volatility

-

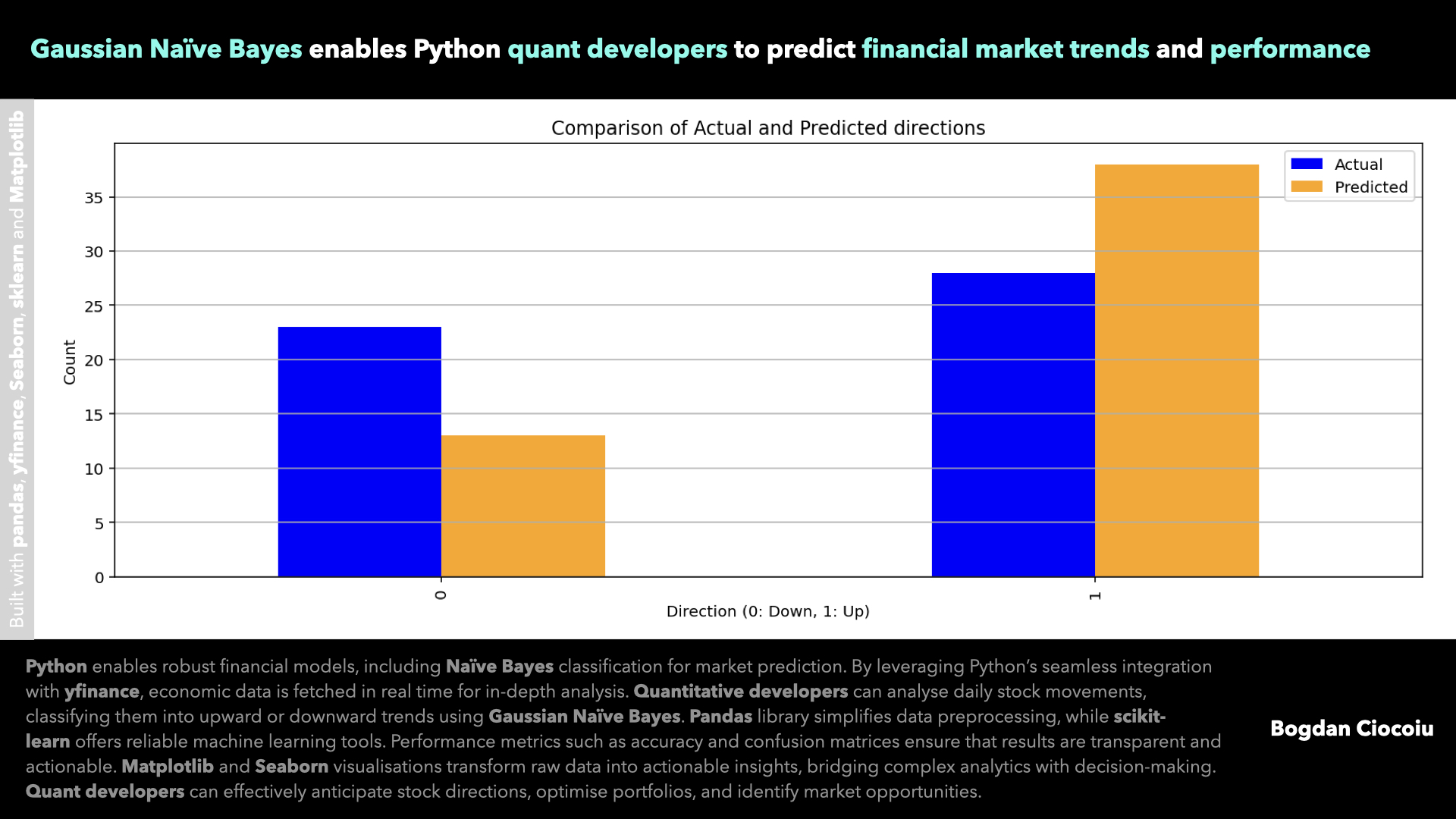

Supervised machine learning – Gaussian Naïve Bayes

In quantitative finance, having access to precise data analytics and advanced predictive models is key. With its versatile ecosystem, Python has emerged as an indispensable tool for quantitative developers seeking to optimise investment strategies and forecast market movements. One such…

