supervised machine learning – Linear regression

Investment decisions demand a blend of precision, speed, and foresight. Quantitative developers play a pivotal role in enabling financial firms to stay ahead by designing predictive models that extract actionable insights from vast amounts of data. Leveraging Python’s capabilities, one…

-

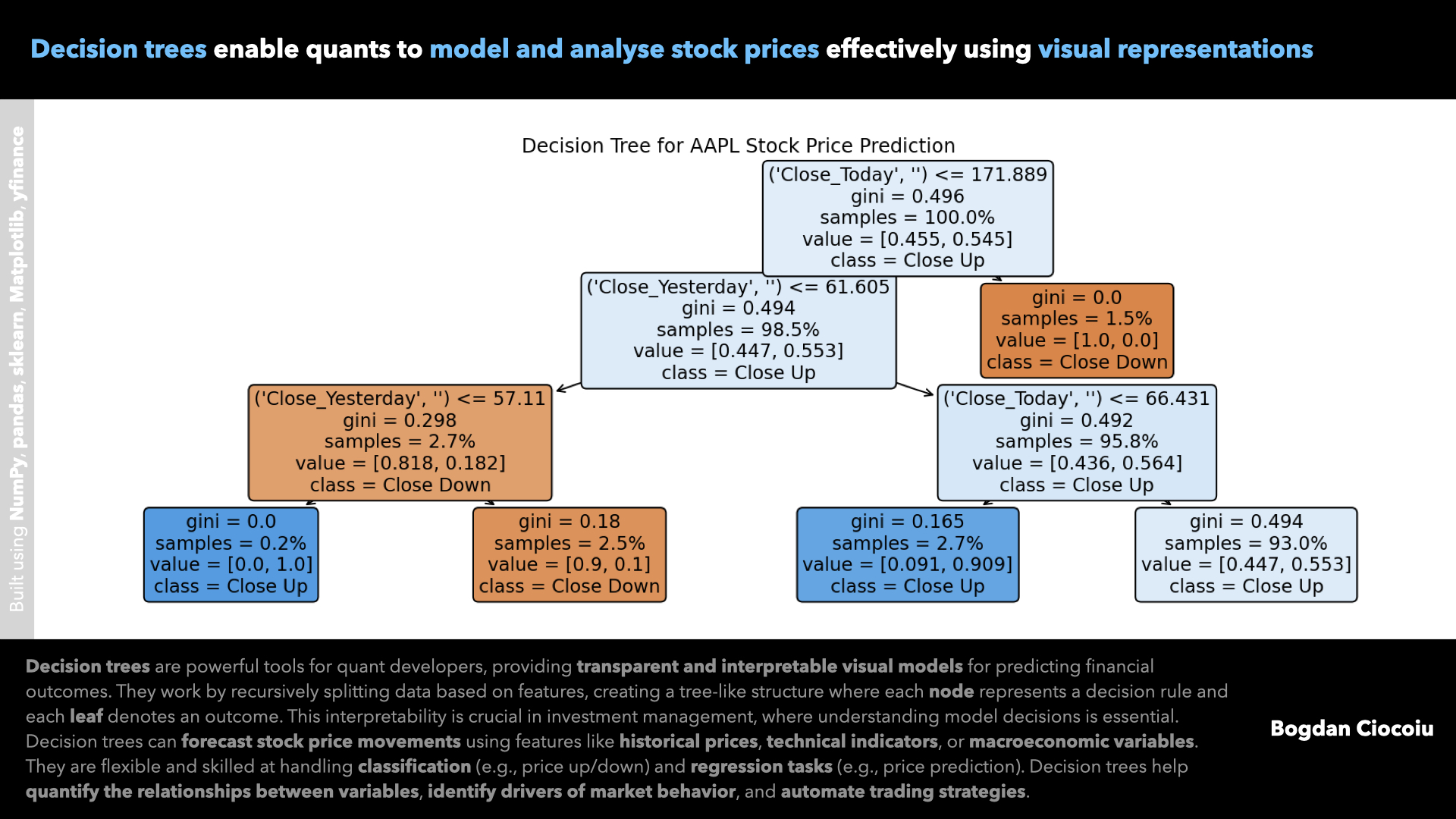

Supervised machine learning – Decision trees

Quantitative developers are pivotal in leveraging data to make informed investment decisions. Among the array of analytical tools available, decision trees are a powerful, interpretable, and versatile method for solving financial problems. Their ability to model decisions based on structured…

-

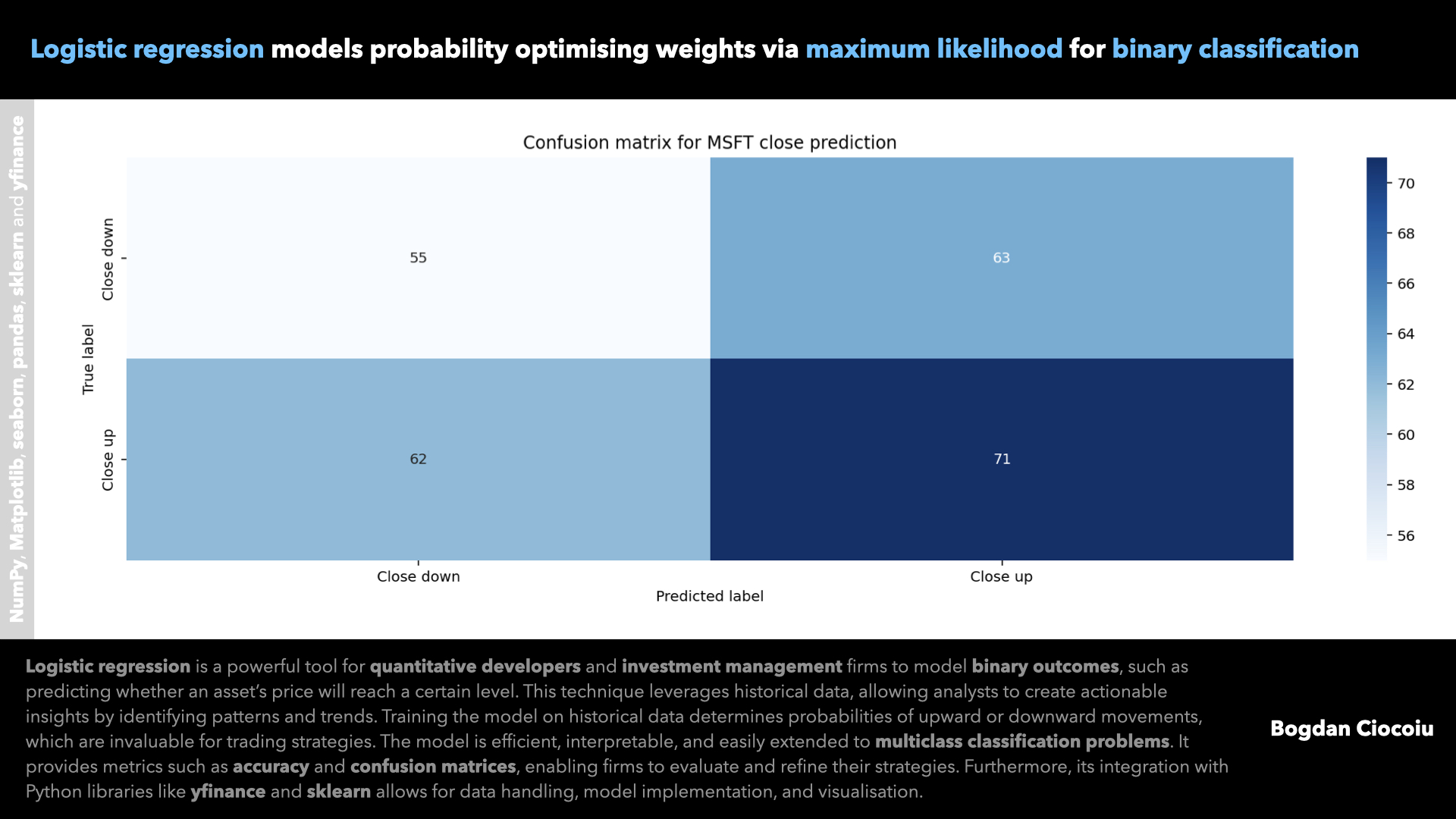

Supervised machine learning – Logistic regression

Predictive models are at the heart of decision-making in quantitative finance. Logistic regression, a fundamental machine learning algorithm, offers quantitative developers a robust and interpretable tool for classification problems. By leveraging logistic regression, financial institutions and developers can predict market…