-

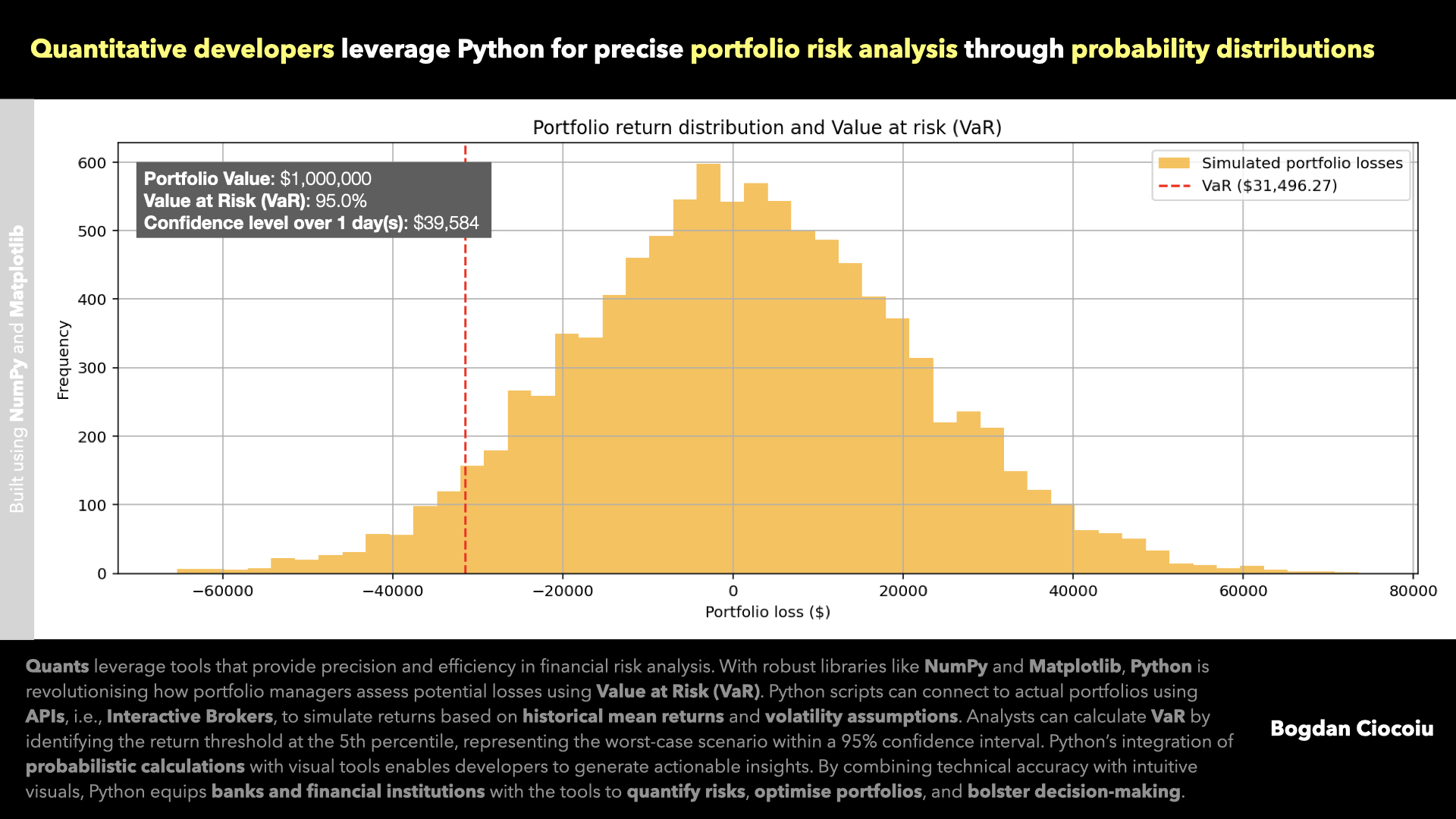

Probability distributions

Risk management is paramount for banks, financial institutions, and investment firms. Accurately predicting potential portfolio losses, especially during market downturns, can mean the difference between resilience and vulnerability. Python has emerged as an indispensable tool for quantitative developers, offering flexibility…