-

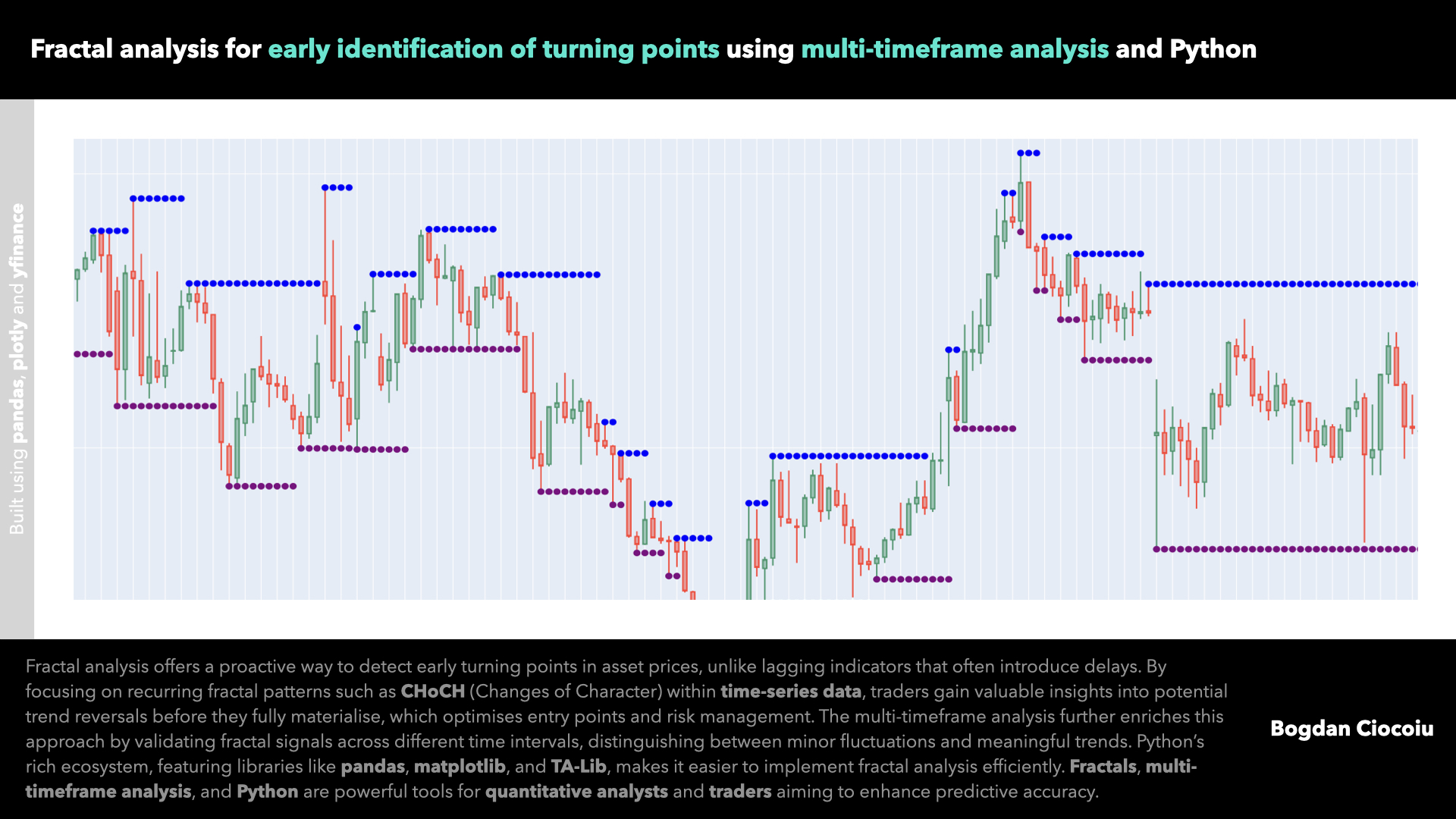

Market structure – Fractal microstructures

In financial markets, the ability to accurately and timely identify turning points in floating assets such as stocks, commodities, or forex pairs can spell the difference between profit and loss. Fractal analysis, a technical approach focusing on repetitive patterns and…